Hdb Loan or bank loan, which is better? It’s been debated very often when a young couple decides to buy their HDB flat. Which loan is better? Should I take the HDB loan versus Bank loan? Let us investigate the pros and cons of each of these loans. Let us simulate the bank home loan rates based on Sibor movement as well.

What is a HDB loan?

Table of Contents

For a HDB flat, you have the choice of choosing a bank loan or a HDB loan.

https://www.hdb.gov.sg/cs/infoweb/residential/financing-a-flat-purchase/housing-loan-from-hdb

Housing development board (HDB) offers a concessionary home loan and interest rate for family members that meet eligibility conditions. Buyings of HDB flat can submit a HLE (HDB Loan Eligibility) letter online.

- You can “Apply for an HLE letter and upload your documents at www.hdb.gov.sg/hleapply” (Source HDB)

In short, a HDB loan is a Housing loan offered by the HDB, whereas a bank loan is a loan for the HDB flat offered by the Bank.

https://www.hdb.gov.sg/cs/infoweb/residential/financing-a-flat-purchase/housing-loan-from-hdb/hdb-loan-eligibility-application

What does HDB Loan consider for Credit Assessment

“HDB does not consider or take into account the following incomes for credit assessment: –

- Alimony/ maintenance fee

- Bonuses

- Claims/ reimbursement/ expenses

- Director’s fee

- Dividend income/ interest from deposit accounts

- Income from ad hoc overtime work

- National Service allowance

- Occupier’s income

- Overseas cost of living allowance*

- Pension*

- Rental income

- Scholarship overseas allowance” (Source HDB)

So do not mistakenly think that HDB loan is easier to get approved.

If your income is still insufficient, you may not find much help with opting for a HDB loan. If your credit is not too bad, you have been rejected by bank loan, you can try to appeal with HDB for a HDB loan.

HDB Loan is more lenient when you are unable to keep up repayment

If you are unable to keep up your HDB Loan repayment, based on anecdotal feedback, HDB does not take back your house immediately. However you are still best to avoid taking this path if you can afford to repay your home loan.

HDB Loan has Higher Loan to value compared to Bank Loan

If your incomes are justified, you can generally apply for up to 90% of the property valuation. But you must also make sure that you are not buying a HDB flat with too few years remaining on the lease.

Age limit is 65 years old while the maximum tenure is 25 years. The remaining lease must cover the youngest buyer’s age up to age 95.

Scenario of Person A = Age 45 and Person B = Age 40.

The HDB flat has a remaining lease of 50 years. That means that at the age of 90 years old (partner’s age 40 + 50 years remaining lease), assuming that the younger partner is still alive, he or she will be without a home. Hence for the loan to be accepted, the remaining lease must then be 55 years or more.

For those families who may not have sufficient downpayment of 25%, taking a HDB loan that allows you up to 90% Loan-to-value and hence a lower downpayment of 10% may allow you to quickly buy a HDB flat.

What is the HDB loan income criteria?

Your instalment must be no more than 30% of your monthly income currently based on 2.6%. Based on a bank loan, MSR of 30% is based on a 3.5% stress test interest rate.

If you jointly earn $4,500 a month, that means that your monthly home loan servicing should not exceed $1,500 a month.

For families, the maximum household income must be less than $14,000 (per month) or less than $21,000 (per month) including extended families and $7,000 for single person applying for HDB loan.

* For HLE applications and flat applications received before 11 September 2019, the income ceilings are $12,000 for families, $18,000 for extended families, and $6,000 for singles.

HDB loan or Bank Loan – Comparing the key differences

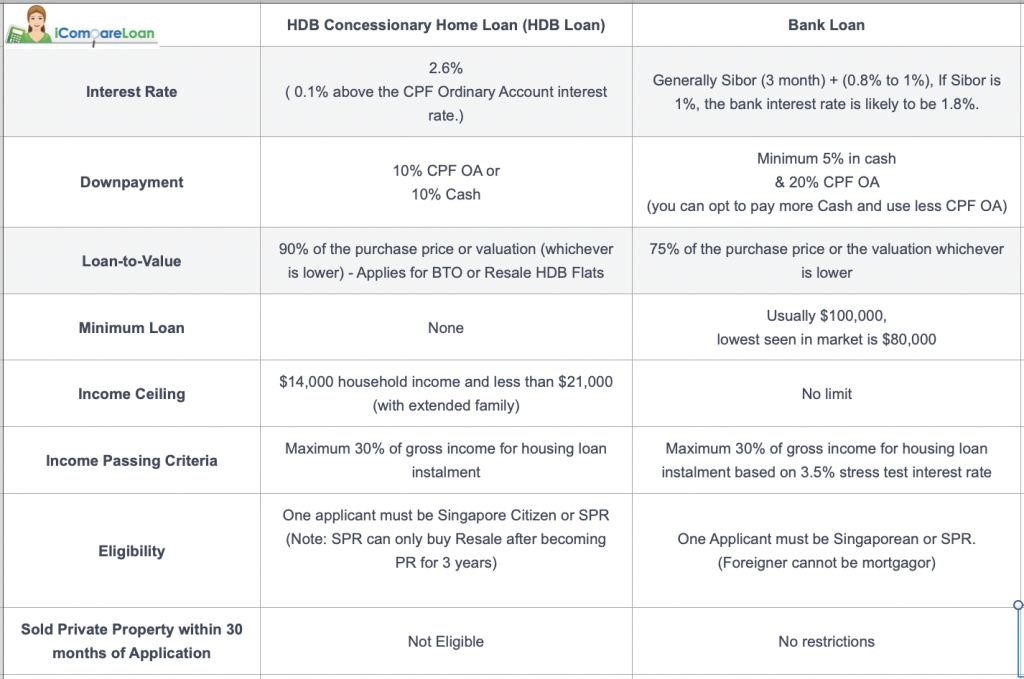

Table 1: HDB Loan versus Bank Loan Table at a glance, iCompareLoan.com

What is HDB Loan’s concessionary home loan interest rates?

HDB loan is set at 0.1% above the CPF OA rates of 2.5%.

HDB Loan or Bank Loan – Which is cheaper?

Bank loans have been cheaper than HDB loans for many years.

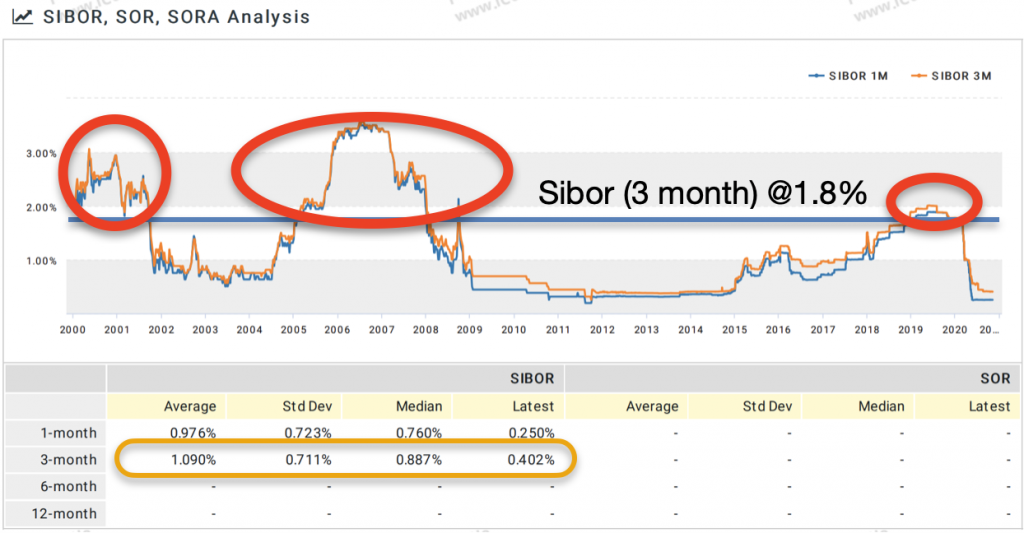

Chart 1: Sibor Rate from 2000 to 2020, iCompareLoan.com

Assuming bank loans have been priced at Sibor (3 month) + 0.8%, that means when Sibor (3 months) is more than 1.8%, that will equate to a bank loan interest rate of more than 2.6%.

Based on a spread of 0.8%, i.e. Sibor (3 month) + 0.8%, that would be 2.6%. There are roughly 4 years out of a 20 year period where the bank interest rate is lower than 2.6%, the stated HDB concessionary loan rate of 2.6%.

The 20 years Average 3-month Sibor is about 1.09%

The 20 years median 3-month Sibor is 0.887%.

The likely bank loan rates within this 20 year period is: –

- Average 1.09% + 0.8% (Spread) = 1.89%

- Median 0.887% + 0.8% (Spread) = 1.687%

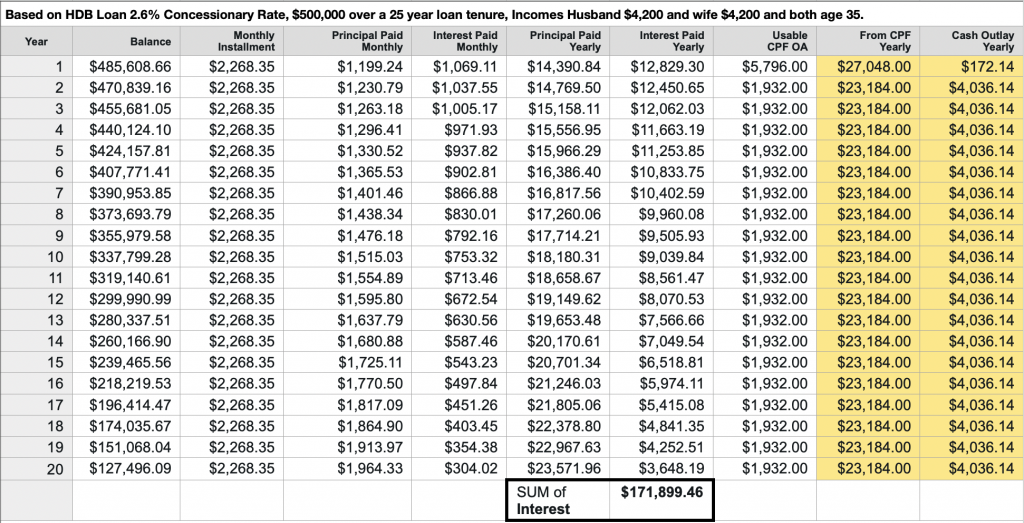

Table 1: HDB Concessionary loan 2.6% amortisation table, 500k Loan over a 25 year tenure with Husband and wife both earning $4,200 at age 35, iCompareLoan.com

A total of $171,900 of interest is paid over 20 years, and this is not even considering time-value-of-money and the outstanding loan balance of $127,496 remains at end of year 20.

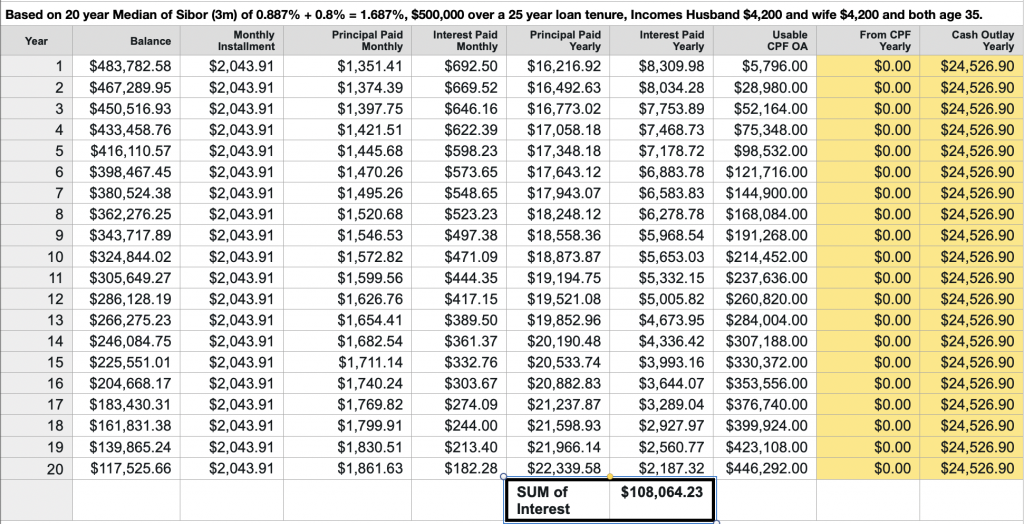

Table 2: 20 year history median of Sibor (3 month) + 0.8% = 1.687% Amortisation table, 500k loan over a 25 year tenure with Husband and wife both earning $4,200 at age 35, iCompareLoan.com

A total of $108,064 of interest is paid over 20 years with an outstanding loan balance of $117,526 remains.

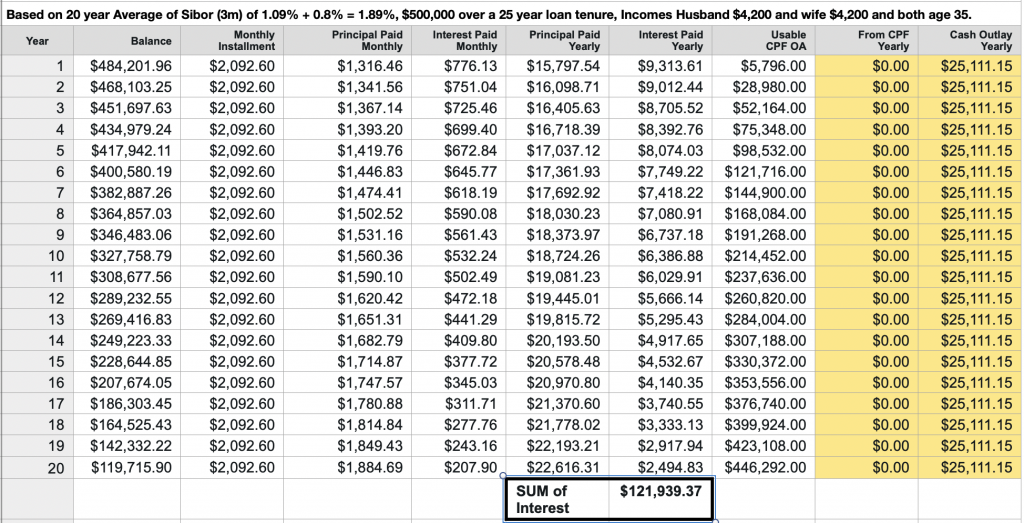

Table 3: 20 year average of Sibor (3 month) + 0.8% = 1.89% Amortisation table, 500k loan over a 25 year tenure with Husband and wife both earning $4,200 at age 35, iCompareLoan.com

HDB loan or Bank loan – What is the Interest payable over 20 years

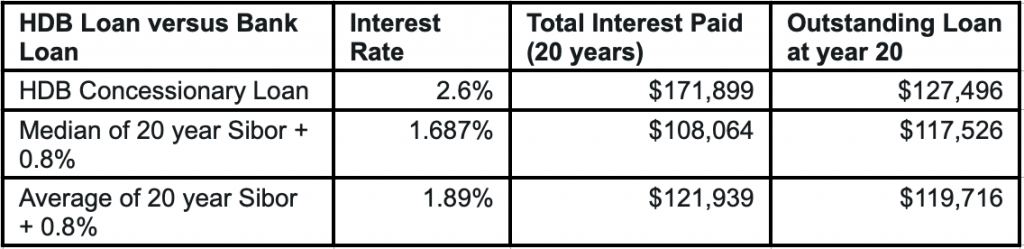

Table 4: HDB loan or Bank Loan? Comparisons of Hdb loan versus bank loan of Total Interest Paid over 20 years, iCompareLoan.com

The interest cost difference paid using a HDB concessionary loan compared to a bank loan could be around $63,835 ($171,899 – $108,064) or $49,960 ($171,899 – $121,939) as well as about $10,000 lower in outstanding loan.

Or to put it in another way, between paying $108,064 (based on 20 year median) or $121,939 (based on 20 year Sibor average) versus paying $171,899. HDB concessionary loan rate is at least ~41% higher compared to a bank rate that is based on the average of a 20 year sibor rate.

CAN YOU GO BACK TO A HDB LOAN AFTER CHOOSING A BANK LOAN?

No, once you choose a bank loan, you cannot go back to take a HDB loan.

Where is Singapore Interest Rate Heading?

Based on the current Covid-19 pandemic and the economic damage it has caused the world over, the US Federal Reserve has printed a lot of money, this caused the interest rates to stay low for several years in the USA. This money printing has caused the world to be flooded with cheaper money and hence a lower Sibor rate, and hence lower interest rates. This has been evidenced in lower interest rates between 2008 (US Financial crisis) to 2014 where the interest rates has stayed low for 5 to 7 years.

For those who want to buy a property, the lower interest rates also means that property investors would likely see positive returns as the yields less-off interest cost would still be positive.

Now could also be time to consider refinance your home loan.

Here is a Property Buyer Report for HDB Flat, you can take a look.

Are you still unsure if you should take a HDB Loan or bank loan? Follow your heart.

Generally it is not easy to get a HDB bank loan as you can only spend up to 30% of your gross income on the installment of the property. This is also known as MSR < 30%.

Read our other HDB Loan or Bank Loan articles here: –

https://www.icompareloan.com/resources/hdb-loans-now-expensive-bank-loans-almost-decade/

Brought to you by https://www.icompareloan.com