As the biggest bank in Singapore, DBS has always had a good share of the market for home loans. That’s because they have been offering attractive home loan packages to homeowners. Has this changed over the years? Is DBS home loans still THE best DBS housing loan that we know? To answer that, we decided to dig into the data of the best DBS housing loan since 2018. We have summarised everything into this best DBS housing guide 2020 where we share with you the insights and trends on DBS home loans we found through the data.

Image 1 – Best DBS housing loan from DBS (Photo from Piqsels)

Is The Best DBS Housing Loan Still The Cheapest On The Market?

In the previous edition of our best DBS housing loan guide, we shared that DBS has been a trendsetter in the housing loan market. DBS was the first to introduce floating rate that is pegged to its fixed deposit rate, which is known as Fixed Home Rate (FHR). At that time, it was one of the best deals you can find on the market. But is it still the case today? Or have rival banks managed to catch up with DBS and started offering cheaper housing loan deals than the best DBS housing loan?

According to our data and research, the best DBS housing loan isn’t really the best home loan you can find. The best DBS housing loan is its DBS FHR home loan with 1-year or 2-year lock-in. The interest rate on these two packages are 1.80% and 1.73% respectively. Well, that is almost 27% to 36% higher than the range of cheap SIBOR home loans that banks like SCB, Maybank, OCBC, Citibank and HSBC are offering. While we reminisce about the time when DBS FHR home loan was the best DBS housing loan, it is sadly not the case today.

Best DBS Housing Loan Is Moving Towards Fixed Interest Rate Packages

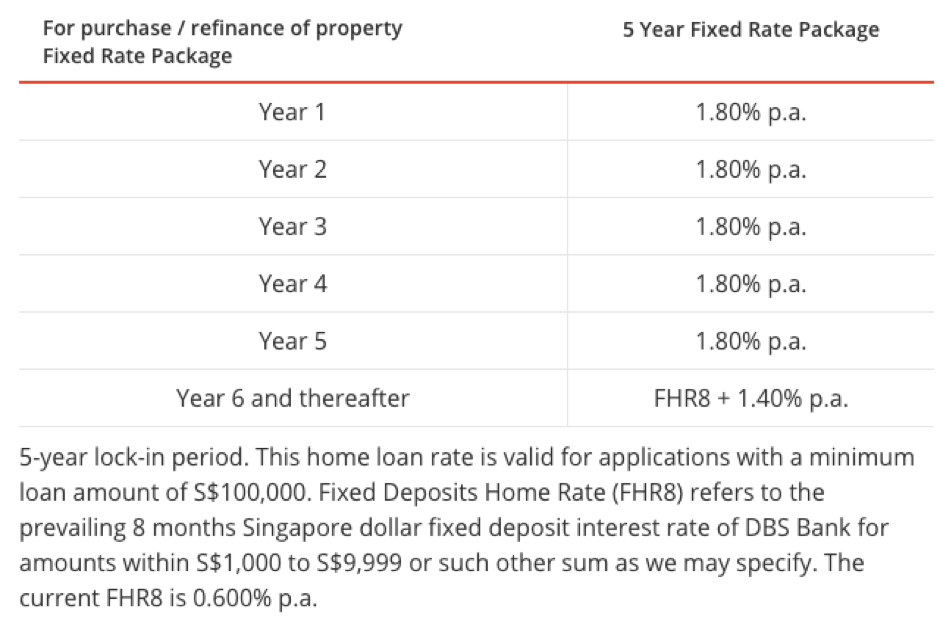

One interesting trend that we observe from our data is that DBS has been secretly moving towards fixed interest rate home loans. For example, DBS is currently offering a fixed interest rate with 5-year lock-in where the interest rate is 1.80% for the next five years.

The selling point on this best DBS housing loan (fixed interest) is that it is way cheaper than the HDB housing loan of 2.5%. Plus, you don’t have to worry about fluctuating interest rate and the upside risk of your interest rate skyrocketing.

Table 1 – Best DBS housing loan (fixed interest rate with 5-year lock-in)

One reason why DBS is offering such a good deal on its fixed interest rate package is because of customers’ interest. As interest rate was rising, customers prefer to have a fixed interest rate package that aren’t affected by rising interest rate.

Interest Rate On Best DBS Housing Loan Lowering Over The Past Few Years

Another insight that we made from the data is that interest rate on the best DBS housing loan has been trending lower. Since 2018, the spread on DBS housing loan has been decreasing. This ties in with the rise in SIBOR rates over the past 2 years as the total interest rate on DBS housing loan increased.

Moving forward, with the new low interest rate environment, we think that DBS could be revamping its best DBS housing loan. The best DBS housing loan could soon start to offer better rates again for customers in the near future. However, now is definitely not the time yet to refinance with DBS housing loan because the interest rate is still not attractive yet. Check with a mortgage broker who can assist you to evaluate your housing loan for possible refinancing.

Historical Best DBS Housing Loan Since 2018

Click on this to pick the Best DBS housing Loan or Refinance away from DBS.

| Interest Rate Type | Date | Best DBS Housing Loan Package Name | First Year Rate | Second Year Rate | Third Year Rate | Fourth Year Rate | Fifth Year Rate |

| Floating Rate | Feb-20 | DBS Housing Loan – BUC FHR8 +1.0 Floating (No-Lock) | 1M SIBOR + 1 % | 1M SIBOR + 1 % | 1M SIBOR + 1 % | 1M SIBOR + 1 % | 1M SIBOR + 1 % |

| Fixed Rate | Jul-19 | DBS Housing Loan – 1+1+1 Year Fixed Rate 1.89% | 1.89 | 2.18 | 2.18 | 1M SIBOR + 1.23 % | 1M SIBOR + 1.23 % |

| Floating Rate | Jul-19 | DBS Housing Loan – Floating 2-Years Lock (+1.05%) deviated | 1M SIBOR + 1.05 % | 1M SIBOR + 1.05 % | 1M SIBOR + 1.05 % | 1M SIBOR + 1.05 % | 1M SIBOR + 1.05 % |

| Fixed Rate | Jul-19 | DBS Housing Loan – 2-Yr Fixed 2.05% | 2.05 | 2.05 | 1M SIBOR + 1.1 % | 1M SIBOR + 1.1 % | 1M SIBOR + 1.1 % |

| Floating Rate | Jun-19 | DBS Housing Loan – Floating 1-Years Lock (+1.13) PTE | 1M SIBOR + 1.13 % | 1M SIBOR + 1.13 % | 1M SIBOR + 1.13 % | 1M SIBOR + 1.13 % | 1M SIBOR + 1.13 % |

| Floating Rate | Apr-19 | DBS Housing Loan – PTFD Rate 2 Years Lock-In – Completed Properties | 1M SIBOR + 1.2 % | 1M SIBOR + 1.2 % | 1M SIBOR + 1.2 % | 1M SIBOR + 1.4 % | 1M SIBOR + 1.2 % |

| Fixed Rate | Mar-19 | DBS Housing Loan – HDB Loan-5 years Fixed rate | 2.5 | 2.5 | 2.5 | 2.5 | 2.5 |

| Floating Rate | Mar-19 | DBS Housing Loan – PTFD Rate No lock in BUC | 1M SIBOR + 1.4 % | 1M SIBOR + 1.4 % | 1M SIBOR + 1.4 % | 1M SIBOR + 1.4 % | 1M SIBOR + 1.4 % |

| Fixed Rate | Mar-19 | DBS Housing Loan – 1+1 Fixed Rate 2.38% (completed) | 2.38 | 2.38 | 1M SIBOR + 1.43 % | 1M SIBOR + 1.43 % | 1M SIBOR + 1.43 % |

| Fixed Rate | Oct-18 | DBS Housing Loan – 2 Years Fixed Rate – Completed Residential | 2.68 | 2.68 | 1M SIBOR + 1.73 % | 1M SIBOR + 1.73 % | 1M SIBOR + 1.73 % |

| Fixed Rate | Oct-18 | DBS Housing Loan – 3 Years Fixed Rate – Residential Loan | 2.88 | 2.88 | 2.88 | 1M SIBOR + 1.93 % | 1M SIBOR + 1.93 % |

| Floating Rate | Jun-18 | DBS Housing Loan – PTFD Rate No Lock-In – Completed Properties | 1M SIBOR + 1.9 % | 1M SIBOR + 1.9 % | 1M SIBOR + 1.9 % | 1M SIBOR + 1.9 % | 1M SIBOR + 1.9 % |

| Floating Rate | Jan-18 | DBS Housing Loan – PTFD Rate 2 Years Lock-In – Completed Properties | 1M SIBOR + 1.4 % | 1M SIBOR + 1.4 % | 1M SIBOR + 1.4 % | 1M SIBOR + 1.4 % | 1M SIBOR + 1.4 % |

Table 2 – Best DBS housing loan since 2018

Are you a homeowner with an existing home loan with DBS? Share with us what you think about the interest rates that you are paying for your mortgage. Do you think it is too high or just the right amount for your home?