The widow of a taxi driver faulted the CPF Home Protection Scheme in late September for failing to cover her husband even though he had been prompt in paying his premiums. In writing to the Chinese publication, Lianhe Zaobao, the widow said how she was hopeful that the Scheme would help her family from losing their HDB flat after her husband’s death, and how her hopes were dashed by the CPF Board.

Writing a letter titled, ‘Our Grievous Mid-Autumn Festival’, in the newspaper’s Voices section on 27 September 2018, the widow explained her troubles in her own words:

“One morning in mid-April this year, my husband was driving a taxi on the Ayer Rajah Expressway when his heart suddenly stopped beating. He used the last breath to stop the car, and the taxis and passengers were unharmed. After the accident, he was lying in the intensive care unit for five days. I was calculating how much the medical expenses would be to keep him in life support and realised that the money in his Medisave account can only keep him in this world just for a few more days.

Before deciding to remove him from life support, I first let the children say goodbye to their father, settle down and go home. I then returned to the hospital alone, held my husband’s hand, watched him painfully withstand the heart’s increasingly weak beating, and finally unable to bear his last breath and the body getting cold. I burst into tears.”

The widow continued that after her ordeal, one of her neighbour’s comforted her saying the CPF Home Protection Scheme will come in handy in protecting her house.

Table of Contents

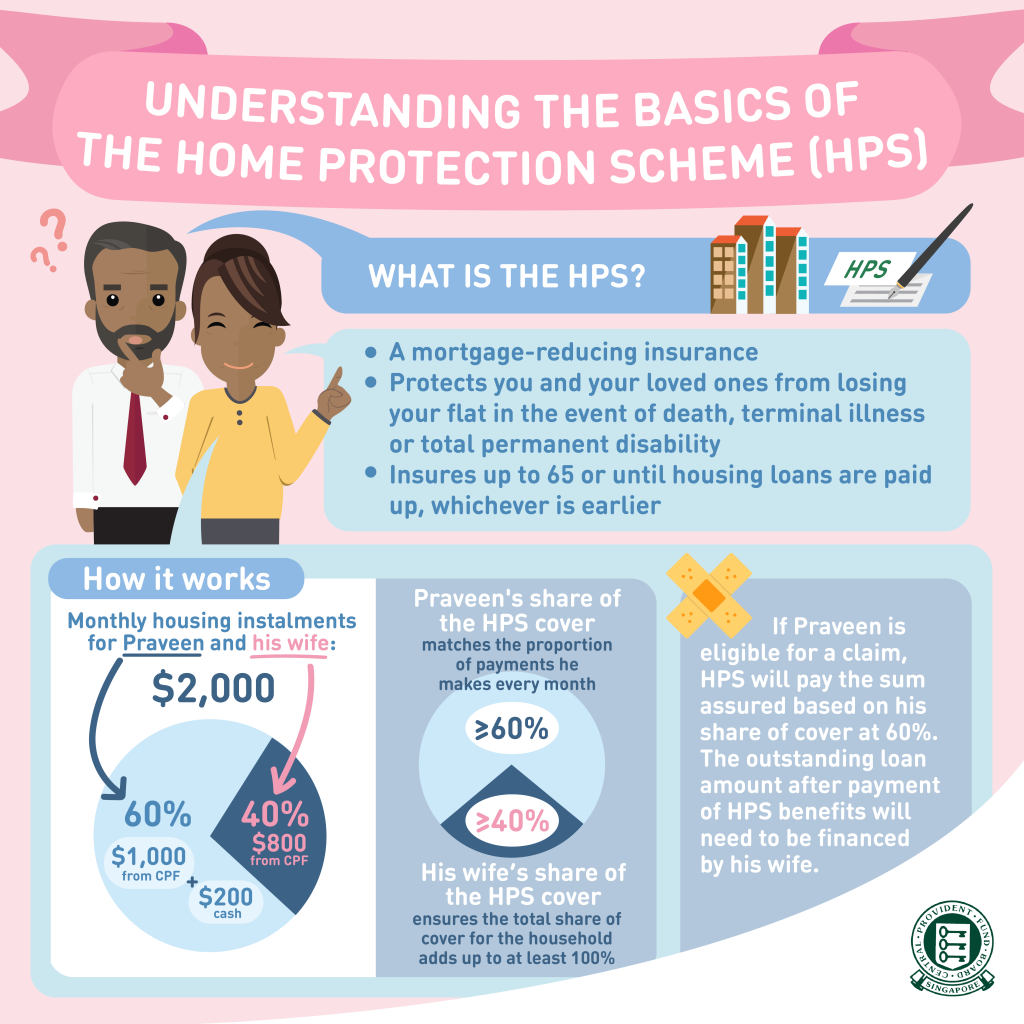

The CPF Home Protection Scheme (HPS) protects CPF members and their families from losing their HDB flat in the event of death, terminal illness or total permanent disability. The CPF Home Protection Scheme is a mortgage-reducing insurance that protects members and their families against losing their HDB flat in the event of death, terminal illness or total permanent disability. HPS insures members up to age 65 or until the housing loans are paid up, whichever is earlier.

https://www.icompareloan.com/resources/cpf-private-properties-scheme/

When the widow called the CPF Board about her husband’s claim, a staff of the Board comforted her, and assured her that the claim process has been launched. The staff reminded her not to default on her mortgage payments until the claim clears successfully. The widow borrowed some money to pay her mortgage loan promptly hoping that her CPF Home Protection Scheme claim will be cleared soon.

But four months later, the claim had still not cleared and she had also used up all the monies she had borrowed. She was however still hopeful that her claim will clear soon. She had disappointing news on the day of Mid-Autumn Festival.

On that day, she noticed that there was suddenly a deposit of $135 from CPF. She also received a letter from CPF saying that when the husband bought the CPF Home Protection Scheme coverage, he did not report that he had diabetes and heart disease. The Board decided that they could not payout his claim as a result and that they would return premiums he paid before his death.

The CPF Board returned $269.46 in unused CPF Home Protection Scheme premiums. The widow received $135, and the balance was divided equally between her two children.

The widow said:

“My husband signed the Home Protection Scheme at the HDB. If the relevant personnel had enquired, he will not deliberately conceal his medical history of chronic diseases. The hospital has records and he can’t hide it. Now how does the insurer prove that he has been asked about his health status when signing Home Protection Scheme?

“How can I prove that the relevant terms have been explained to my husband? When he walked through the door of the government department, he believed that the insurance was a guarantee provided by the government and that there was no need to doubt that the Government will honour its commitment.

“Since this is an insurance, the insurer is responsible for ensuring that the policyholder understands all the conditions and submits the proper documents and medical reports.

“If the CPF Home Protection Scheme will not cover for his death because of his diseases, why did my husband pay a premium of $1382.16 last year? If you will not cover, you should not collect the money. It now appears that if my husband was still alive, he will continue to pay the premiums, and his claim will continue to be not honored.

“If he had not died, he would be working hard every day and getting up early, just so that he can pay the premium of more than $1,300 this year. He will take more customers and buy cheaper daily necessities for our children.”

https://www.icompareloan.com/resources/mortgage-broker-singapore-best-rate/

The CPF Board and HDB responded to the widow on Oct 2 and said that it had a duty to ensure integrity of Home Protection Scheme administration:

“We refer to Ms Li Yue’s letter, ‘Our Grievous Mid-Autumn Festival’ (27 September 2018).

We would like to convey our deepest condolences to Ms Li and her family on the demise of her husband. We are currently assisting her family and will reach out to Ms Li to see how we can help her with HDB’s financial assistance measures so that she can tide over this period of financial difficulty.

Please allow us to clarify how the Home Protection Scheme (HPS) works for the benefit of the readers.

HPS is an insurance scheme where claims are paid out from premiums collected. To keep premiums low and the application process simple, members are required to fully disclose their health conditions when they apply for HPS. Members who declare in the HPS form that they are healthy would generally not be inconvenienced by further underwriting and an HPS cover would be issued in good faith.

In Ms Li’s case, her husband bought an HDB flat in 1998. As he did not use his CPF savings to service his monthly housing instalment, HPS was optional and he did not seek HPS coverage then.

In 2013, Ms Li’s husband was hospitalised for a serious health episode. Soon after his discharge, he approached HDB to apply for an HPS cover. As with every HDB flat buyer who signs up for the HPS, the HDB officer would have explained to him the requirement to fully declare his health conditions in the application form. However, in his HPS form, he declared that he did not undergo any operation or hospital treatment in the last five years, nor did he declare the medical condition he was hospitalised for. HPS cover was issued to him on the basis of his declarations.

We are not in a position to speculate about the reasons why Ms Li’s husband did not disclose recent material facts at the time of his application. However, given the seriousness of his health conditions then, he would not have been eligible for an HPS cover.

As part of sound insurance practice, CPFB has a duty to ensure the integrity of HPS administration. Therefore, upon detection of non-disclosure by any insured member, we will terminate the HPS cover and refund the unused premiums into the insured’s Ordinary Account. It would not be fair otherwise to members whose HPS applications are rejected for similar reasons.

The vast majority of HPS claims by beneficiaries have been successful. Nonetheless, CPFB will look into how the HPS application and underwriting process can be improved.”

Written by: Phoenix Lee/Contributor iCompareLoan

How to Secure the Best Home Loans Quickly

iCompareLoan is the best infomercial loans portal for home-seekers, buyers, investors and real estate agents alike in Singapore. On iCompareLoan, you will be able to find all the latest news and views, informational guides, bank lending rates and property buying trends, and research data and analysis.

Whether you are looking to buy, sell or refinance apartments, condominiums, executive condos, HDB flats, landed houses or commercial properties, we bring you Singapore’s most comprehensive and up-to-date property news and best home loans trends to facilitate your property buying decisions.

Our Affordability Tools help you make better property buying decisions. iCompareLoan Calculators help you ascertain the fair value of a property and find properties below market value in Singapore.

Our trademarked Home Loan Report is Singapore’s first one-of-a-kind analysis platform that provides latest updates of detailed loan packages and helps property agents, financial advisors and mortgage brokers analyse best home loan packages for their clients, so that they may give unbiased home loan/commercial loan analysis for their property buyers and home owners. Our distinguished Panel of Property Agents who are users of our Home Loan report can give the best all-rounded advise to real estate seekers.

All the services of our mortgage consultants are ABSOLUTELY FREE, which means it’s all worth it to secure a loan through us.

Whether it is best home loans, best commercial loans or refinancing of existing loans or SME loans, CONTACT US TODAY!