If you haven’t already heard from your friends or colleagues, DBS has recently announced a revision to its DBS fixed deposit rates. This revision in DBS fixed deposit rates will have an impact on its DBS home loan since its home loan is pegged to its DBS fixed deposit rates. So if you are a homeowner with a DBS home loan, read on to see how the new DBS fixed deposit rates that were announced on 4th May 2020 impact you

Image 1 – Photo by Aditya Chinchure on Unsplash

Newly Released DBS Fixed Deposit Rates

| For amounts $1,000 to $49,999 | For amounts $50,000 to $99,999 | For amounts $100,000 to $999,999 | ||||

| Tenor | Existing interest rate (% p.a.) | New interest rate (% p.a.) | Existing interest rate (% p.a.) | New interest rate (% p.a.) | Existing interest rate (% p.a.) | New interest rate (% p.a.) |

| 7 months | 0.95 | 0.40 | 0.95 | 0.40 | 0.95 | 0.40 |

| 8 months | 0.95 | 0.60 | 0.95 | 0.60 | 0.95 | 0.60 |

| 9 months | 1.35 | 0.90 | 1.35 | 0.75 | 0.96 | 0.75 |

| 10 months | 1.35 | 1.10 | 1.35 | 0.75 | 0.98 | 0.75 |

| 11 months | 1.35 | 1.10 | 1.35 | 0.75 | 0.99 | 0.75 |

| 12 months | 1.40 | 1.15 | 1.40 | 0.75 | 0.90 | 0.75 |

| 18 months | 1.30 | 1.30 | 1.30 | 0.90 | 0.90 | 0.90 |

Table 1 – DBS fixed deposit rate after revision (Source: DBS), 4th May 2020.

DBS Fixed Deposit Rates Lowered For All Tenors

So, what are the DBS fixed deposit rates that have changed after the recent revision by DBS?

According to the official announcement, the DBS fixed deposit rates for tenors (Tenure) from 7 months onwards have been lowered. This applies to all the DBS fixed deposits for any amount, starting from $1,000. In general, we see that the DBS fixed deposit rates have been adjusted by anything between 25 basis points to 55 basis points. The shorter the tenor of your DBS fixed deposit, the lower your DBS fixed deposit rates will be adjusted to.

Why Is DBS Lowering The DBS Fixed Deposit Rates?

The main reason for the lowering of DBS fixed deposit rates is because central banks around the world are cutting interest rates to stimulate economic growth. Banks like DBS are also cutting the interest rates that they offer on fixed deposits to adjust for the new low-interest rate environment.

Another reason why DBS is lowering its DBS fixed deposit rates is that it foresees investors flocking into safe assets like fixed deposits. Since there is a demand for fixed deposits, DBS can lower its cost of deposits and still garner a lot of interest from the public to deposit their money with the bank.

What Does Lower DBS Fixed Deposit Rates Mean For Homeowners?

Since DBS’ Fixed Deposits Home Rate (FHR) is pegged to the DBS fixed deposit rates, lower DBS fixed deposit rates mean that DBS FHR will also be lowered. This means that existing homeowners that are on DBS home loan package pegged to the DBS FHR will see savings on your mortgage payment. Well, that’s what we thought but it really depends on the FHR that your home loan is pegged to.

More Savings For DBS FHR8; No Savings For FHR18

For instance, if your home loan is on FHR8, you will see a significant reduction in your home loan interest rate. That’s because the FDR8 has dropped significantly post the fixed deposit rate update from DBS. If your home loan is on other FHR such as FHR18, you will not get to enjoy any savings. That’s because the DBS fixed deposit rates for 18 months tenor will remain the same post update from DBS.

But the question is, are those savings you get from DBS FHR enough? Well, while we think that it is significantly lower and better than nothing, it isn’t exactly the kind of good savings that you want as a homeowner. There are home loan packages out there in the market that can get you even more savings if you keep your eye out for good deals.

Refinancing To SIBOR Home Loans Will Get You More Savings

If you are really looking for some savings from your home loan, perhaps you should consider refinancing to SIBOR pegged home loans. Compared to FHR, SIBOR rates are much more adaptive to changes in the market.

Figure 2 – SIBOR rate chart over time, in case the chart does not load well, click SIBOR chart here.

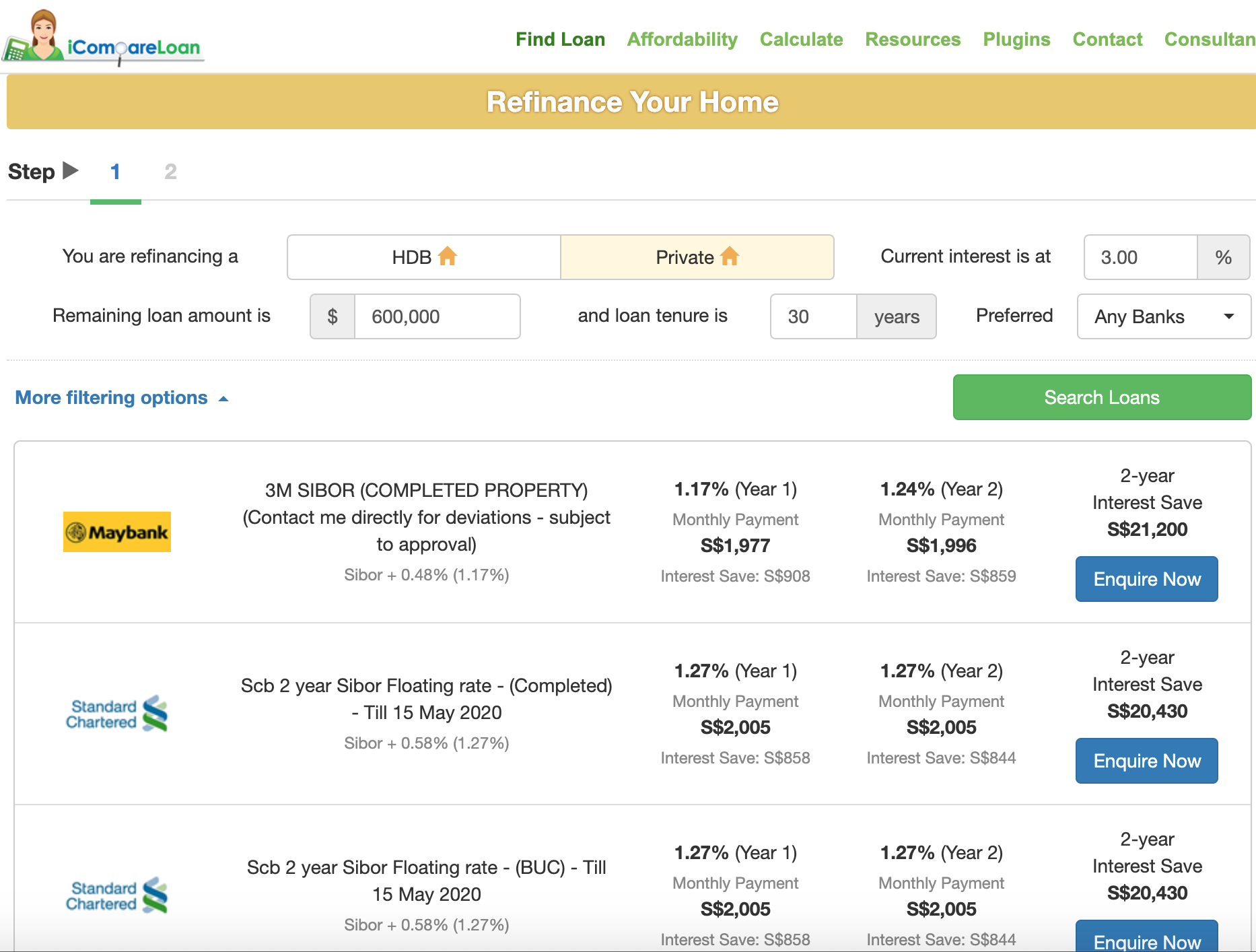

dAs you can see from the SIBOR rates chart, SIBOR has dropped quite a lot since the start of 2020. So, if you are on a SIBOR home loan, you will get more savings much quicker than if you were on a FHR pegged home loan. Just do a simple search on iCompareLoan’s loan comparison tool and you can find that the cheapest home loans on the market right now are SIBOR pegged home loans.

FHR Home Loan Still More Expensive Than SIBOR Home Loan

With DBS FHR home loan, you will be paying 1.73% to 1.80% interest rate even after the reduced FHR18. Compared to SIBOR home loan, DBS FHR home loan is still much more expensive than SIBOR pegged home loans such as the ones from SCB and Maybank. SIBOR home loans range between 1.17% to 1.36%. This means that you can save a few hundred dollars on your monthly mortgage repayment by refinancing with SIBOR home loan.

Figure 3 – Cheap SIBOR home loan based on iCompareLoan’s comparison tool

Why Pay More When You Can Pay Less With SIBOR Home Loans?

So, what are you waiting for? It’s time to bag some savings on your home loan to reduce your monthly expenses in the current economic condition. If you are thinking about refinancing with a SIBOR loan but don’t know how, reach out to us at iCompareLoan and let iCompareLoan help you.

Share with us your thoughts at iCompareLoan on what you think about the changes to DBS fixed deposit rates. Do you think DBS is doing enough for its home loan customers? Or do you think they should extend the savings to their DBS FHR home loans?

Find out what are the history and trends of the best home loans in Singapore over the past many years.

https://www.icompareloan.com/resources/best-ocbc-home-loans-guide-trend/