April is typically the time for taxpayers like you and I to be filling for our taxes, be it personal tax or property tax. Well, that’s under usual circumstances. However, we are currently undergoing unprecedented times with the Covid-19 (aka coronavirus) disrupting our usual way of life. As such, Income Revenue Authority of Singapore (IRAS) declared a few key measures to help individuals and businesses survive such unprecedented times. These measures include deadline extension for tax filing, tax relief and property tax rebate.

Image credit: Property tax calculator from Unsplash

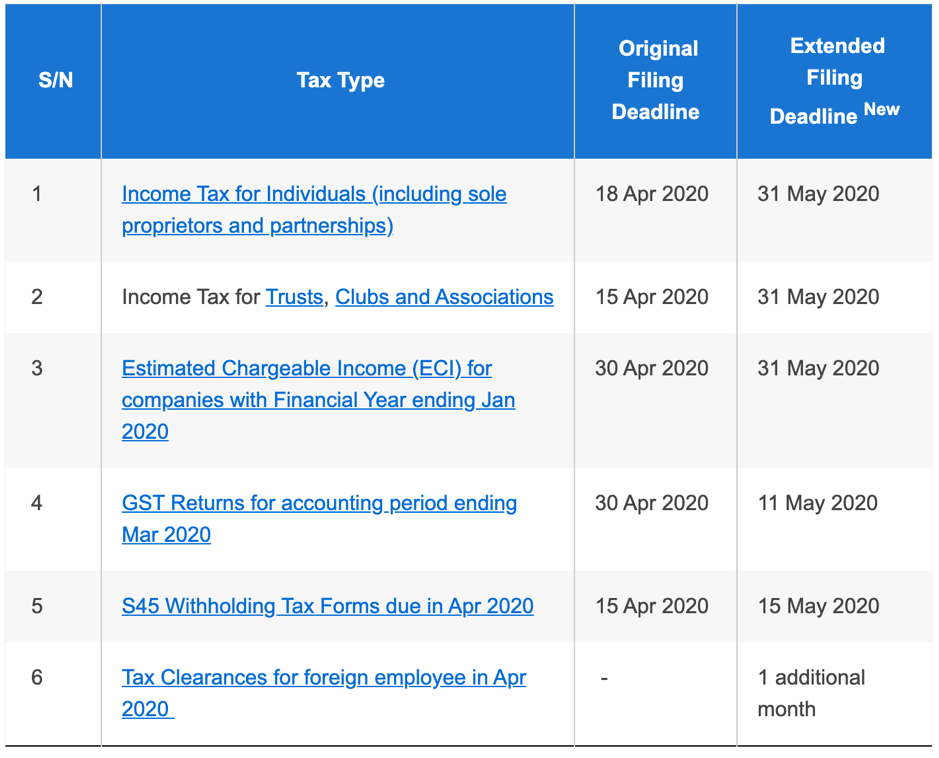

1. Tax Filing Extension For Individuals, Businesses Till 31st May 2020

Table of Contents

As you know, filing for the Year of Assessment (YA) 2020 started on 1st March 2020. With a 6 week time period given to individuals and businesses to file your taxes, you should have been done by 18th April 2020.

However, with the Circuit Breaker measures coming into play, some individuals and businesses might not be able to complete the tax filing within the deadline. Plus, IRAS also wants to align with stricter safe distancing measures and avoid having a large crowd in their building that’s trying to file taxes before the deadline.

Table 1 – IRAS tax filing extension for each tax type

2. Income Tax Relief And Tax Deferral For Businesses, Self-Employed

Under the Unity Budget, businesses will be given 25% Corporate Income Tax Rebate for the year 2020. Each company can stand to receive up to $15,000 in rebate under this Corporate Income Tax Rebate announced in the Unity Budget. On top of that, businesses are also granted a 3-month deferral on income tax payments so that you won’t face any cash flow problems.

The same 3-month deferral also applies for any individual that is self-employed, be it whether you are a freelancer or taxi driver. This will be automatically deferred with no application required.

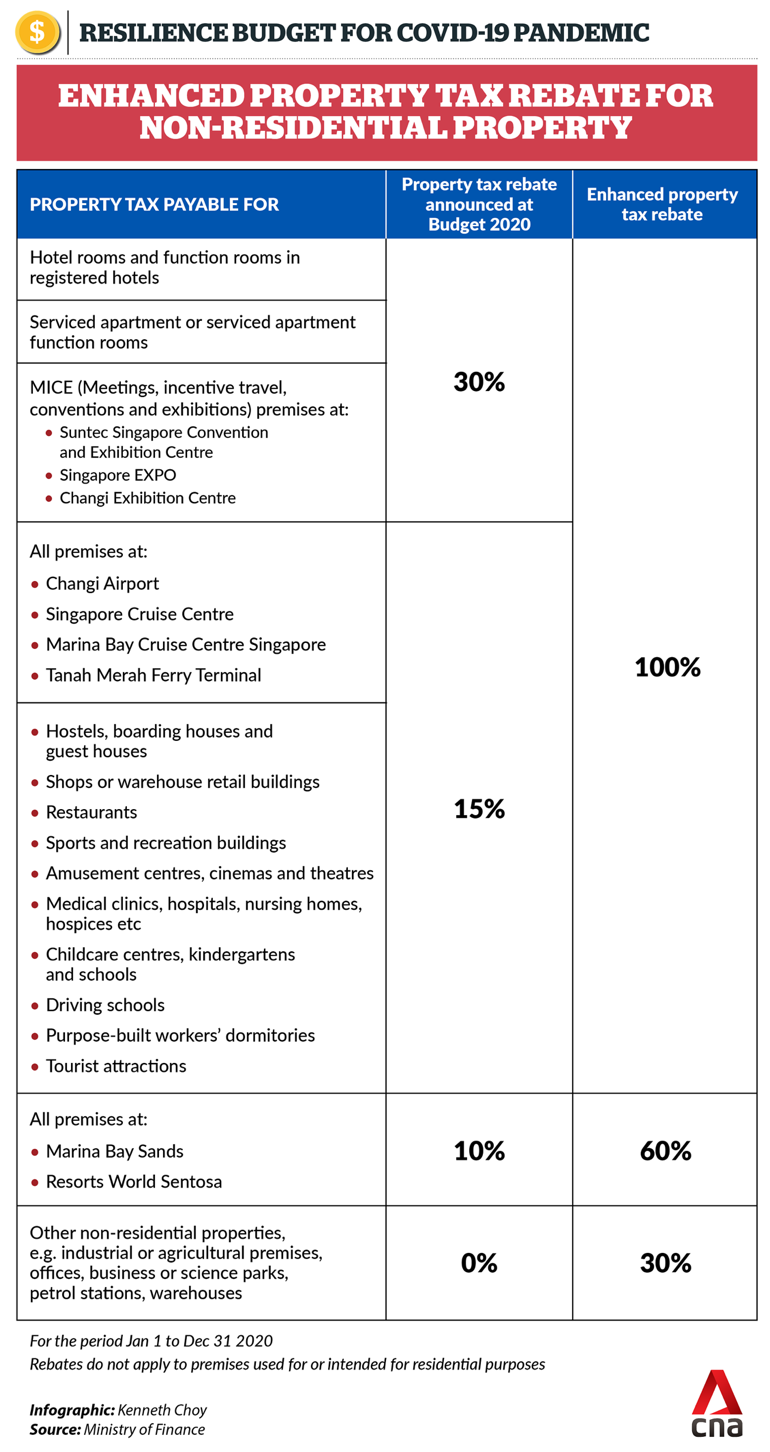

3. Property Tax Rebate For Non-Residential Property

To help ease the financial impact on businesses, Singapore government announced a slew of measures to help businesses stay afloat. One of them is the property tax rebate. For selected sectors that are badly hit by the Covid-19 (e.g. tourism, hotels, f&b), your business will receive 100% property tax rebate from the government. Other businesses that aren’t as badly hit will get a 30% property tax rebate as announced in the Resilience Budget.

Since the property tax rebate was introduced to help businesses stay afloat, landlords are required to pass on the rebate to your tenants. The government is already in the midst of introducing new legislation to make it compulsory for the property tax rebates to be passed on to your tenants. Some examples are lump sum rebate, instalment payment or set off against future payable rent.

Table 2 – Property tax rebate for non-residential property, Ministry of Finance, CNA.

Need help with filling for your property tax? Check out iCompareLoan’s property tax Singapore guide to help you ensure that you don’t miss out any of your property tax obligations.

Property Tax Rebate For offices

What does a property rebate of 30% really mean? You have to vacate the office for 2 months, in other words you are paying rent for 2 months. Let us put in a more realistic scenario.

For example the annual value is $40,000. The property price is estimated to be around $800,000 to $1,500,000 depending on the rental yield at the prevailing moment. The chief valuer sets the annual value.

Rental @ 3% yield for a $1,000,000 property is $30,000 or $2,500 a month.

A 30% rebate on the tax which can be around 10% of the annual value. If annual value is $40,000, the annual value is $4,000. And a 30% rebate amounts to $1,200 only.

This amounts to only $1,200 or slightly less than half a month’s rent while the tenant suffers a 2 month loss of use. So this is grossly insufficient.

Paul Ho, our Chief Mortgage Consultant suggested the following:

“Additional Property Tax Rebate to assist tenants: –

Pass on Grants

Interest charge moratorium on landlords who will then pass on 100% of these interest servicing cost savings to tenants. If the landlord has fully paid off the property, a direct grant of 2 months out of the annual value will be better.

If the annual value is $48,000, then 2 months (2 monthly value) will be $8,000. This grant will come in handy for the Singapore registered company tenant who otherwise loses the effective use of the office, which in most case causes huge dip in office productivity, or worse of all, for some businesses, a complete halt of businesses.

Defer Office Rental

Alternatively, we can defer the rental cost for 3 to 6 months. These deferred payment causes land lord hardships, as a result of these, the government should fund the deferment to landlords via a zero interest loan.”

Paul Ho says, “The rental price and the annual value will differ as the Annual value is measured across an entire planning zone and applied as a blanket tax rate for the zone applying some methodology. The actual rent tends to be higher than the annual value, so the actual cost is definitely more painful for tenants.

A financial crisis is often caused by cash flow mismatch, leading to surpluses and shortages in cashflow. It is these floods and droughts that kill companies. If we can freeze these rental costs and defer them down the road, these can go a long way to helping companies survive, keeping employees employed while the companies re-calibrate the way they do businesses or to fight for revenues.”

Is the 30% property tax rebate good enough to help businesses in Singapore stay cash flow positive? Discuss your thoughts on our Facebook page here.

https://www.icompareloan.com/resources/property-tax-relief/