Retail property market prices increased by 0.3% in 3rd Quarter 2018, compared with the decrease of 1.3% in the previous quarter said the real estate statistics for 3rd Quarter 2018 Urban Redevelopment Authority (URA) released on October 26. As at the end of 3rd Quarter 2018, there was a total supply of 501,000 sq m Gross Floor Area (GFA) of retail space from projects in the pipeline, compared with the 498,000 sq m GFA of retail space in the pipeline in the previous quarter.

The amount of occupied retail space decreased by 26,000 sq m (nett) in 3rd Quarter 2018, compared with an increase of 21,000 sq m (nett) in the previous quarter. The retail property market saw stock of retail space decreased by 11,000 sq m (nett) in 3rd Quarter 2018, compared with the increase of 10,000 sq m (nett) in the previous quarter. As a result, the island-wide vacancy rate of retail space increased to 7.6% at the end of 3rd Quarter 2018, from 7.3% at the end of the previous quarter.

JLL noted that the retail property market stayed lacklustre in 3Q18, with the URA’s rental index for Central Region extending the decline that was recorded in 2Q18 following a momentary quarter of modest uptick in 1Q18.

Table of Contents

“The latest dip in rents came on the back of the 0.3 percentage point rise in islandwide vacancy rate from 7.3% in 2Q18 to 7.6% in 3Q18 as demand for retail space contracted,” JLL said.

Adding: “changing tenant profile to include large-form activity based retailers such as Superpark, ABC Cooking Studio, Holey Moley, is also believed to have played a part in keeping rents soft. Landlords are increasingly adding such retailers in the hope of driving footfall to their malls.”

https://www.icompareloan.com/resources/mortgage-broker-singapore-best-rate/

Ms Tay Huey Ying, JLL’s Head of Research and Consultancy for Singapore said: “on a brighter note, vacancy rates on Orchard Road continued to improve and by the end of 3Q18, they are 3.3 percentage points below the recent high of 9.2% in 2Q16. This demonstrates that Singapore’s prime shopping belt remains appealing to retailers, both new-to-market and expanding brands, because of its diverse catchment comprising locals and tourists.”

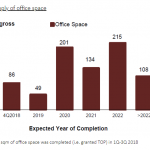

She added: “Looking forward, we expect landlords to have to continue to experiment with different tenant mix strategies in pursuit of improving occupancy and footfall. The substantial supply coming on stream over the next 15 months amounting to a total gross floor area of 308,000 sqm will continue to weigh down rents.

“In short, until brick-and-mortar retail stores manage to convert foot traffic into in-store purchases, rent movements are expected to remain subdued.

“Prices, on the other hand, are demonstrating greater signs for firming as the URA’s price index for Central Region inched up a modest 0.3% q-o-q in 3Q18 – the second uptick in three quarters. This could be an indication of strengthening investors interest given the 15.2% total price decline in the Central Region, and a more substantial 19.2% fall in the Central Area, from their recent peaks in 1Q15.”

Ms Tay said that with more investors potentially diverting their interest from private residential to other asset classes to avoid hefty additional buyer stamp duties, coupled with the ample liquidity in the market, it looks like there is scope for retail property market prices to recover earlier than rents.

https://www.icompareloan.com/resources/singapore-banks-transferring-interest-volatility-risks-consumers/

A research by Savills released in August, suggests that retail property market vacancies are moderating while rents are weakening. The research noted that despite the festive spending prior to Hari Raya Aidilfitri, which lifted retail sales (excluding motor vehicles) in May, the overall sales growth for both April and May was restrained by sluggish sales of discretionary goods.

The research noted that island-wide vacancy level for the retail property market was down by 0.2 of a percentage point (ppt) quarter-on-quarter (QoQ) to 7.3% in Q2/2018, marking the lowest quarter since 2016, said the report.

It further said that the retail rental index in the central region slipped 1.1% QoQ in Q2/2018, reversing the slight recovery of 0.1% in the preceding quarte, and that prime monthly rents in Orchard Road and the suburban area stayed flat at S$29.90 and S$28.80 per sq ft respectively in Q2/2018.

The research on the local retail property market suggested that although the retail industry remains very challenged, rents may be trying to find a base at current levels.

Savills said that for the past few years, household income and tourism expenditure have been rising consistently and it seems counter intuitive that the retail sales index should remain subdued for so long. It asked if the new electronic payment means were causing the under-reading.

In its outlook for the prospects of the retail property market, the Research said “it is important for landlords and retailers to adapt to emerging trends and come up with new and interesting concepts to bring shoppers back into malls,” and that “it is important for landlords and retailers to adapt to emerging trends and come up with new and interesting concepts to bring shoppers back into malls.”

How to Secure a Commercial Loan Quickly

Are you searching for properties in the retail property market and need a commercial loan, or are unsure if you qualify for one? iCompareLoan mortgage brokers can set you up on a path that can get you a commercial loan in a quick and seamless manner. Our brokers have close links with the best lenders in town and can help you compare Singapore commercial loans and settle for a package that best suits your purchase or investment needs.

Whether you are looking for a new commercial loan or to refinance, our brokers can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the loan. And the good thing is that all their services are free of charge. So it’s all worth it to secure a loan through them.

For advice on a new commercial loan or Personal Finance advice.

To speak to our Panel of Property agents.