In an interview with CNBC, President Donald Trump expressed frustration with the Federal Reserve (US Fed) and said the central bank could disrupt the economic recovery.

The US Fed raised the benchmark lending rate on June 13 which brings the the federal funds rate to a range of 1.75 to 2 per cent. Being the second increase of the year, the hike signaled that the US Federal Reserve will be more aggressive about rate increases this year.

Although President Trump acknowledged that he had a good man in Chairman Jerome Powell at the helm of the US Fed, Trump said that he was not thrilled “because we go up and every time you go up they want to raise rates again. I don’t really — I am not happy about it. But at the same time I’m letting them do what they feel is best.”

Table of Contents

Adding: “But I don’t like all of this work that goes into doing what we’re doing.”

https://youtu.be/GYQC7wvPvTU

In announcing Federal Open Market Committee’s unanimous decision to raise interest rates in June, Powell said that its meeting in May indicated that the labor market has continued to strengthen and that economic activity has been rising at a solid rate.

“Job gains have been strong, on average, in recent months, and the unemployment rate has declined. Recent data suggest that growth of household spending has picked up, while business fixed investment has continued to grow strongly. On a 12-month basis, both overall inflation and inflation for items other than food and energy have moved close to 2 percent. Indicators of longer-term inflation expectations are little changed, on balance.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2 percent objective over the medium term. Risks to the economic outlook appear roughly balanced.

In view of realized and expected labor market conditions and inflation, the Committee decided to raise the target range for the federal funds rate to 1-3/4 to 2 percent. The stance of monetary policy remains accommodative, thereby supporting strong labor market conditions and a sustained return to 2 percent inflation.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.”

If the US Fed puts the brake on its interest rates hike considering President Trump’s unhappiness, it will be good news for borrowers in Singapore.

This is because the US Fed rate hike has an impact on credit cards, mortgages, vehicle loans and bank savings accounts here. This is because Singapore interest rates are closely correlated with those in the US.

https://www.icompareloan.com/resources/mortgage-market/

The SIBOR (Singapore interbank offered rate) for example is expected to go up. This could dent some of the enthusiasm in the buoyant property market.

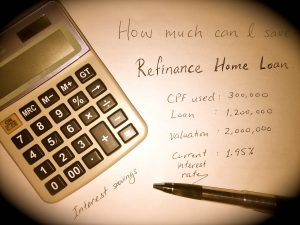

Since the beginning of this year, banks have raised interest rates for both fixed and floating home loan packages by 10 – 30 basis points (bps). Some banks have already upped their mortgage rate to 2.05 per cent, to keep pace with the increasing interest rates.

Since the beginning of this year, banks have raised interest rates for both fixed and floating home loan packages by 10 – 30 basis points (bps). Some banks have already upped their mortgage rate to 2.05 per cent, to keep pace with the increasing interest rates.

The 3-month SIBOR has hovered at 1.41 per cent since May. The further increase announced by the US Federal Reserve on Wednesday is expected to drive the interest rates for mortgage loans even higher.

DBS is now charging 1.95 percent a year for each of the three years for its 3-year fixed rate package, while UOB recently increased its 3-year fixed rate package to 2.05 percent a year for each of the three years. OCBC, on the other hand, raised its 2-year fixed rate package to 1.85 per cent.

Tin Min Ying, an investment analyst at Phillip Securities Research Pte Ltd, said in early June that SIBOR and SOR will continue their upward trend.

“3-month SIBOR crept up in May to near 10-year highs. We expect the Singapore banks’ NIMs (Net Interest Margin Securities) to be on a gradual upward trend given expectations of 3 or more Fed rate hikes in 2018. NIM expansion will be the main share price catalyst for the next few quarters. Despite the 40bps increase in SIBOR this year, mortgage loans growth has remained resilient at 4.4% YoY. Therefore, we do not expect new mortgage loans to be adversely affected by the gradual increase in SIBOR.”

Tin also said that Singapore’s domestic loans in April grew 5.7% year-on-year.

Banks, however, are usually slow off the mark in raising the interest rates in response to global news like the US Federal Reserve rate hikes. This lag time is where a mortgage consultant can best help a distressed buyer to finance a new purchase or to refinance their current property.

Mr Paul Ho, chief mortgage consultant said that it is the most wealthy who usually use mortgage brokers as they see the value in engaging them.

He added: “Younger people are receptive to mortgage brokers and they are also used to price comparison sites like icompareloan.com. Older people tend to think that you are not the bank and so are more apprehensive.”

Mr Ho said that older people tend to place a lot more respect on bankers despite the fact that banks have lowered their criteria for hiring bankers.

“Furthermore, a banker cannot tell you that his bank is not giving you the best packages as his/her role is to sell the bank’s packages,” he said.

If you are looking to buy properties, our Panel of Property agents and the mortgage consultants at icompareloan.com can help you with affordability assessment and a promotional home loan. The services of our mortgage loan experts are free. Our analysis will give best home loan seekers better ease of mind on interest rate volatility and repayments.

Just email our chief mortgage consultant, Paul Ho, with your name, email and phone number at paul@icompareloan.com for a free assessment.