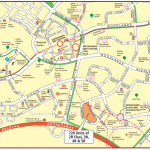

Cushman & Wakefield announced on May 13 that it has been appointed as the marketing agent for the sale of a Club Street shophouse. The three-storey conservation shophouse with mezzanine is located at 93 Club Street. The 999-year Club Street shophouse is situated within the heritage district of “Chinatown-Telok Ayer” in the Central Business District (CBD).

Zoned “Commercial” under the Master Plan 2014, the Club Street shophouse sits on a land area of about 800.8 sq ft and has an estimated floor area of about 2,885 sq ft.

Table of Contents

Club Street was historically a haven to a number of exclusive trade guilds and elite social clubs such as the Chui Lan Teng Club, Ee Hoe Hean Club and the Chinese Weekly Entertainment Club, from which it acquired its namesake. Today, the precinct is a vibrant and bustling destination with a wide variety of trendy cafes, restaurants, bars, galleries and entertainment joints, attracting both locals and tourists alike.

Mr Shaun Poh, Executive Director of Capital Markets at Cushman & Wakefield, commenting on the Club Street shophouse said, “The shophouse is positioned in a prime central location within the city centre and just a stone’s throw from the upcoming Maxwell MRT station. It presents an excellent opportunity for investors such as boutique funds, family offices and shophouse collectors or end-users such as F&B operators and business owners to acquire a limited piece of heritage asset within the CBD.”

“There is also tremendous potential for rental and capital upside given the anticipated growth in tourism footfall following the expected completion of several new hotel developments in the immediate vicinity,” he added.

Foreigners are eligible to purchase the Club Street shophouse and Additional Buyer’s Stamp Duty (ABSD) is not applicable.

The property will be sold with existing tenancy, and the sale is being conducted through an Expression of Interest exercise which closes on 11 June 2019 at 3 p.m.

With the winding down of the success of residential en bloc sales, commercial properties are now trying to join in the bandwagon. Many commercial en bloc sale attempts fail because the asking prices are often too high. Two critical factors affecting the success of commercial sites going en bloc are pricing and location. Older commercial buildings especially, may see a need to catch the current wave as an exit strategy as their rental yields come under pressure due to competition from newer commercial buildings.

The government’s swift response to curb home price growth in July 2018, has tampered the prospects of residential properties as attractive investments. Investors looking for alternatives to park their money could divert their attention to shophouses as they are not subjected to this round of purchase or sales restrictions.

The biggest gainers following the new property cooling measures is likely be owners of strata portfolio of offices and shophouses approved for commercial use. The property cooling measures affected almost all categories of buyers and is predicted to achieve its intended objectives of cooling demand and moderating price growth.

One report said investors looking for alternatives to park their money in the wake of property cooling measures, would divert their attention to the strata office and shophouse markets as they are not subjected to this round of purchase or sales restrictions/encumbrances.

https://www.icompareloan.com/resources/mortgage-broker-singapore-best-rate/

Paul Ho, the chief mortgage consultant at iCompareLoan said: “Properties such as Club Street shophouse may be bought under personal name, but total debt servicing Total Debt Servicing Ratio (TDSR) will apply on the individual’s income on such purchases. To buy a commercial or industrial property under company name, total debt servicing ratio TDSR also applies on the individual director’s income if the company is an investment holding company or an operating company that is loss-making or does not have sufficient cash flow to servicing the repayment.”

He added: “To buy a commercial or industrial property under company name where the company is well established with an existing operating business with strong financials, TDSR may be waived on the individual. However director is usually required to become personal guarantors of the loan the company undertakes. Hence this may affect the director’s other purchases, such as for buying a residential property, due to the loading from the TDSR for guaranteeing a loan.

Some banks even advertise 100 to 120% loan. This is due to a combination of working capital as well as commercial/industrial property loan, but this only applies to company with strong cash flow position. Commercial property is different from residential property and the considerations are more complex and varied though the payoff may be worthwhile for investors.”

https://www.icompareloan.com/resources/good-property-agents-qualities-look-find/

He said that many of the home owners who refinanced their home loans to fixed rate home loans or those with 2 years locked-in or 3 years locked-in period will incur full home loan redemption penalty. This penalty is usually 1.5% of the loan amount. This tends to affect those who have bought their properties in recent years as their loan size tends to be bigger and their corresponding home loan redemption penalty higher.

How to Secure the Best Commercial Loans Quickly

iCompareLoan is the best ]commercial loans portal for, buyers, investors and real estate agents alike in Singapore. On iCompareLoan, you will be able to find all the latest news and views, informational guides, bank lending rates and property buying trends, and research data and analysis.

Whether you are looking to buy, sell or refinance apartments, condominiums, executive condos, HDB flats, landed houses or commercial properties, we bring you Singapore’s most comprehensive and up-to-date property news and best home loans trends to facilitate your property buying decisions.

Our Affordability Tools help you make better property buying decisions. iCompareLoan Calculators help you ascertain the fair value of a property and find properties below market value in Singapore.

Our trademarked Home Loan Report is Singapore’s first one-of-a-kind analysis platform that provides latest updates of detailed loan packages and helps property agents, financial advisors and mortgage brokers analyse best home loan packages for their clients, so that they may give unbiased home loan/commercial loan analysis for their property buyers and home owners. Our distinguished Panel of Property Agents who are users of our Home Loan report can give the best all-rounded advise to real estate seekers.

All the services of our mortgage consultants are ABSOLUTELY FREE, which means it’s all worth it to secure a loan through us.

Whether it is best home loans, best commercial loans or refinancing of existing loans or SME loans, CONTACT US TODAY!