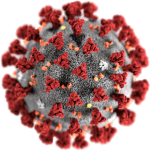

Singapore FinTech Firms gets support amid the challenging business climate caused by the COVID-19 pandemic

The Monetary Authority of Singapore (MAS), Singapore FinTech Association (SFA), AMTD Group and AMTD Foundation (collectively, AMTD) on May 13 announced the launch of a S$6 million MAS-SFA-AMTD FinTech Solidarity Grant (the Grant) to support Singapore FinTech firms amid the challenging business climate caused by the COVID-19 pandemic.

The Monetary Authority of Singapore (MAS), Singapore FinTech Association (SFA), AMTD Group and AMTD Foundation (collectively, AMTD) on May 13 announced the launch of a S$6 million MAS-SFA-AMTD FinTech Solidarity Grant (the Grant) to support Singapore FinTech firms amid the challenging business climate caused by the COVID-19 pandemic.

The Grant will help Singapore FinTech firms maintain their operations, and enable them to continue to innovate and grow. The Grant complements the S$125 million support package announced by MAS on 8 April 2020 to sustain and strengthen capabilities in the financial services and FinTech sectors.

AMTD has provided an initial S$2 million to support the Singapore FinTech firms ecosystem. MAS will provide an additional S$4 million from the Financial Sector Development Fund , taking the total grant amount to S$6 million. Applications for the Grant will open on 18 May 2020 and will be available until 31 December 2021. The Financial Sector Development Fund (FSDF) is established under the MAS Act to promote Singapore as a financial centre. The FSDF provides funding to support: skills development and upgrading; research and development programmes; and industry projects and infrastructure, for the Singapore financial services sector.

The Grant for Singapore FinTech Firms comprises two components:

- S$1.5 million Business Sustenance Grant (BSG). Eligible Singapore-based FinTech firms can receive a one-time grant for up to S$20,000 to cover day-to-day working capital expenditures, such as salaries and rental costs. The short-term assistance will help FinTech firms sustain their operations and retain their employees. The BSG is fully funded by AMTD’s contribution.

- S$4.5 million Business Growth Grant (BGG). Eligible Singapore-based FinTech firms can receive up to S$40,000 for their first Proof of Concept (POC) with financial institutions on the API Exchange (APIX) platform, and S$10,000 for each subsequent POC, subject to a total cap of $80,000 per firm for the entire duration of the grant. The BGG enables these companies to continue to innovate in partnership with financial institutions and create opportunities for growth. The BGG is jointly supported by AMTD and MAS. The API Exchange (APIX) is a cross-border, open-architecture API platform that serves as a global marketplace for financial institutions, regulators, supervisors, central banks and FinTechs to connect with one another. APIX also provides a sandbox to design experiments collaboratively, and deploy innovative solutions easily via a cloud-based architecture. APIX is a flagship product of the ASEAN Financial Innovation Network (AFIN), a non-profit entity formed by the Monetary Authority of Singapore, International Finance Corporation, a member of the World Bank Group, and the ASEAN Bankers Association, with the objectives of supporting financial innovation and inclusion around the world.

- In addition, the BGG will provide funding for the salaries of undergraduate interns, capped at S$1,000/month per intern. This grant will support around 120 interns in the FinTech sector, assuming an average internship duration of 3 to 5 months. We hope to encourage FinTech firms to continue to offer internships and develop the local FinTech talent pipeline.

Singapore FinTech firms can apply for both BSG and BGG if they fulfil the eligibility criteria for both grants. SFA will administer and review the grant applications.

Mr Chia Hock Lai, President, SFA said, “FinTech firms are in a great position to seize opportunities presented by the accelerated trend towards digital financing induced by the COVID-19 pandemic. The Business Sustenance Grant helps FinTech firms to plug their short term financing gaps while Business Growth Grant enables them to grow and sell through the APIX platform. These will help save jobs while making our FinTech firms competitive for the post COVID-19 economic recovery world.”

Mr Sopnendu Mohanty, Chief FinTech Officer of MAS, said, “There is a surge in demand in the financial services industry around the region for solutions to address the need for remote digital services amidst the COVID-19 pandemic. FinTech firms have a great opportunity to step up actively during this period to provide these solutions. The Business Growth Grant will help FinTech firms offset their costs. By conducting their POCs on APIX, financial institutions and FinTech firms will not need to set up test infrastructure for integration. This will help accelerate project development while still working remotely.”

Mr Calvin Choi, Chairman and CEO of AMTD Group, and Founder and Chairman of AMTD Foundation, said, “As an active financial institution focusing in the Asian region, we see the immediate need for the private sector to foster closer partnership with FinTech firms to formulate tailor made solutions to cater for the increasing demand for digital services and greater opportunities to scale up. This is an important moment in time to overcome challenges while identifying every opportunity and client servicing angle through proactive collaboration with the APIX platform to achieve FinTech success and FI transformation. The Business Sustenance Grant and the Business Growth Grant provide a holistic solution to ensure sustainability and growth opportunities for FinTech firms during the COVID-19 pandemic.”

For more information about the grant for Singapore FinTech Firms, please visit SFA website at www.singaporefintech.org on the application process and criteria.

About Singapore FinTech Association (SFA)

The SFA is a cross-industry and non-profit organisation. Its purpose is to support the development of the FinTech industry in Singapore, and to facilitate collaboration among the participants and stakeholders of the FinTech ecosystem in Singapore. The SFA is a member-based organisation with over 350 members. It represents the full range of stakeholders in the FinTech industry, from early-stage innovative companies to large financial players and service providers.

To further its purpose, the SFA also partners with institutions and associations from Singapore and globally to cooperate on initiatives relating to the FinTech industry. The SFA has signed over 50 international Memorandum of Understanding (MoU) and are the first U Associate organisation to be affiliated with National Trades Union Congress (NTUC). Through their FinTech Talent (FT) Programme, launched in 2017, over 300 professionals have been trained in FinTech, including blockchain & cryptocurrency, cybersecurity and regulation.

About AMTD Group

AMTD Group is a leading comprehensive financial services focused conglomerate, with businesses in investment banking, asset management, digital financial solutions; and non-financial services areas to include education and real estate.

AMTD International (NYSE: HKIB; SGX: HKB), a subsidiary of AMTD Group, comprises the largest independent investment bank in Asia and one of Asia’s largest independent asset management companies, and has been a leading investor in FinTech and the new economy sector. AMTD International also represents the 1st dual class share scheme listed company on SGX-ST. AMTD Digital, the digital arm of AMTD Group is a comprehensive digital solutions connected platform with Singapore as its headquarters, covering digital financial services and solutions, digital connectors and eco-systems, digital marketing and data intelligence, and digital investments.

About AMTD Foundation

AMTD Foundation, a charitable organisation founded by Mr. Calvin Choi, is set up to fulfil its commitment of giving back to the society and upholding its social responsibility. AMTD Foundation has been putting in great efforts to promote education, relieve poverty, and support people in need in Asia and across the world. AMTD has entered into strategic partnerships with The Hong Kong Polytechnic University and the University of Waterloo in Canada respectively, for the establishment of “AMTD FinTech Centre of PolyU Faculty of Business” and “The AMTD Waterloo Global Talent Postdoctoral Fellowships”, and established a long-term partnership to develop the “Singapore Digital Finance Leadership Programme” with Xiaomi Finance, Singapore Management University (SMU) and the Institute of Systems Science (ISS) at the National University of Singapore (NUS). Recently, AMTD has partnered with Singapore FinTech Association to announce a AMTD Global FinTech Fellowship programme to anchor and support FinTech talents’ development post COVID-19 and beyond.

About Monetary Authority of Singapore

The Monetary Authority of Singapore (MAS) is Singapore’s central bank and integrated financial regulator. As central bank, MAS promotes sustained, non-inflationary economic growth through the conduct of monetary policy and close macroeconomic surveillance and analysis. It manages Singapore’s exchange rate, official foreign reserves, and liquidity in the banking sector. As an integrated financial supervisor, MAS fosters a sound financial services sector through its prudential oversight of all financial institutions in Singapore – banks, insurers, capital market intermediaries, financial advisors, and stock exchanges. It is also responsible for well-functioning financial markets, sound conduct, and investor education. MAS also works with the financial industry to promote Singapore as a dynamic international financial centre. It facilitates the development of infrastructure, adoption of technology, and upgrading of skills in the financial industry.