First half 2020 GLS Programme shows that Government is keeping its finger on the pulse of the property market

The Government on Dec 3 announced the first half 2020 (1H2020) Government Land Sales (GLS) Programme, which comprises three Confirmed List sites and eight Reserve List sites. These sites can yield about 6,490 private residential units, 114,000 sqm gross floor area (GFA) of commercial space and 1,070 hotel rooms.

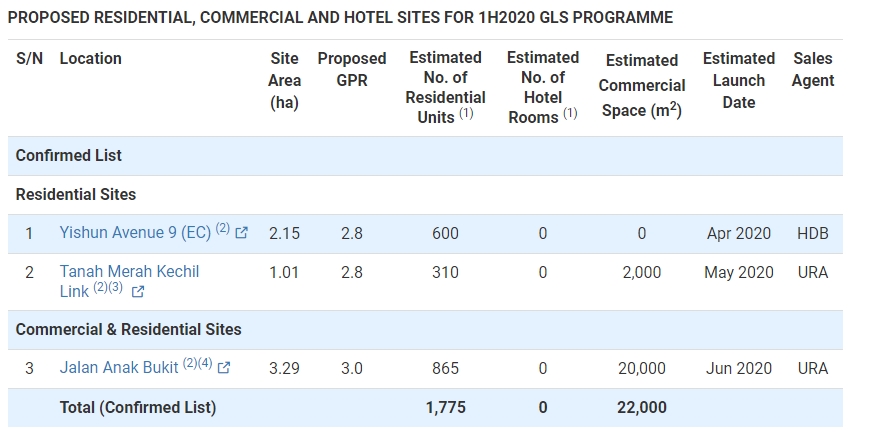

The Confirmed List comprises two private residential sites [including one Executive Condominium (EC) site] and one commercial & residential site which can yield about 1,775 private residential units (including 600 EC units) and 22,000 sqm GFA of commercial space.

Supply of Private Housing

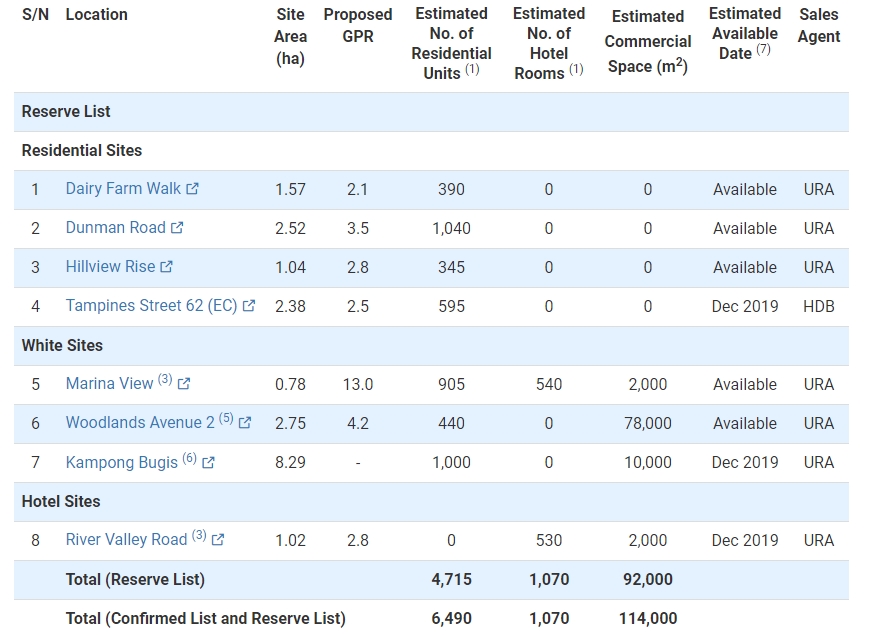

The Reserve List comprises four private residential sites (including one EC site), three White sites and one hotel site. These sites can yield about 4,715 private residential units (including 595 EC units), 92,000 sqm GFA of commercial space and 1,070 hotel rooms.

The supply of private housing units in the pipeline remains high, at around 39,000 units currently, even though it has declined progressively over the past few quarters. This pipeline supply comprises around 34,000 unsold units from GLS and en-bloc sale sites with planning approval, and an additional 5,000 units from sites that are pending planning approval.

While the demand for private housing units has increased in the past two quarters, the overall transaction volume has remained modest relative to the period leading up to the introduction of the property market cooling measures in July 2018. Meanwhile, developers’ demand for residential land remains moderate and there continues to be bidding interest for GLS tenders.

To continue to cater to the housing needs of the population, the Government has decided to keep the supply of private residential units on the Confirmed List for the first half 2020 GLS Programme broadly similar to that for the 2H2019 GLS Programme.

The Government said that will continue to monitor the property market closely and adjust the supply for future GLS Programmes, as necessary.

Supply of Commercial Space

The 22,000 sqm GFA of commercial space on the Confirmed List is mainly from the predominantly residential site at Jalan Anak Bukit with an integrated bus interchange, and will provide amenities for commuters and residents in the area.

The 1H2020 Reserve List includes a White site at Woodlands Avenue 2 for a mixed-use development, which is carried over from the 2H2019 Reserve List. This will help to sustain the development momentum of Woodlands Regional Centre as a major commercial node outside the city, in line with the Government’s objective of decentralising employment centres to bring job opportunities closer to homes.

Supply of Hotel Rooms

The 1H2020 Reserve List includes two sites at Marina View and River Valley Road, which are carried over from the 2H2019 Reserve List. These sites will provide ample opportunities for developers to initiate additional supply of hotel rooms over and above the current pipeline supply.

Commenting on the first half 2020 GLS Programme, Colliers International said, “as expected, the government continues to keep its finger on the pulse of the property market in Singapore, lining up a conservative slate of land supply.” It added that the announcement of the first half 2020 GLS Programme “comes amid slowing economic growth, substantial pipeline of residential units, and relatively more muted demand for homes on the back of fresh cooling measures, which were implemented in July 2018.”

“The Ministry of National Development (MND) announced on Tuesday (3 Dec 2019) that it will place three new sites on the Confirmed List for the upcoming GLS – Yishun Avenue 9 (EC), Tanah Merah Kechil Link, and Jalan Anak Bukit – which can potentially yield 1,775 dwelling units and 22,000 sq m of commercial space. Of the three Confirmed List sites, two of them are pure residential sites (Yishun Avenue 9 (EC) and Tanah Merah Kechil Link) – the fewest number of such sites offered in the GLS in 10 years.

Among the Confirmed List sites, we believe the Tanah Merah residential site is the most attractive, given its proximity to the MRT station, popularity of the estate, and the small palatable size.

Given the ample supply of 39,000 units of private residential stock in the pipeline, the government has maintained a cautious approach in its GLS programme. We believe this will help to continue to stabilise the property market, particularly given the cocktail of challenges including more subdued economic outlook, geopolitical tensions in the region, and trade uncertainties.

In addition to the three plots on the Confirmed List, eight sites on the Reserve List in the 2H 2019 will be carried over to the Reserve List in the upcoming GLS. These sites can offer a further 4,715 residential units, 1,070 hotel rooms, and 92,000 sq m of commercial space. We note that two of the plots have seen a slight reduction in size: Kampong Bugis now has a site area of 8.29 ha compared with 9.20 ha under 2H 2019 GLS; and the hotel site in River Valley Road went from 1.07 ha to 1.02 ha and will yield 530 rooms instead of 560 under 2H 2019 GLS.”

Colliers analysed the confirmed list sites from the first half 2020 GLS Programme as such:

“Yishun Avenue 9 (EC)

The Yishun Avenue 9 site is located at the edge of the Yishun town, around 2km from the Yishun MRT station. It is the newest EC site in the locality to be offered on the GLS since 2014 after The Criterion and Signature at Yishun, so there could be some pent-up demand. It is next to Symphony Suites (completed in 2018) which have transacted at SGD1,100-1,200 psf in 2019.The site is regular shaped and can be built up to 600 units. Given its distance away from the MRT station, we expect land bids to be around SGD450 psf per plot ratio, and developers can look to potentially launch at SGD900 psf.

Tanah Merah Kechil Link

We think this site is probably the most attractive among the new sites as it is next to the above-ground Tanah Merah MRT station in the eastern part of Singapore, and is of a palatable size of 310 units. It is between two completed private condominiums – Urban Vista (completed in 2012) and Optima (2012). Meanwhile, Grandeur Park Residences, opposite the site, has sold 98% of its 720 units since launch in March 2017 as of October 2019, with the latest median price of SGD1,550 psf.Jalan Anak Bukit”

We think the residential and commercial plot in Jalan Anak Bukit is the most interesting. It is perhaps timely to offer such sites seeing the good response to recently launched residential and commercial developments such as One Holland Village and Sengkang Grand. It is also near Beauty World MRT station along the Downtown line. However, there are more conditions attached to such sites, such as the requirement to build an integrated bus interchange (estimated 5,000 sqm GFA), up to 7,500 sq m GFA can be for retail, and the site is relatively sizable (865 residential units) which entails a relatively large land price quantum of over SGD1 billion. One Holland Village and Sengkang Grand residential and commercial sites were awarded in May and August 2018 respectively at SGD1,888 and SGD924 psf ppr respectively.There are also ample new launches nearby – Daintree Residences sold 69 units and View at Kismis sold 47 units at an average price of about SGD1,700 psf as of October 2019. There are also existing commercial spaces available nearby such as Beauty World Centre, Beauty World Plaza, Bukit Timah Shopping Centre and Bukit Timah Plaza.”