Anomaly – Young Couple Cannot Afford HDB But Can Afford Condominium

——- Featured on YAHOO, click here

By PAUL HO

HDB issues a new rule issued on the 27th Aug 2013 and effective on the 28th Aug 2013. Under this new rule, Singapore Permanent residents who will need to wait 3 years before they can purchase a HDB. This will be welcome news for most young Singaporean couples as less competition will mean more controlled prices.

In line with the government’s aim to impose financial prudence, monthly servicing ratio (MSR) for HDB has been set at 30%. This means that the housing related servicing must not exceed 30% of a person or household gross income.

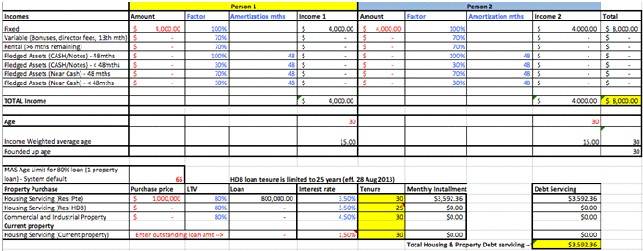

For example, a household who earns $8,000 (husband $4,000 and wife $4,000) can only spend a maximum of $2,400 on property financing for HDB.

You may ask, $2,400 monthly payment is fine, but don’t forget, this is not based on actual interest rates charged by the banks, but rather by a rate of 3.5% mandated by the MAS. So when you use 3.5% to calculate the monthly servicing, it can be higher than $2,400 easily, depending on your property price.

The loan tenure plays a part as well. If the loan tenure is 30 years, that means that the couple will be able to afford a higher priced HDB flat. If the loan tenure is shorter, that means that the price of the HDB that they can afford will drop.

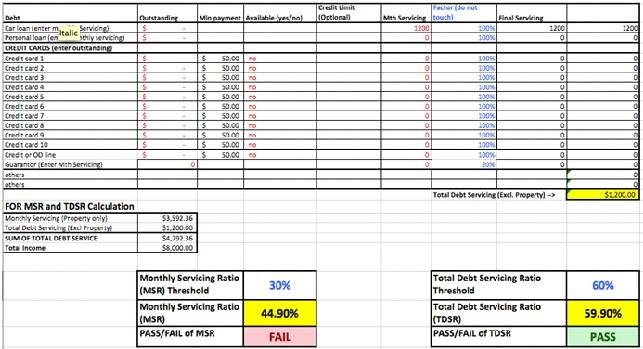

For HDB property buyers, they have to meet 2 criteria. First the MSR must be not more than 30%, followed by the Total Debt Servicing Ratio (TDSR) must be not more than 60%.

With effect from 28th Aug 2013, (reference 1,2), HDB loan tenure for 80% loan is capped at 25 years (down from 30 years).

What is the impact of this rule?

Under the impact of this rule, young couples will be find that buying a HDB resale flat is even harder to pass the MSR rule.

An example, a young 30 year old couple with $8,000 joint income and $1200 of car loan, no credit card or other debt.

BEFORE 28 Aug 2013

Before the rule, a young couple earning a total income of $8,000, with a car loan servicing of $1200 per month cannot afford a HDB flat of $700,000 as the MSR comes up to ~31.43% based on 80% borrowing. In other words, a $560,000 loan.

AFTER (ON OR AFTER 28 AUG 2013)

On or after the 28th Aug 2013, the young couple cannot even afford to buy a HDB flat of $600,000 as the MSR comes up to 30.04% based on 80% borrowing. In other words, a $480,000 loan. This is due to the reduction of the loan tenure from 30 years to 25 years.

As the young couple cannot pass the MSR criteria, there is no need to compute the TDSR which they can pass easily.

But in the government’s aim for financial prudence, it seems that perhaps an anomaly has opened up.

Using Total Debt Servicing Ratio (TDSR) of 60%, this couple would be able to borrow up to $800,000 and yet meet TDSR at about 59.9% as Private property purchase is not subjected to MSR requirement.

A couple cannot borrow $480,000 for HDB but they can borrow $800,000 for Private property or Executive Condominium. How is financial prudence served this way?

If you are looking to check if you can afford a new property, you can check out the guys are www.iCompareLoan.com they are able to help you to calculate your affordability as well as compare home loan rates.

If you are an agent and want to serve your property buyers better, you can access Home Loan reports for your buyers.

References:

1.

http://www.hdb.gov.sg/fi10/fi10296p.nsf/PressReleases/2311677DFDF53AC248257BD40032F6A4?OpenDocument

2.

http://www.hdb.gov.sg/fi10/fi10297p.nsf/ImageView/CORPORATE_PR_27082013_Annex%20C/$file/Annex+C.pdf

For advice on a new home loan.

For refinancing advice.

Download this article here.