Malaysia KL Property Market Transformation – Kuala Lumpur is likely to Transform into a Tier 1 city

Table of Contents

Many Singaporeans have always viewed Malaysia with some apprehension. Some say it is more dangerous and not as safe. Well, in a larger country, it is always not as safe if you stray into the less lit areas. However Malaysia as well as the KL property market is set to be transformed by massive infrastructure investments and transport connectivity.

I will be speaking about Malaysia Economic Fundamentals & Currency Outlook at

Asia Square Tower 1, #15-07B (Entrance from South Lobby)

EcoWorld Singapore Gallery on the 21st & 22nd April, 2pm.

For more information and to RSVP for the seminars, please contact 9325 2255.

Image Credits: Silk Route, Wikimedia commons

What are the key drivers of Malaysia’s transformation?

Malaysia is a major beneficiary of China’s modern day Silk Road, called the one-belt-one-road initiative to connect and improve regional economies and increase trade. Singapore has traditionally controlled the sea routes from which an approximate 15% of the world’s trade pass through. And the narrative that Singapore was a Fishing village that grew into a world class city that it is today, that is untrue. Singapore is already well endowed without any raw mineral resources, but geography has dealt Singapore a deck of winning cards. A constricted Malacca straits, ships has to pass through Singapore and stop at Singapore. Why stop at Singapore? Singapore has a natural deep sea port that is very rare in the world. Located at the choke point of the trade route and endowed with a natural deep sea port, this made Singapore what it is today. This geography made Singapore great as ships came, so did talents from all over the world. It is true that talents made Singapore great, but it is the ideal geography (born lucky) that brought in the talents to work here.

Many cities have flourished along the silk route and when the silk route faded, the cities became ruins. This also largely explains why most major cities are along the coast or rivers.

Singapore controls a strategic choke point in the sea routes between east and west. Malacca could not simply take Singapore’s place as the straits of Malacca is very narrow and Malacca’s ports are not deep enough and the technology to make the ports deeper were not advanced in the earlier days and the cost is way too huge.

In recent years, Singapore’s leaders have tilted towards the US against China, China has realised that it cannot rely on Singapore to guarantee it’s crude oil supplies if Singapore were to side with America during a conflict. Hence China needs the One-belt-one-road to build alternative routes into China, else it will be starved of critical resources such as crude oil.

Malaysia is therefore chosen as a second choice to Singapore, in which to ensure safe passage of critical supplies to China.

Goodies That came with Malaysia’s closer alignment with China

In 2016, Malaysia’s Prime minister led an entourage of ministers and business leaders and came away with the following: –

- 14 business to business (B2B) MOUs and agreements worth RM 144 billion (US$33.8 billion) in various areas such as trade and investment, development of technology parks as well as supply of goods and services.

- Another 16 government to government (G2G) MOUs signed and soft loans worth RM55 billion (US$13 billion) by China for the East Coast Rail Link (ECRL) and the Malaysia-China Kuantan Industrial Park (MCKIP) in pahang.

- During the Belt and Road Forum in Beijing in May 2017, 9 more MOUs with a total value of RM31 billion (US$7.2 billion) were signed.

- Jack Ma – Founder of Alibaba Group is appointed and accepted appointment as Malaysia’s digital economy Adviser in Late 2016.

- Formation of the KLIA Aeropolis digital free trade zone (DFTZ) park in Sepang, Selangor.

- Alibaba will set up its first regional hub outside of China in Malaysia.

- Zhejiang Geely Holdings (who also owns Volvo Car Group) takes a 49.9% stake in Proton Holdings Bhd.

- Melaka is building the Kuala Linggi International Port (KLIP) RM 12.5 billion, financed by belt-road funds from China.

- China invests in building the Gemas-Johor double tracking railway worth RM8.9 billion.

- Since 2014, the S$100 billion “Eco city” project known as Forest City in Johor.

With top people on their board of advisory such as Mr. Jack Ma for their digital transformation, we expect Malaysia to see more innovative digital innovation initiatives. A large part of these may take root in the Multi-media super corridor (MSC), bringing Malaysia onto the world map. The renewed digital push will also greatly enhance the KL property market.

The China Factor

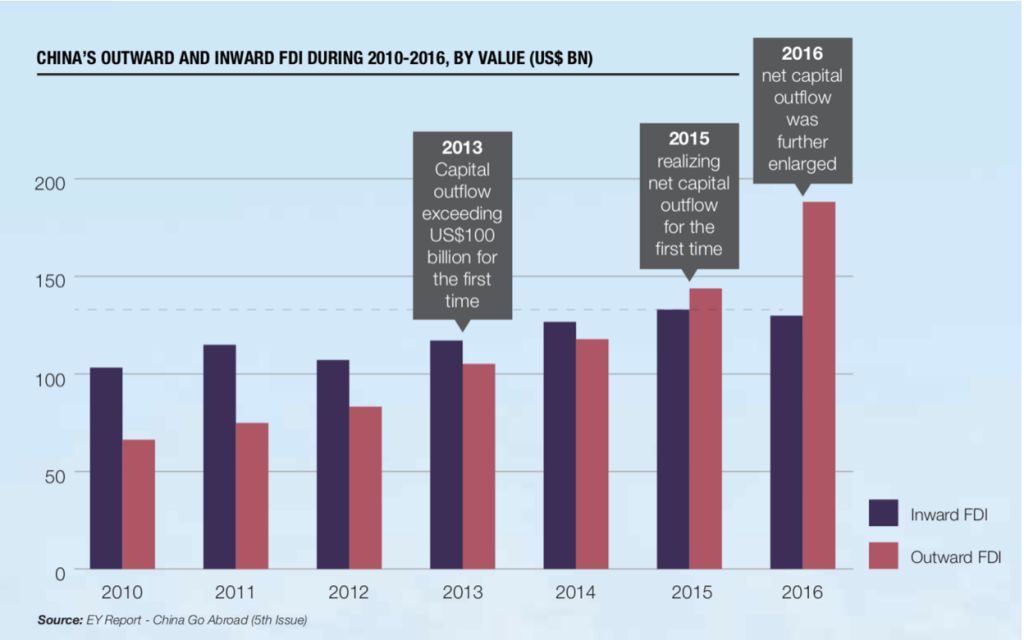

Image Credits: China’s Outward and Inward FDI from 2010 to 2016 (US $ Billions), EY Report – China Go Abroad (5th Issue), Knight Frank (Chinese Corridors in Malaysia 2018)

Malaysia continues to attract investors through healthy Foreign Direct Investment from China and beyond.

There is also the HSR signed in 2016 between the Malaysian and Singapore government, linking Singapore to Kuala Lumpur.

One of the major thrust is infrastructure investment that is transforming Malaysia and stimulating it’s domestic economy as well as the ascension of Kuala Lumpur KL property market into a Tier 1 city becoming more connected and more liveable.

China is one of the major beneficiary of China’s Belt and Road Initiative. (Globalriskinsights, https://globalriskinsights.com/2017/09/impact-chinese-investments-malaysia/)

Malaysia’s Macro Economic Fundamentals at a Glance

Many people have always worried about the Ringgit and the Malaysia economy. In fact there really have nothing to worry about.

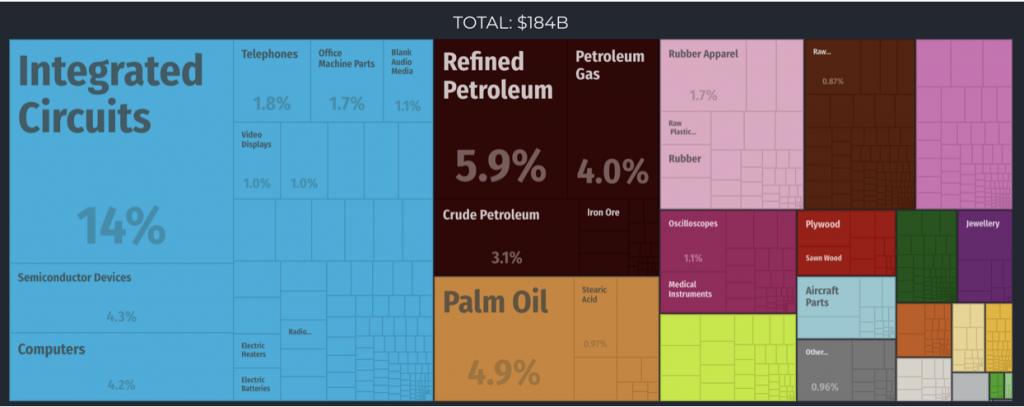

Malaysia runs consistent budget surplus for many consecutive years. And integrated Circuits, manufacturing made up 42% of it’s economy. Hence the impact of petroleum on it’s budget is hugely over-rated, moreover it also imports various oil derivative products to the tune of what it imports, negating any loss. Malaysia is a moderately advanced economy with economic complexity at 14th out of 89 countries measured and the world’s top 20th exporters.

Image credits: Malaysia’s Composition of Exports 2016, MIT Media Lab

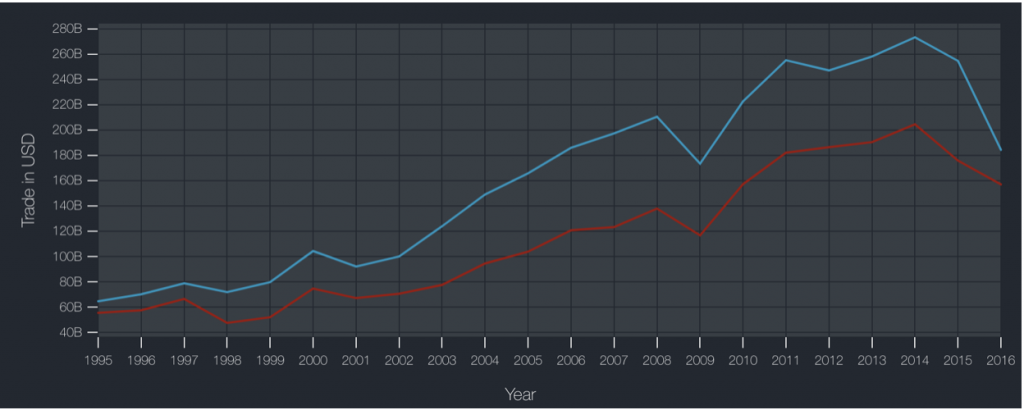

Image Credits: Malaysia’s Export markets, MIT Media Lab

Singapore and China are Malaysia’s biggest buyers, followed by USA, Japan, Thailand, Hong Kong and India, making up 62.2% of it’s exports.

Image Credits: Malaysia’s Export versus Imports and Trade surplus, MIT Media Lab

A quick snapshot of Malaysia’s macro economy shows you a very strong and robust economy.

| Malaysian Macro Economic Fundamentals | Data | Comments |

| GDP Growth Rate | 5.9% Q4, 2017 | Very high growth rate |

| Budget Deficit |

3% |

Reduced budget deficit compared to previous |

| Govt. Debt-to-GDP % |

50.9% 2017, (previous 52.7%) | Very low compared to most countries |

| Inflation (YOY) | 1.4% (Feb 2018) | Low Inflation (High growth has not led to overheating yet) |

| Core Inflation | 1.8% (Feb 2018) | Low Core inflation. |

| Currency | US$ 1 : ~ RM 3.9 | Stable (Banned NDF trading offshore a plus against speculation) |

| 10 Year Bond Rates | 3.98% (Apr 2018) | |

| Foreign Direct Investments | RM 2763 million (Q4, 2017) | RM 39.183 Billion (2017) – slower pace than 2016 |

| Stock Market | 1873.02 (02 April 2018) | Near all time high of 1887.07, reflecting current optimism. |

Table 1: Malaysian Macro Economic Fundamentals, Trading Economics, iCompareLoan.com

| Malaysian Macro Economic Fundamentals | Data | Comments |

| Budget Surplus | RM 9 billion (Feb 2018) | Consistent Budget Surplus indicates a strong economy |

| Capital Flows | RM 4,985.5 Million (Jan 2018) | Better Capital Inflows support the Ringgit |

| Foreign Reserves | US$ 140.6 Billion (Jan 2018) | More than sufficient to cover all the debt. Very strong position. |

| Interest Rate (Benchmark Policy rate) | 3.25% (Mar 2018) | Remains unchanged and moderate. |

| Unemployment Rate | 3.3% (April 2018) | Almost full employment |

| High labour force participation | 68.2% (Jan 2018) | High labour participation could lead to salary hikes |

| Housing Index | 5.1% (Sep 2017) | Prices have been rather flat |

| Malaysia’s Household Debt to GDP | 67.3% (Q4, 2017) | Improving and becoming less indebted |

| Consumer Confidence | 82.60 (Jan 2018) | Jan 2016 was at 63.8. High consumer confidence may lead to domestic economic expansion. |

Table 2: Malaysia Macro Economic Fundamentals, Trading Economics, iCompareLoan.com

Malaysian’s Stock market remains at close to the height, but there is nothing to worry as CEIC indicated that the overall P/E ratio of Bursa Malaysia is at 16.51 times. This is within the healthy range. This indicates the expectation of stronger earnings.

The strong trade surplus, shrinking budget deficit, strong GDP, low overall government debt, stable Foreign direct Investment (FDI) is a strong confidence booster to the ringgit coupled with the massive amount of infrastructure projects supported by China that Malaysia would have otherwise not been able to do itself means, all looks good for the macro fundamentals. Bank Negara has also banned offshore Non-delivery forward trades, earning the ire of speculators, but stabilising the Ringgit. Given the strong reserve position and limited opportunity for speculators to short the market, the Ringgit should remain stable vis-a-vis the US dollar.

Bond issuance is expected to be moderate given the rush last year 2017 to refinance the bonds before interest rate normalisation.

Kuala Lumpur KL Property Market Trends

Malaysia is a big country. There is ample land for development and property projects. This is also part of the reason why Malaysian property index stays flat. However with new infrastructure development, established estates, town or city centres will continue to see demand.

Despite the luxury market remains challenging, we see positive development from congested city centres. More and more Malaysian are moving into the city to avoid the traffic jams to stay near to where they work.

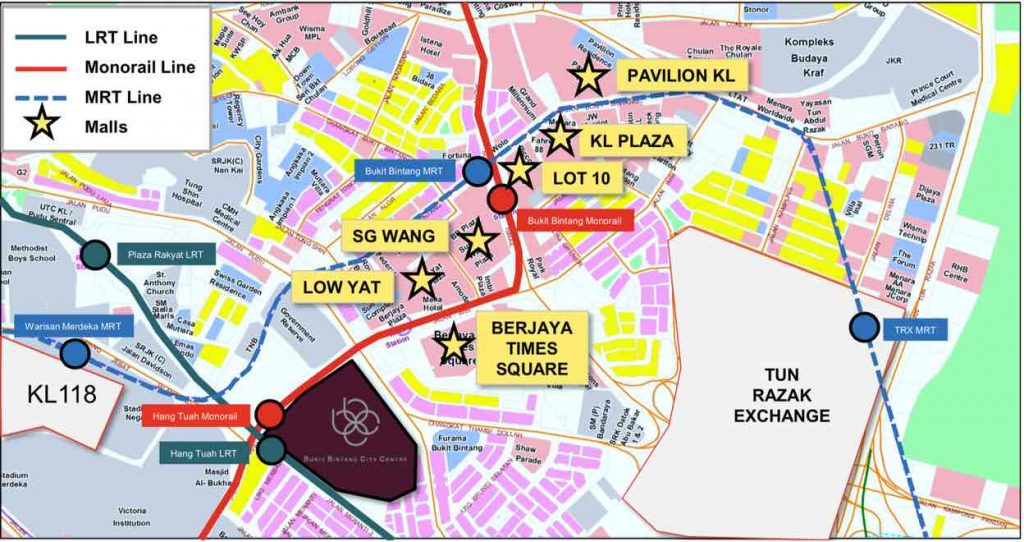

Image Credits: LRT, Monorail MRT and Malls, Transformation of Bukit Bintang, Savills

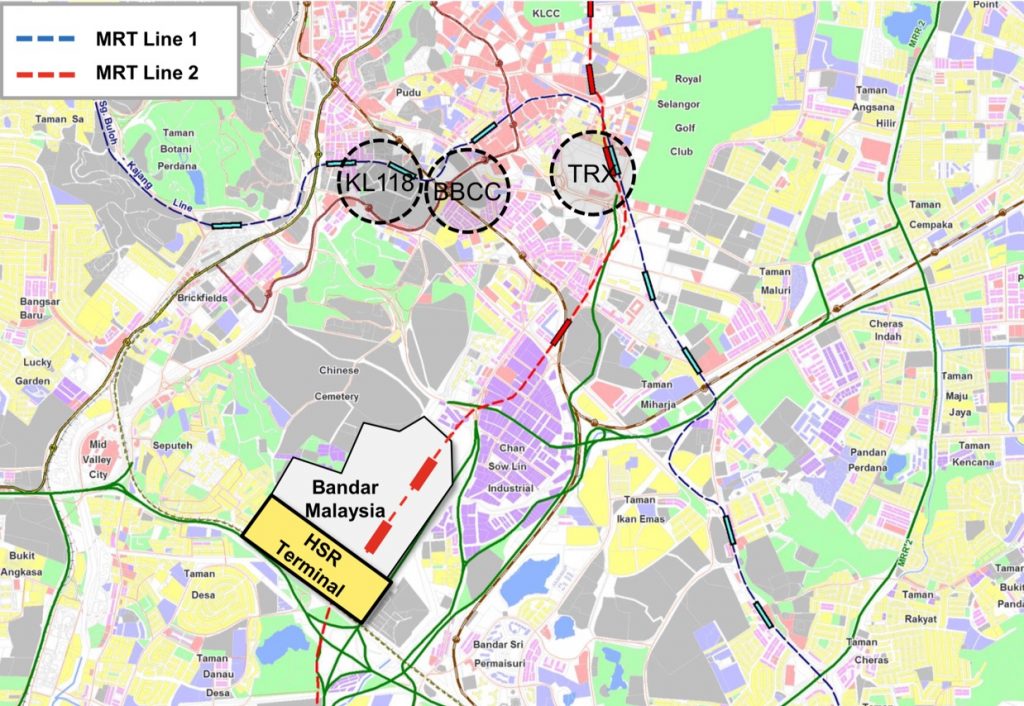

Image Credits: High Speed Rail location within Kuala Lumpur, Savills

Kuala Lumpur has a heavy traffic flow, and with the advent of the multiple LRT, MRT, Monorail line, MRT line 1 and MRT line 2, areas in and around the Bukit Bintang area, mid valley city, Selangor Golf club areas are going to become more and more exclusive. The high speed rail HSR is also slated to start latest by 2026, by any chance it should be earlier. This is going to bring massive traffic from Singapore business person directly into the city centre.

En Bloc redevelopment is also not unique to Singapore, there also many such en bloc sales of commercial buildings going on in Kuala Lumpur KL property market, indicating price movement potential to rebuild, redevelop the city centre.

As KL is congested, we are now seeing a trend within the KL property market of integrated developments that includes, hotels, service apartments, themed shopping malls, entertainment, Meetings, incentives, conferencing, exhibitions.Meetings, incentives, conferences and exhibitions (M.I.C.E.) and transport hubs within the development. This brings vitality to the development and rental demand. Good developers such as Ecoworld that has the financial muscle and vision are increasingly transforming the Malaysian property landscape. Bukit Bintang City Centre is one such project that will start the ball rolling to transform the KL property market.

Get unique perspectives on the Malaysia KL property market: –

- Malaysia Economic Fundamentals & Currency Outlook by Paul Ho, Founder of iCompareLoan

&

- Malaysia My Second Home programme by AIMS Immigration & Relocation Specialist

I will be speaking at Asia Square Tower 1, #15-07B (Entrance from South Lobby)

EcoWorld Singapore Gallery on the 21st & 22nd April, 2pm.

For more information and to RSVP for the seminars, please contact 9325 2255.

Connect with Paul HO on Linkedin.

You may want to read also about buying a property in Singapore.