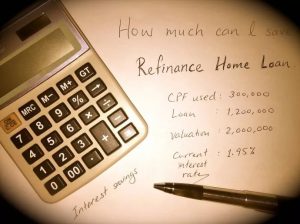

It is important for the homeowner to have a clear understanding of their financial situation and objectives – keeping them in mind in order to acquire the best home loan refinancing deals.

By: Phoenix Lee/

If mortgage rates happen to be lower than when they were when the home was originally financed, or if the homeowner decided upon an adjustable rate mortgage accompanied with a lower interest rate than the current rate, monthly payment will decrease.

That is assuming the homeowner doesn’t significantly shorten the loan term or cash out equity. When the home owner refinances, that means that monthly payments will be lowered and there will be extra money for those desired extras such as dinners, new clothes, or investing into a retirement or education fund.

However, that is not the only reason to get the best home loan refinancing deal, but it is possible for the homeowner to not have the funds to bring to the closing table at the end of the initial mortgage loan.

Table of Contents

https://www.icompareloan.com/resources/investigating-mortgage-options/

Most of the time, all of the closing costs of the initial loan can be placed into a new loan, which means less money will come out of the homeowner’s pocket. Even an interest rate reduction of one-half of a percent can make a difference in the payments that is quite noticeable.

Due to the fact that fees associated with best home loan refinancing deal can extend into the thousands of dollars, it is important to go over the numbers and make sure that the home will be occupied by the residents long enough to recover the costs of this type of transaction.

Those homeowners with good credit can get special deals on their closing costs from various lenders. In these cases, getting the best home loan refinancing deal may make sense as it helps them to achieve lower interest rates.

If the homeowner is in the position to make a monthly payment that is higher than usual because of good fortune or an increase in salary, the homeowner may want to think about switching from a 25-year mortgage to a 15 or 20 year mortgage. This allows the homeowner to build equity quicker and save more money on the financing fees. In other words, the homeowner builds equity at a faster rate without putting out substantial amounts of money every month.

In getting the best home loan refinancing deal, many homeowners decide to go for an adjustable rate mortgage because of the low rates in the beginning, especially before interest rates begin to fall. However, these mortgages are quite unpredictable and may increase without warning. This means the mortgage is able to fluctuate and can do so monthly by hundreds or even thousands of dollars.

https://www.icompareloan.com/resources/mortgage-broker-services/

Some homeowners have the desire to move to a fixed rate mortgage after starting with an adjustable rate mortgage because of its added stability. Since interest rates are always fluctuating, the original deal suddenly becomes less attractive. People decide to change their loan programs so that they can capitalise on those available rates that are best for them at that time.

Achieving better credit scores is another great reason to get the best home loan refinancing deal. If the homeowner’s credit score has gotten better because mortgage payments have been made on time, the homeowner may be able to take advantage of that improved credit by refinancing into a loan with lower interest rates decreased payments.

If the homeowner has paid off a car, inherited a sum of money, or received a bonus at work, if the homeowner is planning to own their home into retirement, refinancing down from a 25-year loan to a 20 or a 15 year loan may be a good move financially. The payments will rise, but the extra money can be used to cover the difference.

By paying off the home earlier with the best home loan refinancing deal, the interest that is saved over the life of the loan is quite significant. The homeowner will also own the home free-and-clear sooner.

Homeowners of private properties may consider cash-out-refinancing. The homeowner can use the money from a cash-out refinance to pay off other bills such as credit cards. This is the same as transferring the debt into the home loan. Due to the fact that mortgage rates are most likely lower than that of credit cards, not only will the total amount of monthly payments go down, you they will also have the peace of mind.

How to secure the best home loan refinancing

if you are concerned about salary increases and your ability to purchase the dream home? Don’t worry because trusted mortgage broker can set you up on a path that can get you a home loan in a quick and seamless manner.

Mortgage brokers have close links with the best lenders in town and can help you compare Singapore home loans and settle for a package that best suits your home purchase needs. You should also find out more about money saving tips.

Whether you are looking for a new home loan or to refinance, the Mortgage brokers can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the best home loans in Singapore. And the good thing is that all their services are free of charge. So it’s all worth it to secure a loan through them. While you are at it, you should also look for advice on a new home loan, and on refinancing advice.