Retail market bottoming with the stabilisation of rents in the last few quarters, although any recovery is likely to be subdued given the lack of catalyst

Prices of retail space increased by 1.8% in 4th Quarter 2019, compared with the increase of 1.1% in the previous quarter. Rentals of retail space increased by 2.3% in 4th Quarter 2019, following the same increase of 2.3% in the previous quarter. For the whole of 2019, prices of retail space increased by 1.3%, compared with the increase of 0.6% in 2018; while rentals of retail space increased by 2.9%, compared with the decline of 1.0% in 2018.

Supply in the Pipeline

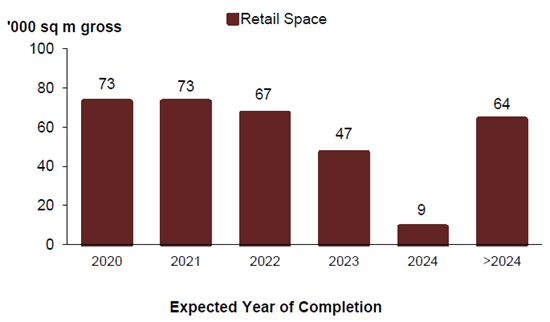

As at the end of 4th Quarter 2019, there was a total supply of 333,000 sq m GFA of retail space from projects in the pipeline, compared with the 288,000 sq m GFA of retail space in the pipeline in the previous quarter.

Stock and Vacancy

The amount of occupied retail space increased by 26,000 sq m (nett) in 4th Quarter 2019, compared with the increase of 29,000 sq m (nett) in the previous quarter. The stock of retail space increased by 29,000 sq m (nett) in 4th Quarter 2019, compared with the increase of 16,000 sq m (nett) in the previous quarter. As the changes in occupied retail space and stock of retail space were similar, the island-wide vacancy rate of retail space remained at 7.5% as at the end of 4th Quarter 2019, same as the end of the previous quarter.

Commenting on retail market bottoming with the stabilisation of rents, Colliers International said:

“retail rents continued to improve in Q4 2019, with the URA’s Retail Rental Index for the Central Region growing 2.3% QOQ. For the full year 2019, retail rents for the Central Region were up 2.9% YOY, reversing the full year decline of 1.0% in 2018. Rents are still 15% below the last peak in Q4 2014.

Prices of retail properties in the Central Region were up 1.8% QOQ in Q4 2019 as reflected by URA’s Retail Price Index. In 2019, prices in the Central Region were up 1.3% YOY, compared to a 0.6% increase in 2018.

According to Colliers Research, with the retail market stabilising, investor interest has returned to the retail property sector. 2019 saw record retail capital market transactions in a decade. In 2019, total retail investment sales jumped 204% YOY to reach SGD4.1 billion, driven by keen investor interest and M&As. Major transactions in 2019 included The Star Vista, Rivervale Mall, Duo Galleria, Liang Court mall and Chinatown Point mall. In 2020, the market remains conducive for deals given a favorable interest rate outlook and improved demand-supply dynamics in the retail property market.

Meanwhile, islandwide retail vacancy stayed flat sequentially at 7.5%, despite more retail space being granted Temporary Occupation Permit (TOP). During the quarter, 24,400 sq m of retail space was completed, with the most significant supply coming from Tekka Place’s 10,300 sq m of Gross Floor Area (GFA).”

Commenting on retail market bottoming with the stabilisation of rents, Ms Tricia Song, Head of Research for Singapore at Colliers International, said:

“We see the retail market bottoming with the stabilisation of rents in the last few quarters, although any recovery is likely to be subdued given the lack of catalysts.

Looking into 2020, we expect overall retail rents to remain flat with Orchard Road prime rents likely to lead a recovery, particularly in view of the government’s rejuvenation plans for Orchard Road, as well as rising visitor arrivals and tourism receipts.

As the market continues to digest the major supply completions in 2019 including Funan, Paya Lebar Quarter Mall, and Jewel Changi Airport, we expect new supply to ease significantly and stay tight in 2020 (0.3% of total stock versus 10-year historical average of 1.4%) and throughout 2020-2024 (0.4% of total stock). In addition, the new supply is mostly concentrated in suburban and fringe areas, where there is a well-defined population catchment. This should help to support occupancies in the retail market going forward.

After years of test-bedding new concepts, re-jigging tenant mixes, and rental adjustments, we observed that landlords and tenants appear to be more confident about tackling challenges arising from e-commerce by embracing omni-channel retail strategy and driving innovation. They seem to be more aligned in their objectives to stay relevant, consistently adapting to changing consumer preferences. Going forward, we see an increasing adoption of technology by retailers to further enhance customer experience. Meanwhile, we expect landlords to continue “reinventing” retail, with further expansion of flexible workspace into retail malls in 2020.”

As prices of retail space increased by 1.8% in 4th Quarter 2019, prices in the office market decreased.

Rentals of office space decreased by 3.2% in 4th Quarter 2019, compared with the 0.6% decrease in the previous quarter. For the whole of 2019, prices of office space decreased by 0.6%, compared with the increase of 5.7% in 2018; while rentals of office space decreased by 3.1%, compared with the increase of 7.4% in 2018.

Supply in the Pipeline in the Office Market

As at the end of 4th Quarter 2019, there was a total supply of about 753,000 sq m GFA of office space in the pipeline, compared with the 738,000 sq m GFA of office space in the pipeline in the previous quarter.

Stock and Vacancy in the Office Market

The amount of occupied office space increased by 30,000 sq m (nett) in 4th Quarter 2019, compared with the increase of 71,000 sq m (nett) in the previous quarter. The stock of office space increased by 29,000 sq m (nett) in 4th Quarter 2019, compared with the decrease of 4,000 sq m (nett) in the previous quarter. As a result, the island-wide vacancy rate of office space declined to 10.5% as at the end of 4th Quarter 2019, from 10.6% as at the end of the previous quarter.