Knight Frank Singapore, the exclusive marketing agent of 409-419 Upper East Coast Road, on Nov 28 announced the launch of the sale of the redevelopment site, by tender.

409-419 Upper East Coast Road is a landed development located in District 16, comprising 6 strata terrace homes covering a site area of 1,251.1 sq m (approx. 13,466 sq ft). Under the 2014 Master Plan, the site is zoned “Residential, 3-storey mixed landed” and has redevelopment potential for 6 semi-detached homes, subject to authorities’ approval.

The redevelopment site boasts a short 3-minute walk to the upcoming Bayshore MRT station, which is set to be part of the new Thomson-East Coast Line that will be completed by 2024. Well-connected by East Coast Parkway (ECP), it takes only 15 minutes to hit the Central Business District (CBD), and less than 10 minutes to Changi Airport. A wide array of eateries and shopping amenities is also available at the Siglap and Bedok areas, which are less than 5 minutes’ drive away.

All six owners of the redevelopment site, who have given 100% consensus for the sale, are looking towards a swift transaction without requiring application to the Strata Titles Board for the Sale Order.

The owners of the redevelopment site are expecting offers above their reserve price of $18 million, which works out to $1,337 per square foot (psf) on land.

Table of Contents

Mr Loh shares, “Despite recent cooling measures on the residential segment, interest in landed homes has remained strong, due to its scarcity. With the new Thomson-East Coast Line coming up, the new development will likely yield strong interest from homebuyers.”

The tender for the redevelopment site at 409-419 Upper East Coast will close on 31 January 2019, Thursday at 3.00pm.

En Bloc Sales Process Singapore – A Definitive Step-by-step Guide

With the winding down of the success of residential en bloc sales, commercial properties are now trying to join in the bandwagon. Many commercial en bloc sale attempts fail because the asking prices are often too high. Two critical factors affecting the success of commercial sites going en bloc are pricing and location. Older commercial buildings especially, may see a need to catch the current wave as an exit strategy as their rental yields come under pressure due to competition from newer commercial buildings.

The biggest gainers following the new property cooling measures is likely be owners of strata portfolio of offices and shophouses approved for commercial use. The property cooling measures affected almost all categories of buyers and is predicted to achieve its intended objectives of cooling demand and moderating price growth.

One report said investors looking for alternatives to park their money in the wake of property cooling measures, would divert their attention to the strata office and shophouse markets as they are not subjected to this round of purchase or sales restrictions/encumbrances.

https://www.icompareloan.com/resources/mortgage-broker-singapore-best-rate/

Mr Paul Ho, chief mortgage consultant at iCompareLoan, said that the owners of the redevelopment site are smart to put the aging buildings to put the property on the market before the collective sale window closes. Mr Ho added that the subdued residential property market enthusiasm is also a big blow to en bloc beneficiaries shopping for a replacement property, as well as investors.

“Whatever decision en bloc sale committee makes, it is better to make it fast so that the sale (or non-sale) can be concluded with minimal delay and maximum benefit to the owners,” said Mr Ho.

https://www.icompareloan.com/resources/good-property-agents-qualities-look-find/

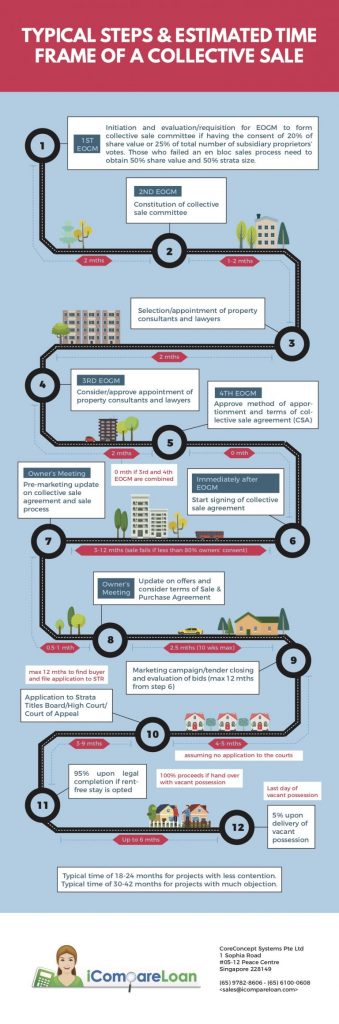

Owners of property which is being collectively sold must be mindful that as collective sale process takes 20 to 30 months to complete, and that during this time, they do not have sufficient funds for down-payment – and also their CPF Ordinary Account funds are tied up in the property – meaning they cannot buy a new condominium early.

By the time the transaction is completed in 20 to 30 months later, the property prices would have already moved up 10 to 20 per cent. This is already evidenced by sellers of older estate asking higher prices. Hence if the process takes 20 months to 30 months, owners may need to consider the cost of a replacement unit by that time, else they may want to hold up a higher selling price.

Mr Ho pointed out that the rules are quite onerous and stringent and is governed by the Land Titles (Strata) Act – section 84A. Over the years, additions and amendments by the Ministry of Law to the en bloc law have made the collective sale rules even tighter.

https://www.icompareloan.com/resources/good-property-agents-qualities-look-find/

He said that many of the home owners who refinanced their home loans to fixed rate home loans or those with 2 years locked-in or 3 years locked-in period will incur full home loan redemption penalty. This penalty is usually 1.5% of the loan amount. This tends to affect those who have bought their properties in recent years as their loan size tends to be bigger and their corresponding home loan redemption penalty higher.

How to Secure a Home Loan Quickly

Are you planning to invest in properties but ensure of funds availability for purchase? Don’t worry because iCompareLoan mortgage broker can set you up on a path that can get you a home loan in a quick and seamless manner.

Our brokers have close links with the best lenders in town and can help you compare Singapore home loans and settle for a package that best suits your home purchase needs. Find out money saving tips here.

Whether you are looking for a new home loan or to refinance, the Mortgage broker can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the best home loans in Singapore. And the good thing is that all our services are free of charge. So it’s all worth it to secure a loan through us.

For advice on a new home loan.

For refinancing advice.