DBS FHR-9 Fixed Home Rate and DBS FHR-12/24 – Set to Hike in June 2018

Is DBS FHR-9 Fixed Home Rate really a fixed rate? Fixed Home Rate is not a Fixed rate that is guaranteed to remain the same. Fixed Home rate (FHR) can rise and fall depending on the overall interest rate environment as Fixed Home Rate is based on the fixed deposit rates being offered to depositors. If Sibor rises, the market interest rates rises, hence the bank will need to pay their fixed depositors higher interest rate.

Image Credits: DBS ATM Branch at Holland Village, Paul Ho, iCompareLoan.com

What is DBS FHR-9 and what is DBS FHR 12/24. A short recap.

Table of Contents

DBS FHR-9 is based on the 9-month fixed deposit rate. As you already know, the longer the deposit tenure, the higher the interest paid that is paid to the depositors. So FHR-12/24 is based on the 12-month and 24-month average. Hence the FHR-12/24 deposit rate will be higher than the FHR-9 deposit rate.

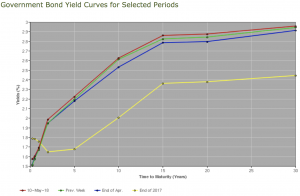

Chart: Singapore Government Bond Yield Curve, Asian Development Bank

Singapore’s government bond yield curve also indicates that the longer the tenure, the higher the interest rate as you can see from the horizontal axis.

When interest rate starts to hike, we have observed that it is the longer tenure bonds that rises less compared to the shorter tenure bonds.

What this means in layman language is, if you place a deposit in a bank for 36 months and this bank pays you 1%, versus a 9 months fixed deposit at 0.25%. If the interest rate rises by 1% globally, the banks may increase the 36 months fixed deposit by 0.5% from 1% to 1.5% to retain the customer, while the 9 months fixed deposit may be increased by 0.6% to go from 0.25% to 0.85%. The logic is simple, towards a higher tenure deposit (or bond), the deposits (investors), they expect an increase in interest rate, but that increase is not a linear and proportional increase, instead you will see that towards the longer tenure, the interest rates tends to flatten out.

Singapore Banks Increase Margins and Pass on Interest Rate risks?

Banks have increasingly passed on the risk of interest rate fluctuation to consumers. How?

As an illustration (not actual rates): –

Past

If FHR-12/24 = 0.65%, Spread = 1%

- FHR-12/24 + Spread = 1.65%

Now

If FHR-9 = 0.25%, Spread = 1.4%

- FHR-9 + Spread = 1.65%

They are both the same at 1.65%. But look at the spread, the bank has locked in a higher spread. Although each bank’s cost of funds is different, the spread does not necessarily mean it is the margin but it roughly approximates it. If the cost of funds is 0.25%, why not use the 1% spread and price the loans at FHR-9 + 1% = 1.25%?

Hence it would be safe to surmise that banks have passed on the risk of interest rate fluctuation to consumers. In this case, if the FHR-9 is 0.25%, then the likelihood of FHR-9 fixed deposit rate dropping is very low, as it is only 0.25% above ZERO. However the move upwards is more unpredictable and perhaps easily exceed the 0.25%.

This means that the “margin” has increased.

DBS FHR-9 and FHR-12/24 to Hike Rates in early June 2018.

DBS to hike FHR-9 by 0.25% and FHR-12/24 by only 0.125%. You will receive the notice in your mailbox about your revised home loan rates already or soon.

Read about DBS FHR-18 hike in Jan/Feb 2018.

|

Fixed Deposit Peg |

Description |

Current |

Revised |

|

DBS FHR-9 |

9 months S$ Fixed deposit |

0.25% |

0.5% |

|

FHR-12/24 |

Average of 12 months and 24 month S$ Fixed deposit |

0.675% |

0.8% |

Table 1: DBS to revise Fixed Deposit Peg Rates

In fact we spoke about this in April 2017 about the risk of interest rate hike being passed to consumers and that the likelihood of any interest rate uptrend is incurred by consumers.

As you can see above, the FHR-12/24 increases less than the FHR-9.

The FHR-9 and FHR-12/24 is not longer being offered, the current DBS flavour is based on the DBS FHR-8, pegged to the 8 months Fixed deposit rate.

Those with home loan packages from DBS FHR-9 and FHR-12/24 and FHR-18 could do well to refinance home loans to fixed rates if they feel that the Federal Reserve will continue to hike the interests in the 2018 and 2019 (Fed predicts 7 hikes in 2018 and 2019 in total and each hike ranges from 0.25% to 0.5%).

Bank such as OCBC have moved away from fixed deposit pegged home loans and instead created the OCBC OHR which is based on the 12-year Sibor Average, this smooths out any rise and fall in short term sibor movements. Others may yet consider longer tenured Fixed deposit based rates such as those from Maybank.

If you are unsure, check with a mortgage broker who can work you through. It’s free to you as they receive a standard distribution fee from the bank.

Read the article about DBS FHR here.

https://www.icompareloan.com/resources/dbs-fhr-history-fhr-9-fixed-home-rate/