DBS FHR-8 raises their fixed deposit rates (FHR) across the board

Table of Contents

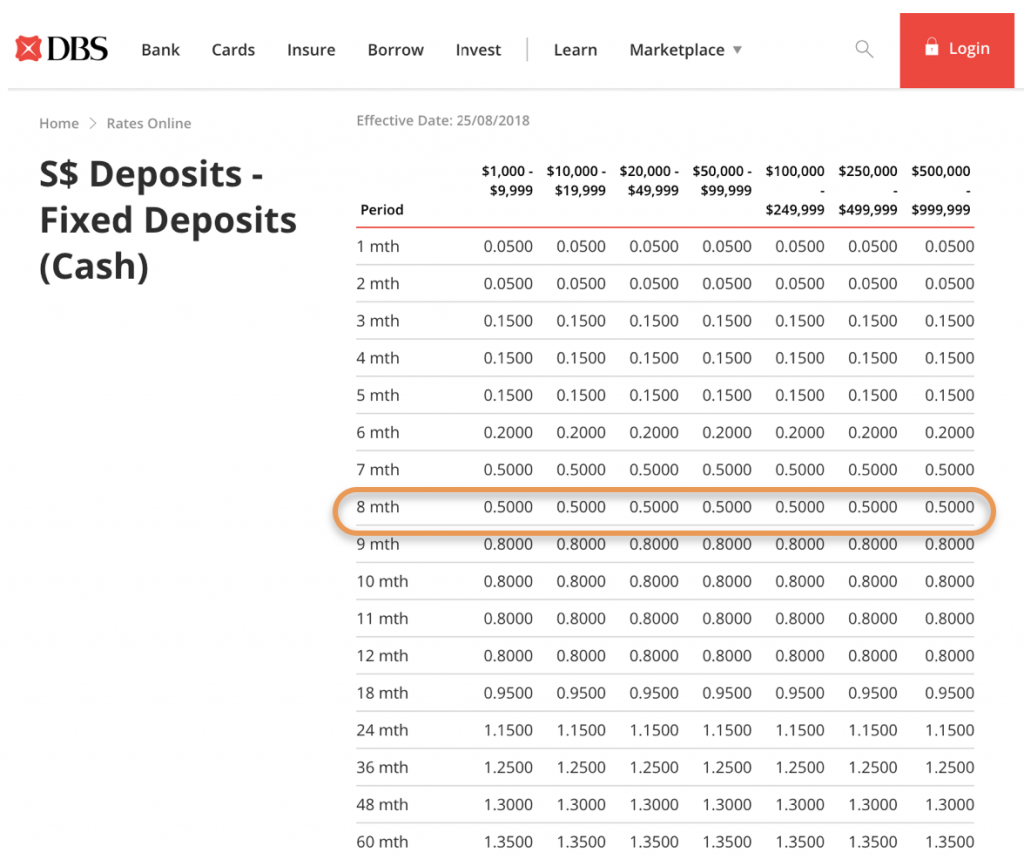

Effective from 25th Aug 2018, DBS has revised their Singapore dollar fixed deposits (Cash) rates. This comes on the back of the Federal Reserve Rate hikes. This means that all the home loans pegged to DBS FHR-8 will hike.

Image Credits: POSB ATM machines at Holland Village, Paul Ho, iCompareLoan.com

Many people who took their home loans with DBS using a fixed deposit reference will be hit with a higher rate in September 2018. This is especially so for those who took the Fixed Home Rate FHR-8 (8-month) reference.

Figure 1: DBS S$ Deposits – Fixed Deposits (Cash) and Fixed Home Rate (FHR) impact, DBS

Previous DBS Rate hikes: –

DBS raised their FHR-18 reference

DBS raised their FHR-9 reference in June 2018 from 0.25% to 0.5% (a 0.25% hike).

FHR-8 (8-month Fixed Home Rate) rose from 0.2% to 0.5% effective on 25th Aug 2018. Each bank normally gives 1 month notice to home owners about the impending change. The letters should be reaching the mailboxes of DBS home loan customers by the 1st week of September for a potential October 2018 rate hike.

This rate hike means that, for those of you who took the following: –

FHR-8 = 0.2% (before 25th Aug 2018)

- DBS FHR-8 + 1.45% = 1.65% (before 25th Aug 2018)

FHR-8 = 0.5% (Effective 25th Aug 2018)

- DBS FHR-8 + 1.45% = 1.95% (effective 25th Aug 2018)

This is quite a hefty hike, but please do not blame DBS for the hike. Read more and you will understand why.

How much more do you have to pay after DBS FHR-8 Fixed Home Rate hike?

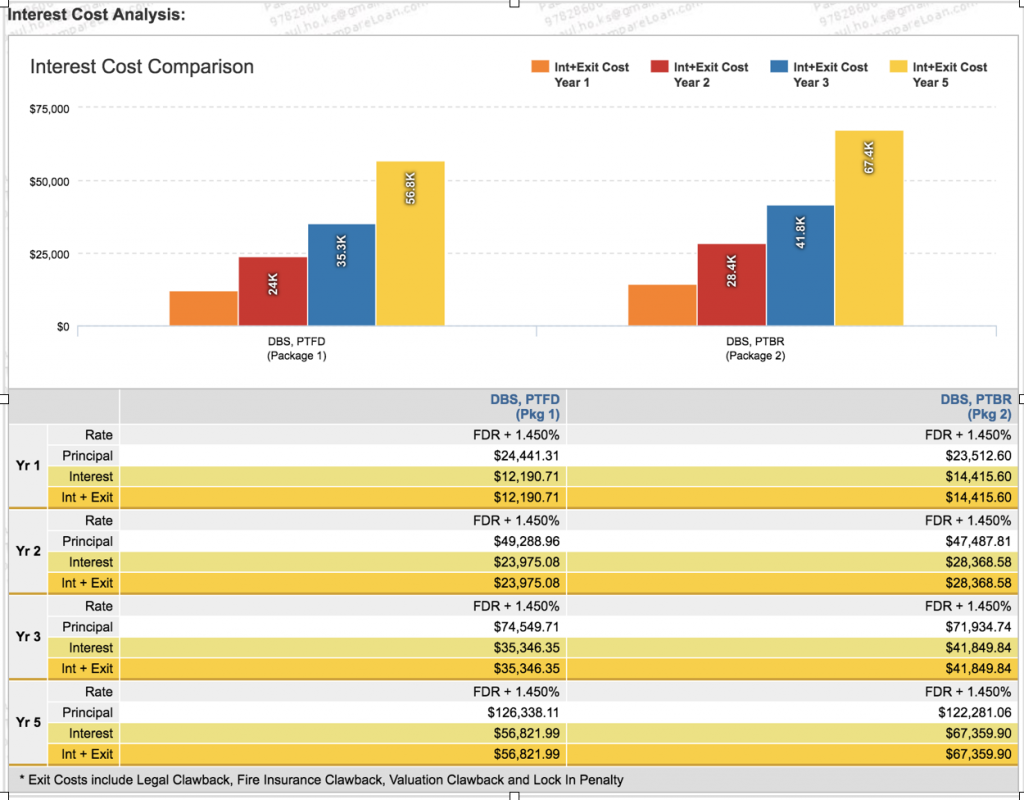

For a S$1m loan, 25 years tenure, the difference between 1.95% and 1.65% interest rate.

Figure 2: DBS FHR-8 interest cost before HIKE and after 25th Aug 2018 Hike, DBS, iCompareLoan.com

Over a 5 year period, the home owner would have paid an $67,359 in interest @ 1.95% versus $56,822 @ 1.65%.

This is a $10,537 in extra interest (over a 5 year period) a home owner is forking out.

Federal Reserve Bank (USA) – The culprit behind rate hikes

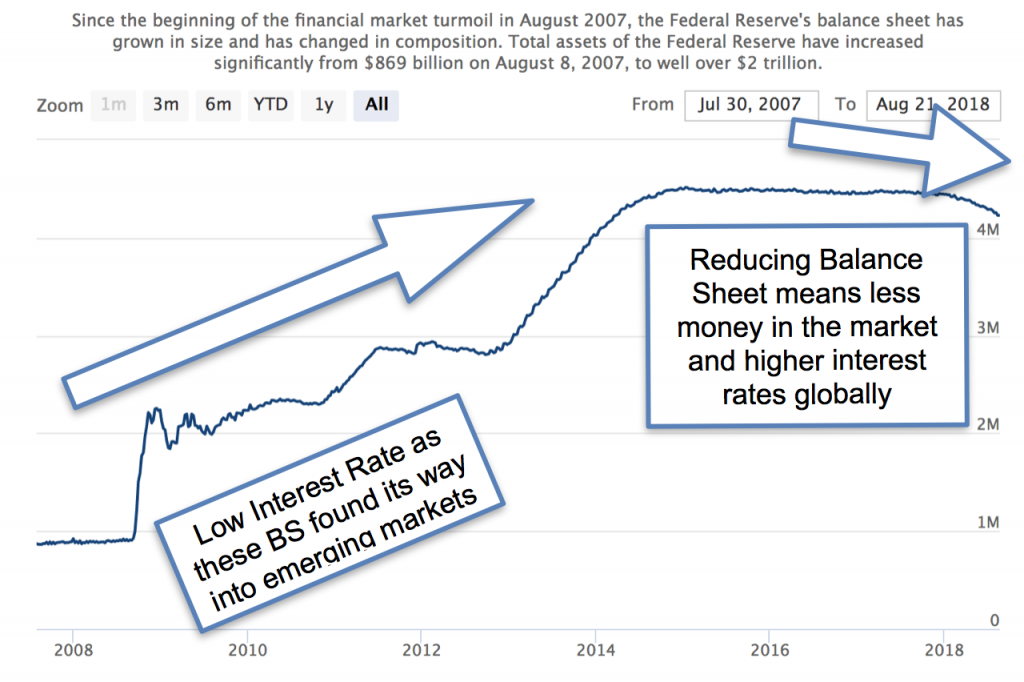

Just a short recap on why the Federal Reserve Bank (USA) needs to raise interest rates. The US government has run huge deficits and as a result of that, the Federal Reserve Bank (a privately owned bank) has printed money to the tune of US$4.5 Trillion. This money is used to buy treasury bonds or newly printed bonds.

Yes, you are right. Right pocket printed US$4.5 Trillion (Left pocket records it as Balance Sheet (BS) and as a result, you have these extra money flushed around in the banking system. US government owes US$4.5 Trillion dollars, owed to a private bank. I know it sounds like a bit of a basket case, because it is.

For the layman, it is money printing (they do not call it printing as printing means they will not repay it, they have a nicer sounding name for it, called “Quantitative Easing”). This means that we have a +US$4.5 Trillion and -US$4.5 Trillion in bonds held by the Federal reserve. This is BS on the Federal Reserve Books.

Why did all these Federal Reserve BS come about?

Chart 1: Federal Reserve BS (balance sheet) from 2008 to 2018, Federal Reserve, https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm, iCompareLoan.com

A nice sounding word is called Balance Sheet, the not so nice sounding word is money printing. These money that is printed will need to be repaid and seriously apart from the recovering US economy, I really do not see how the US will ever be able to repay their debt which is about US$21 Trillion. That is like US$21,000 Billion.

We strongly believe that we are now entering a cycle of tightening amidst the US economic recovery. There is no such thing as the cheapest or best home loans in Singapore, it’s all about picking the right structure in view of the new market realities about to materialise.

Get a Mortgage broker to help you refinance to provide you the necessary safety. It’s free of charge, to secure a home loan through them as they are one of the bank’s distributor.

For advice on a new commercial loan or Personal Finance advice.

To speak to our Panel of Property agents.

For advise on refinancing advice.