Understanding Building under Construction (BUC) Loans in Singapore

Why do people want to buy properties still under construction? After all, there are more risks involved in purchasing an uncompleted house versus a completed one. Who knows? The developer may go bust before the property sees the light of day.

Well, the “early bird catches the worm” mentality is at play here. Some buyers want to grab the best units: units with the most beautiful views, etc. But more often than not buyers are motivated by the monetary savings that comes with early purchases. Developers dangle early-bird perks such as a per-square-foot discounts, or the absorption of stamp duties or other administrative costs.

For whatever reasons you are buying a BUC house, you will likely finance it with a loan. This article provides some useful information about BUC loans.

By iCompareLoan Editorial Team

What are the upfront payments?

Table of Contents

Before the loan commencement, you will be required to stump up 5-25% [depends on the loan-to-value (LTV) limit and if there is any outstanding mortgage] of the transacted price in cash. The remaining difference between the loan amount and purchase price can be paid for with cash and/or CPF fund. As for the buyer’s stamp duty and additional buyer’s stamp duty (ABSD), they can be paid for with cash and/or CPF fund as well.

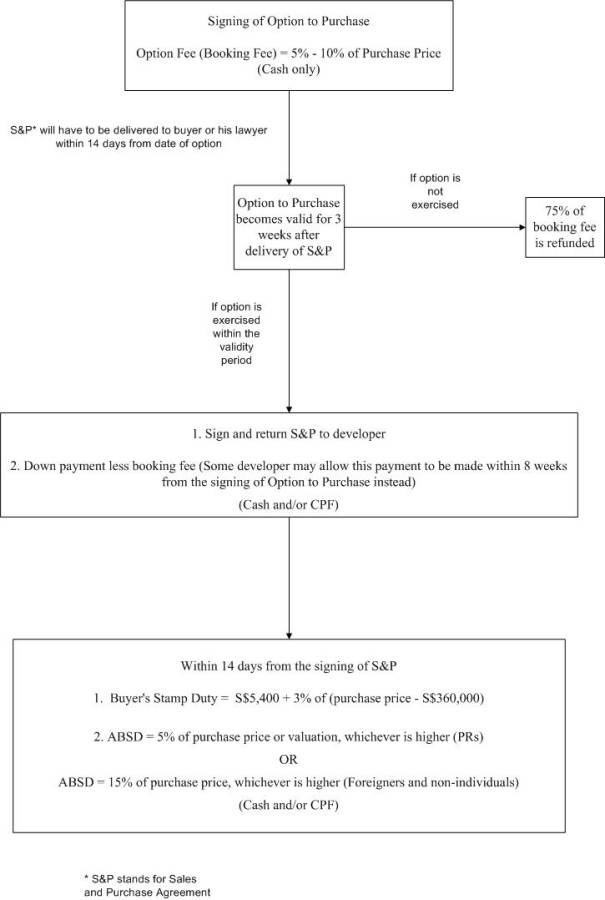

The below flowchart outlines the payment at the different stages. This payment schedule also applies to completed new private properties. Here, we assume it is the first property purchase. In addition, do note that for permanent residents (PRs), and foreigners & non-individuals ABSD is payable.

Figure 1: Payment Schedule for Private Property Purchase from Developer

What is a BUC loan?

Since 26 October 2007, the deferred payment scheme (which defers payment till a later date) was disallowed, so buyers have to rely on the standard payment scheme (Urban Redevelopment Authority, “Progress Payments”) in which payments have to be made at different stages of the property construction. Thus a BUC loan also follows this payment schedule.

Unlike a loan for a completed property which is 100% disbursed at one time, a BUC loan has a progressive disbursement schedule. In other words, a certain percentage of the loan is disbursed at each stage of the property construction. The following example illustrates this.

Example 1

Purchase Price: S$2,000,000

Loan Quantum: S$1,600,000

Table 1: Disbursement Schedule for a BUC Loan

|

Stage |

Month |

Disbursed Ratio |

Interest Rate |

Disbursed Balance |

Monthly Installment |

| Completion of Foundation |

1 |

10% |

1.250% |

S$200,000.00 |

S$666.50 |

| Completion of Superstructure |

7 |

10% |

1.250% |

S$397,243.81 |

S$1,342.32 |

| Completion of Brick Wall |

13 |

5% |

1.450% |

S$491,658.14 |

S$1,731.45 |

| Completion of Ceiling/Roofing |

17 |

5% |

1.450% |

S$587,100.42 |

S$2,086.91 |

| Completion of ElectricalWiring/Plumbing |

21 |

5% |

1.450% |

S$681,580.43 |

S$2,445.75 |

| Completion of Roads/CarsParks/Drainage |

25 |

5% |

1.450% |

S$775,079.97 |

S$2,808.04 |

| Issuance of Temporary OccupationPermit (TOP) |

29 |

25% |

1.450% |

S$1,267,580.46 |

S$4,637.19 |

| Certificate of Statutory Completion |

40 |

15% |

2.750% |

S$1,534,842.41 |

S$6,759.05 |

Source: www.iCompareLoan.com

Repayment of the loan commences at the first disbursement. That is in the first month. Disbursed Ratio is the percentage of the purchase price, not the loan quantum. In the first month 10% is disbursed and in the seventh month, another 10% is disbursed, and so on.

Do note that this schedule is only a guide, the actual completion time for each stage may vary in reality, but the amount payable at each stage should be the same.

If you still need clarification on the payment schedule of a BUC loan, you can turn to the professional mortgage consultant at www.iCompareLoan.com, who dispenses free advice and reports generated from Singapore’s most advanced loan analysis system.

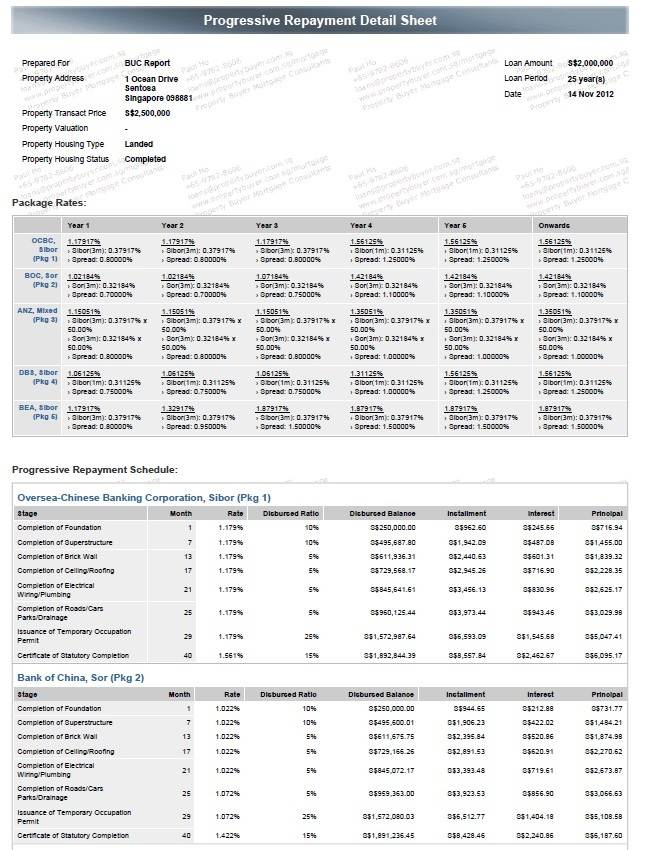

Figure 2: Sample of a BUC Loan Report

Source: www.iCompareLoan.com

What are the types of BUC loans?

Similar to the loan for a completed property, a BUC loan comes in the usual types:

- Fixed Rate Package

- Variable (Floating) Rate Package

- Board rate (bank’s internal reference) – pegged

- SIBOR-pegged

- SOR-pegged

- Combo SIBOR/SOR [recently introduced by Australia and New Zealand Banking Group Limited (ANZ)]

Previously, interest-only loans were popular among buyers of BUC projects because this type of loans allows them to defer principle repayments till a later date. This makes monthly installment much lower as it consists only of interest repayments. However, this fuelled property speculation, causing the Government to cancel interest-only loans since 14 September 2009.

For the existing loan types (ie. fixed rate or variable rate package), conversion if allowed is usually after TOP.

Things to take note of

As BUC loans are disbursed progressively, full repayment will be subjected to a cancellation fee, normally 1.5 – 2.0% of the un-disbursed amount. If the repayment is during the lock-in period, you will have to bear the cancellation fee on top of the lock-in penalty.

Please note that interest rates for BUC loans are not necessarily higher than loans for completed properties. Consequently, it well may be more worthwhile to buy a property while still under construction as the loan quantum is smaller, and hence interest payment, during the initial few years.

For advice and get a Free Home Loan Report (TM) on a new home loan

For refinancing advice.

Download this article here.

Read more about New Launch Building-under-construction condo.