Retail upheaval paints a bright future for shops and malls post COVID-19; shift in landlord-tenant relationships

Optimistic recovery for the retail industry as retailers and landlords evolve towards inter-dependent partnerships and accelerate digital transformation.

Mr Leonard Tay, newly-appointed Head of Research at Knight Frank Singapore, provides retailers and landlords with areas of opportunities for business recovery in his latest analysis citing the fundamentals of Singapore’s retail landscape. Tay identifies key factors in Retail Real Estate Opportunities After COVID-19 that can influence the recovery of retailers following the assumed conclusion of the circuit breaker on 1 June 2020.

Leonard Tay joined Knight Frank Singapore with more than a decade of real estate experience. Tay has participated in numerous consulting assignments including market studies and due diligence advisory, development and financial feasibility studies, investment strategy and occupier portfolio studies, for a wide range of clients such as Central Provident Fund Board, Ascendas Real Estate Industrial Trust, Standard Chartered Bank and CapitaLand Limited. Tay will lead the Research team at Knight Frank Singapore in providing cross-sector market research.

Retail upheaval shows strong potential for scaling up of online shopping

“Despite the acceleration of e-commerce brought on by the pandemic, online retail sales account for less than 10% of overall retail volume throughout the whole of 2019 and into the first three months of 2020. There remains huge potential for online shopping to scale nationwide, especially for sole brick-and-mortar retailers who are still reliant on physical shops,” explains Tay.

On the success of online shopping platforms, Mr Ethan Hsu, who joins Knight Frank Singapore as the new Head of Retail, says: “Retailers who emerge stronger will be those who understand their customers’ journeys using multiple touchpoints on both digital and physical channels to interact meaningfully with them.”

Ethan Hsu has 20 years of experience spanning across several industries and is known for his passion in Singapore’s retail landscape. Previously the founding Head of Retail at Huttons Asia and Assistant Vice-President of The Straits Trading Company, he has worked on major retail projects in downtown and suburban malls, including Suntec City during its $410m revamp in 2013. Hsu brings a fresh perspective to Knight Frank Singapore as Head of Retail. He will manage a diverse portfolio of retail projects including Change Alley Mall, GR.ID (formerly POMO), Le Quest, New Tech Park, Tekka Place and The Arts House.

Retail upheaval will quicken digital adoption by businesses

“Retail businesses that deploy digital platforms will benefit from analytical tools and big data. As customers continue shopping at physical and online stores, they will value personalised shopping experiences created based on their profiles, preferences, and spending habits.”

Landlord-tenant relationships are set to change. Hsu explains: “Tenancy agreements will take on a partnership approach. Landlords are advised to offer amenable and flexible rent structures to attract stronger tenants, offering a hybrid rent structure that comprises low base rents with higher percentages of sales components.”

Knight Frank Singapore, established in 1940, is part of Knight Frank LLP, a leading independent global property consultancy based in London. The Knight Frank Group has more than 19,000 people operating from 512 offices across 60 markets. Knight Frank Singapore was appointed in January 2020 as an exclusive marketing agent for a portfolio of 11 retail shops in Sim Lim Square. Other prominent projects include Gardens by the Bay, Singapore Sports Hub, Plaza Singapura, Takashimaya Shopping Centre, Marina Square, Rochester Mall and more.

The report on Retail Real Estate Opportunities After COVID-19 highlights key findings on online retail sales, suggesting that local consumers are likely to resume physical shopping with renewed expectations, driving a shift in relationship between retail landlords and tenants.

Retail upheaval will demand that businesses know their customers better

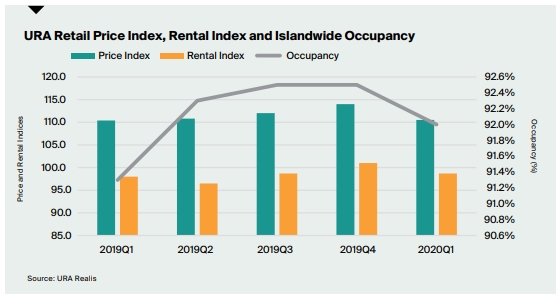

“The retail sector experienced moderate recovery in 2019, with the URA Retail Price Index and the Rental Index increasing by 1.3% and 2.9% respectively during the year. The spectre of the coronavirus disease (COVID-19) in the first quarter of 2020 has since derailed its gains, with the Retail Price Index falling 3.1% and the Rental Index decreasing by 2.3%. In addition, island-wide occupancy levels dropped by 0.5 percentage points to 92.0% during Q1 2020.

Furthermore, a “Circuit Breaker” was imposed by the Singapore government, from 7 April 2020 to 1 June 2020, to stem the rate of COVID-19 infection cases. Closures have been imposed on many “non-essential” retail businesses, while limiting the operational capacities of some food and beverage (F&B) operations. This can only mean that the retail real estate indicators for the rest of the year will not be positive.”

“Businesses that were struggling before the pandemic outbreak will have to adopt technology and offer online shopping channels, or risk being obsolete. Rules of the new playing field will change drastically: movement restrictions and social distancing will be the new norm, while businesses will need to offer omni-channel shopping platforms to customers to stay afloat.

“Furthermore, retailers who aim to emerge stronger will be those who understand their customers’ journeys and create multiple touch points across digital and physical channels to interact meaningfully with them. Even traditional-minded brick-and-mortar shoppers, resistant to the idea of online transactions, would have adopted online shopping ever since the start of the circuit breaker. This major shift towards e-commerce will continue, and retailers will need to diversify their supply chain options, as well as develop logistics and fulfilment strategies quickly to adjust their business models to this new playing field.

“Retailers who have successfully deployed digital platforms will continue to enjoy substantial benefits in the long run. Leveraging on analytics tools and big data will enable businesses to gain valuable insights on their customers. Business operators will be able to track consumer profiles, preferences, spending habits, and other shopping behaviours to craft personalised shopping experiences that customers will value as they continue shopping at physical and online stores.”