The latest figures from HDB shows that the quarter-on-quarter change for the first quarter 2014 resale price index for HDB flats turned negative, marking the third consecutive quarter the index fell. 1Q2014 quarter-on-quarter (Q-o-Q) decline is also the greatest at 1.6 per cent when it slipped from 201.7 in the previous quarter to 198.5. The Q-o-Q decrease for 4Q2013 and 3Q2013 stood at 1.5 and 0.9 per cent, respectively.

Not just prices fell but resale transactions registered a downward trajectory too. Transactions dipped from 4,001 in 4Q2013 to 3,781 in 1Q2014 – a five percentage point drop.

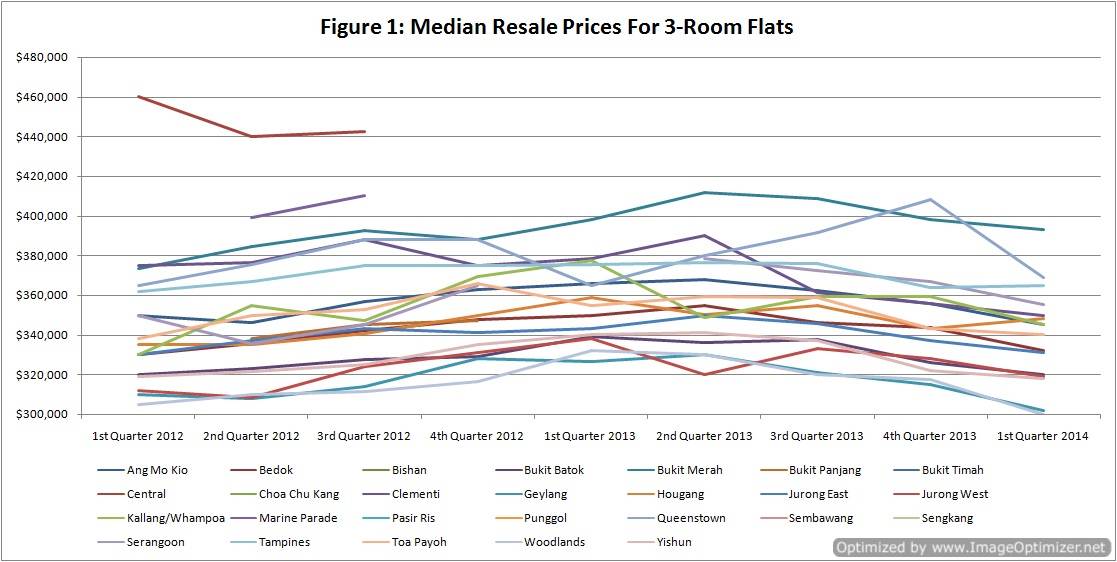

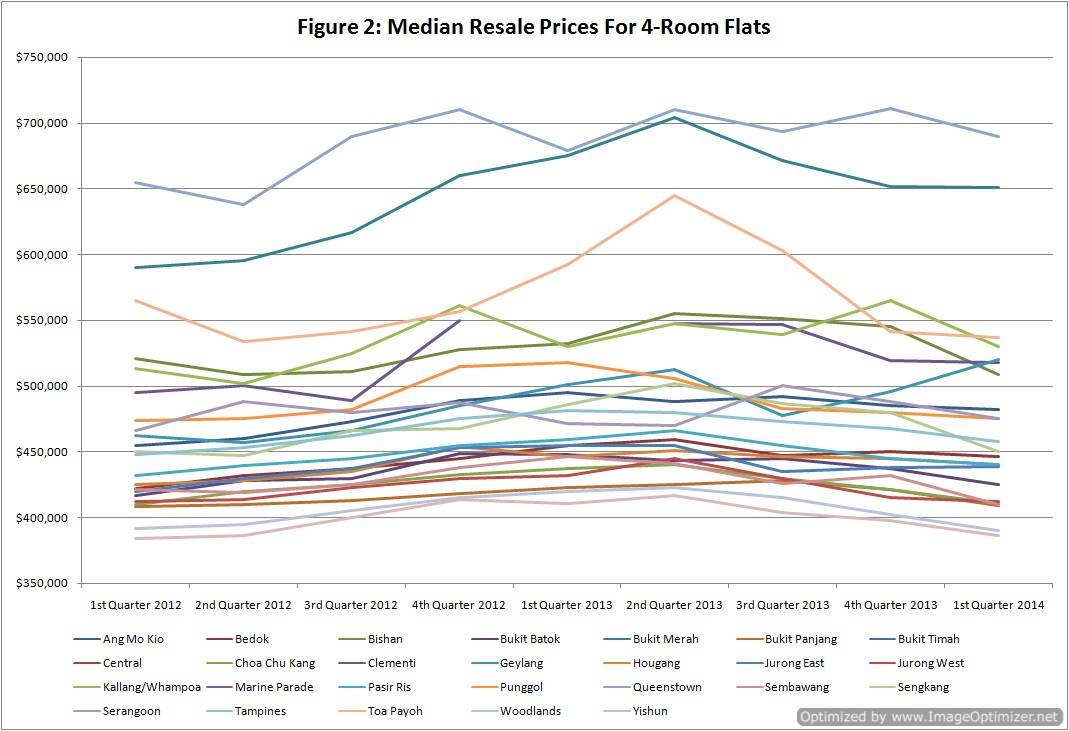

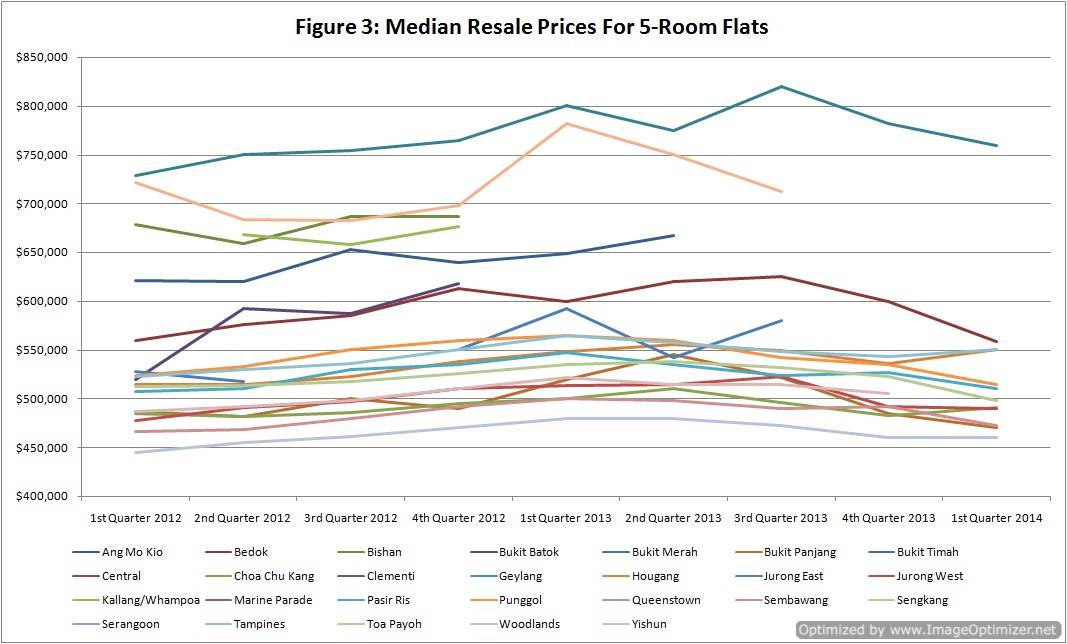

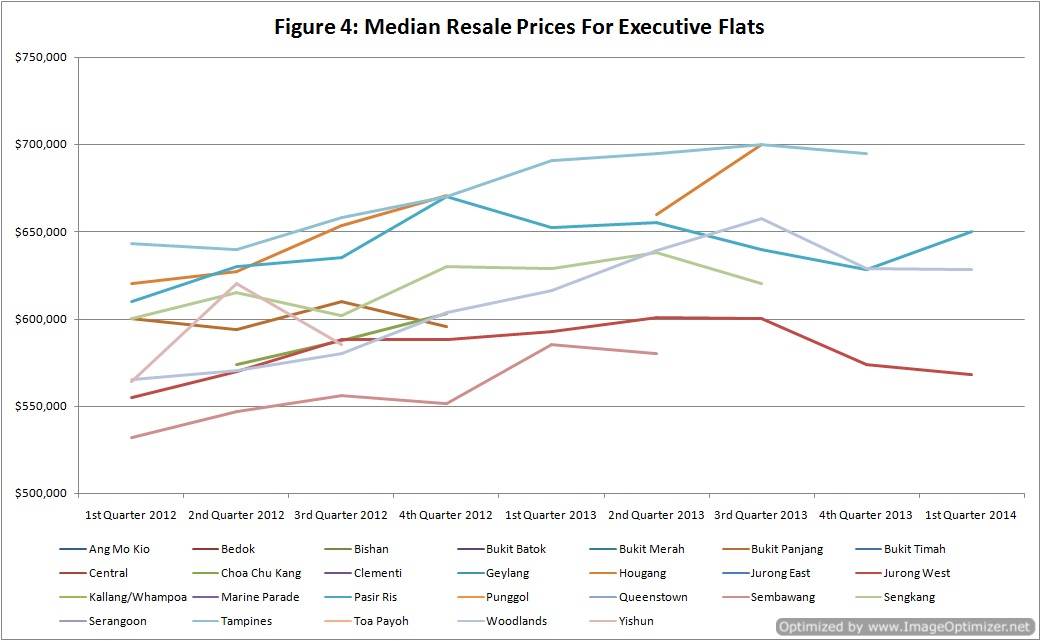

How does the median resale price by town and flat type hold up then? Using HDB data, we proceed to examine the median resale price from 1Q2012 to 1Q1014 for 3-, 4-, 5-room and executive flats by HDB town.

Breaks in the graphs for some HDB towns mean there were less than 20 transactions for that quarter hence the data is unavailable or withheld.

3-Room Resale Flats

Table of Contents

Observations:

1) Towns that command a constantly high median resale price are Bukit Merah, Clementi, Queenstown and Tampines.

2) The median resale price has fallen from 4Q2013 to 1Q2014 for nearly all towns.

4-Room Resale Flats

Observations:

1) The top performing towns are Bukit Merah, Queenstown, and Toa Payoh.

2) Similar as for 3-room flats, the median resale price has fallen from 4Q2013 to 1Q2014 for all but two towns: Geylang and Hougang. .

3) Geylang, despite its sleazy reputation, had a median resale price hike of $24,000. A huge spike compared to Hougang’s $1,000.

4) In fact, Geylang saw an increase for three straight quarters from 3Q2013 to 1Q2014, when its median resale price jumped from $477,300; $496,000 to $520,000.

5-Room Resale Flats

Observations:

1) The winners remain almost unchanged as for the other flat types; namely they are Ang Mo Kio, Bukit Merah and Toa Payoh though data for Ang Mo Kio and Toa Payoh for the last two to three quarters are absent.

2) For 10 HDB towns, the Q-o-Q median resale price for 1Q2014 headed south. Data is missing for 13 towns. Choa Chu Kang, Hougang and Tampines showed a spike of $8,000; $14,000 and $7,000 respectively.

Executive Resale Flats

Observations:

1) For these bigger flat types, the top performers shift to Hougang, Pasir Ris and Tampines.

2) Woodlands trends upwards with decline from 4Q2013 onwards.

With property prices remaining bearish, now might be the best time to look for that dream home. Speak to an iCompareLoan mortgage expert today for some FREE help in comparing mortgage loan Singapore.

For advice on a new home loan.

For refinancing advice.

Download this article here.