CareShield Life, the new kid (program) on the block?

In 2 years’ time, the ElderShield that most Singaporeans are familiar with will no longer be open to new joiners. From 2020 onwards, ElderShield will be replaced by its successor: CareShield Life. As a Singaporean who will be mandated to enroll for CareShield Life, it is important for you to understand what the changes are and how it is going to affect you.

Image Credits: Care Diagnose disease health, Pixabay, https://pixabay.com/en/care-diagnose-disease-health-3031259/

Find out about ElderShield And CareShield Life

What do I do if I am 65 and my ElderShield is about to turn into a CareShield, what are the pros and cons of it.

Before we go into the details, it is important to understand the basics about ElderShield and CareShield Life. For our readers who aren’t familiar with ElderShield or CareShield Life, here is a quick primer. For those who do not care to read, they can contact us directly.

What Is ElderShield?

Table of Contents

ElderShield is a type of long-term care insurance that insures you against severe disability. It was initiated by Ministry of Health (MOH) in 2002 for Singaporeans and PRs age 40 and above. At age 40, you will be automatically enrolled into ElderShield, unless you opt out of it.

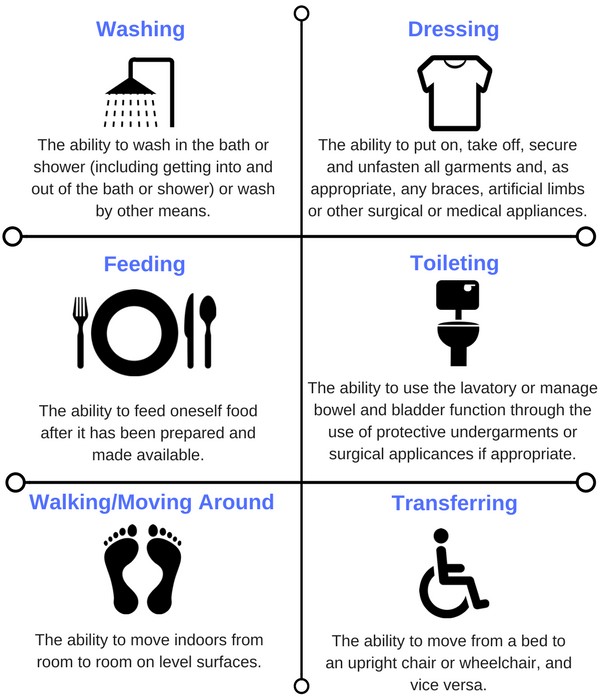

If you are unable to perform at least 3 of 6 different activities of daily living (ADL), be it with or without mobility aids, you will receive a monthly payout from ElderShield.

Picture 1: What does CareShield Cover, MOH

What Is CareShield Life?

CareShield Life is a replacement scheme introduced by the Singapore government to replace ElderShield. It is meant to provide a social safety net for Singaporeans. The fundamental of CareShield Life will remain the same as ElderShield. Anyone who is covered by CareShield Life that is unable to perform at least 3 of 6 ADL will be able to claim monthly payout from CareShield Life.

| ElderShield 400 | CareShield Life | |

| Annual Premium | $175 (Men)

$218 (Women) *Aged 40 when entering the scheme |

$200 (Men)

$250 (Women) #Aged 30 when entering the scheme Increases year-on-year depending on the inflation rate |

| Number Of Years You Need To Pay Premium | 26 | 38 |

| Government Subsidies Available? | No | Yes |

| Payout Amount | $400 a month | $600 a month

Payout amount increases if the payout starts later |

| Duration of payout | 6 | NA |

Table 1: Comparison of ElderShield 400 versus CareShield Life

CareShield Life – What will change with it starts

Now that everyone has a clearer idea of ElderShield and CareShield Life, we can dive into the changes that will impact Singaporeans when CareShield Life starts. Here are seven things you need to know when CareShield Life replaces ElderShield from 2020 onwards.

7 Ways CareShield Life Will Change From Its ElderShield Predecessor

-

Bye Bye Private Insurers, Hello SG Government: The New Administrators Of CareShield Life

Lately, we have been observing a pretty distinct trend in Singapore. Whenever the government is trying to fix something, it takes over entire control of that thing so that they can fix things once and for all. One just has to think of the privatisation of SMRT for evidence. For CareShield Life, the government will also be adopting the same modus operandi. Yes, the government is going to take charge of CareShield Life.

During the time of its predecessor ElderShield, private insurance companies like NTUC Income, Aviva and Great Eastern handled the day-to-day operations of the scheme. This involved handling the issuance of ElderShield, collecting premiums from policyholders and paying out claims to policyholders. But things are going to be different with CareShield Life.

Unlike ElderShield, CareShield Life will be run and administered by the government. The government will be setting up its own infrastructure and operations to administer CareShield Life. The government will take charge of issuance, premium collection, claims handling and even investing the collected premiums.

-

CareShield Life: Singapore’s Own Obamacare

Obamacare was a law enacted during US President Barack Obama’s office term to provide affordable health insurance to all Americans. Under Obamacare, those who had pre-existing conditions like high blood pressure were either rejected coverage or charged higher prices. Upon the introduction of Obamacare, it was legally impossible for private insurers to reject those with pre-existing condition.

CareShield Life is a watered-down version of Obamacare. Just like ObamaCare, CareShield Life is going to provide universal healthcare coverage for all Singaporeans. This includes even those with pre-existing disabilities like autism. According to Ministry of Health (MOH), the government is trying to to have a lenient underwriting process” to allow as many to join the CareShield Life scheme as possible.

There is, however, one caveat. If you are above 40 by 2020 and have a pre-existing disability (i.e. unable to complete at least one ADL), you cannot enroll in CareShield Life.

-

CareShield Life: “Caring For You, For Life”

Picture 2: CareShield Life – Caring for you, for Life, MOH

“Caring For You, For Life”. That is the exact slogan that MOH uses for CareShield Life to create awareness of CareShield Life. The idea probably came from the need to get Singaporeans to focus on its unique feature: Life-long coverage against long-term disability.

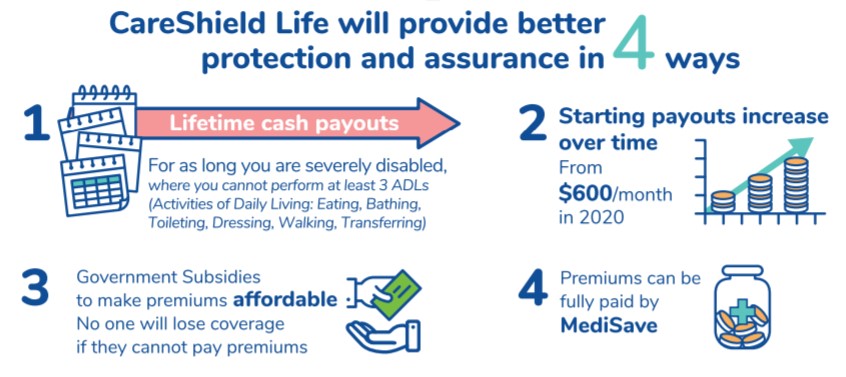

With CareShield Life, you will be able to claim cash payout as long as you are severely disabled. There is no limit to the duration for claim payout, which is opposite of ElderShield where the claim payout duration is a maximum of 6 years.

-

What Is Going To Be The Cost Of CareShield Life For Us?

Since CareShield Life is going to be a mandatory scheme for new joiners, the natural question to ask is, “How much is CareShield Life going to cost us?”. The accurate answer to this question is, nobody knows for sure. This is due to the inflation adjustment that the government plans to introduce with CareShield Life’s premiums.

Expect Increasing Premium Amount For CareShield Life That’s Pegged To Inflation Rate

Under the old ElderShield scheme, the annual premium you need to pay is fixed. It does not increase with your age. For CareShield Life, the annual premium is an increasing amount pegged to the inflation rate in Singapore. The consensus expectation is that premiums will increase by 2% every year. That being said, it has the possibility of being lower, provided that the government is able to achieve better-than-expected investment returns when investing the premiums.

Slight Increase In Premium Payment Term

Under the old ElderShield scheme, premium is payable till the age of 65. For CareShield Life, we will need to pay till we are age 67 (at least for now). This means that there will be a slight increase in premium payment term, i.e. number of years we need to pay premiums for CareShield Life.

Net Effect: More Than 2x Increase In Premium Payable

For a 30-year old man, the estimated premiums payable from age 30 to 67 under CareShield Life will be $11,300. In the old ElderShield 400 scheme, the total premiums payable from age 40 to 65 will be $4,600. This means that the net effect on premium of the new CareShield Life is expected to more than double.

-

What If I Can’t Afford CareShield Life’s Premiums?

When CareShield Life goes live in 2020, the government will be providing a 5-year subsidy for every Singaporean.

| Year | 2020 | 2021 | 2022 | 2023 | 2024 |

| Subsidy | $70 | $60 | $50 | $40 | $30 |

The government will also provide additional subsidies for low income families. The amount of subsidies will be pegged to each family’s monthly per capita household income.

| Monthly per capita household income | <= $1,100 | $1,101 – $1,800 | $1,801 – $2,600 | $2,601 and above |

| Permanent subsidy | 30% of premiums | 25% of premiums | 20% of premiums | None |

For Singaporeans that are still unable to afford CareShield Life premiums, the government will offer to provide additional support to ensure no one is deprived of coverage.

-

CareShield Life Is More Expensive. But Got More Benefits Or Not?

As smart consumers, we know very well that price isn’t the only consideration when analyzing whether CareShield Life or ElderShield is better. We also need to compare the expected benefits between the CareShield Life scheme and ElderShield scheme.

CareShield Life = Lifetime Payout

Firstly, CareShield Life offers lifetime payout. As long as you are alive and meets the disability criteria of being unable to fulfil 3 of 6 ADL, CareShield Life will pay you at least $600 a month. For ElderShield, you will only receive payout for 6 years, even if you continue to live for another 20 years.

However it is often said that if you meet 3 of the 6 of the Activities of Daily Living (ADL), you are most often nearing death and may not enjoy this benefit for many years. The longer payout may not be useful afte-rall, what do you think? Discuss here.

On top of that, the payout can also increase. If you continue to stay healthy and only start claiming for CareShield Life at age 60 (20 years after enrolling in CareShield Life), your payout is expected to increase to $890 per month. The longer you delay your claims, the more monthly payout you can receive.

Case Study: What Happens If You Become Severely Disabled At Age 67?

If you become severely disabled at age 67, you will receive $28,800 in payout from ElderShield within a 6-year duration. Under CareShield Life, you can receive $144,000 in the first 10 years.

If you continue to be severely disabled for another 10 years, you will continue to receive another $144,000. If you were under ElderShield, you will not be able to make further claims.

-

CareShield Life Or ElderShield: Dilemma/Privilege For Those Above Age 38 Today

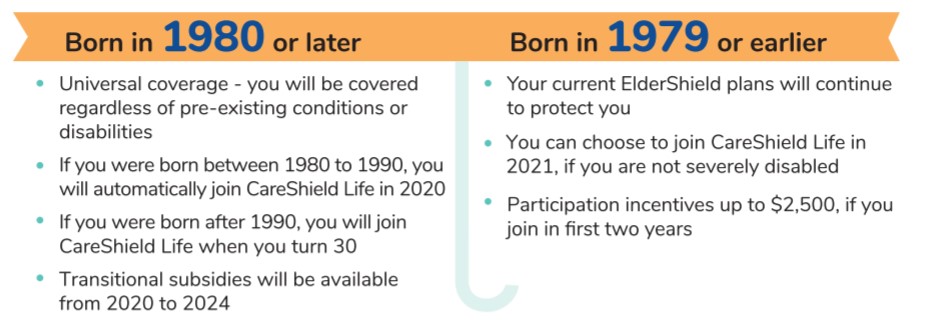

Picture 3: MOH Infographic on people born in 1980 or later and those born in 1979 or earlier.

CareShield Life will officially start in 2020. For those who are above 30 and below 40 by 2020, you will be automatically entered into CareShield Life. The premiums for CareShield Life can be paid using your Medisave.

For those who are above age 38 today, you have the “privilege” to choose between staying in ElderShield or switching over to CareShield Life. From a value perspective, CareShield Life offers much better value for the price. The amount of payout per premium you can potentially receive is 12 times for CareShield Life, compared to 6 times for ElderShield 400. This is due to the larger payout and (much) longer payout period for CareShield Life.

Picture 4: CareShield Life – 4 better ways and assurances, MOH

The only drawback is that CareShield Life will be more expensive. The annual premium for ElderShield 400 is fixed but it increases over the years for CareShield Life.

Join iCompareLoan’s Facebook page to get up to date news about personal finance.