Home owners who have successfully sold their units en bloc may turn to HDB rentals while they wait for a permanent replacement flat. Once the en bloc sales deal is completed, owners can hand over the units with vacant possession for 100 per cent of the sales proceeds, or opt to stay on for another 6 months.

But those that stay put will receive only 95 per cent of the proceeds from their successful en bloc sale. Such home owners may negotiate to stay put for up to 6 months, provided such terms are negotiated and agreed upon during the Collective Sales Agreement (Terms and Condition stage).

https://www.icompareloan.com/en-bloc-sales-process-guide-singapore/

And 5 per cent which will be held back until the home owners move out may not be a small amount. If the owner receives $2 million from the successful en bloc sale of his unit, the 5 per cent will amount to $100,000. And this is a significant amount, especially since the Loan-to-Value (LTV) limits have been tightened with the new property cooling measures.

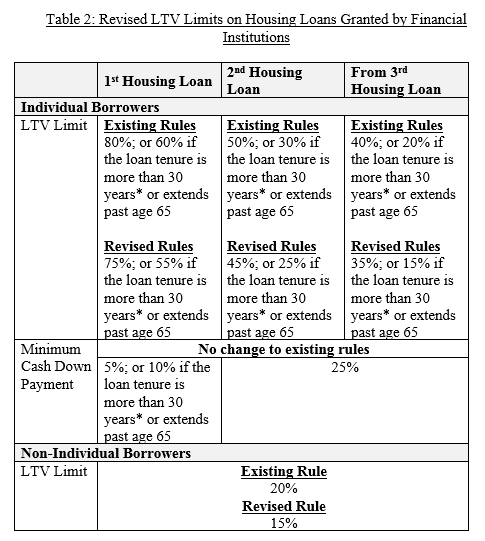

LTV limits will be tightened by 5% points for all housing loans granted by financial institutions. The Table below summarises the adjustments to the LTV limits:

All private residential unit buyers will have lesser loans available for the purchase of their new homes. There is a 5% reduction in every category of loans. So if originally the Loan-to-value is 80%, it becomes 75% now.

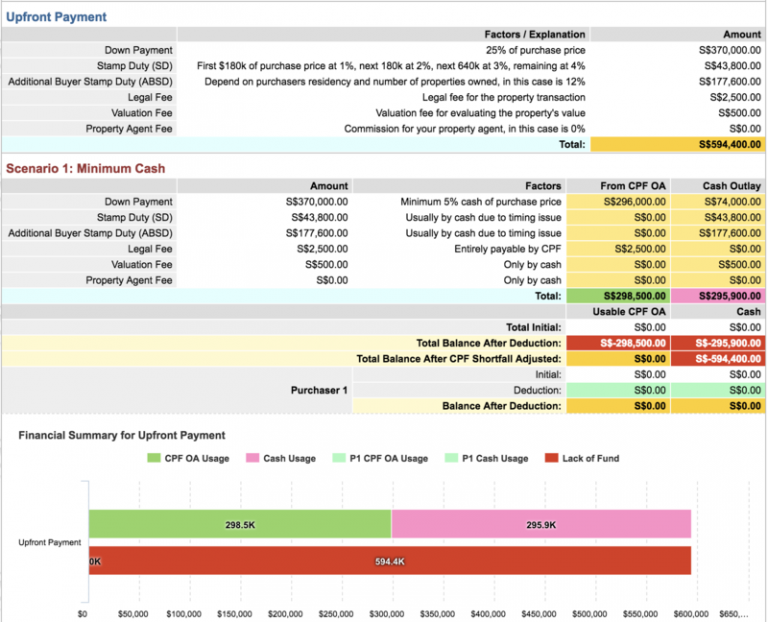

For example, a 75% loan-to-value means a downpayment of 25%, made up of 5% cash and 20% CPF (provided buyers have enough CPF).

For example, for a $1,000,000 house:

- $50,000 cash downpayment

- $200,000 CPF Ordinary account balance (OA) for downpayment

- Buyer Stamp Duty (BSD), 1% on the first $180,000, 2% on the second $180,000 and 3% on the next $640,000 and 4% thereafter. For a S$1m property, the 4% stamp duty does not apply.

- Loan-to-value of 75%, that is $750,000. This 75% of loan is subjected to the usual Total debt servicing ratio (TDSR) which limits the person’s overall debt to be within 60% of a his/her gross income.

This is why HDB rentals may look attractive to home owners who look for more options after successfully selling their units en bloc.

Table of Contents

HDB rentals allows such home owners to patiently search for a permanent private or public residential unit. HDB rentals also provide such home hunters spacious, affordable accommodation whilst they wait for a replacement.

“Some may lease slightly longer since the replacement cost of buying a new home is now higher under the new cooling measures, especially for those who own multiple properties,” said OrangeTee & Tie head of research & consultancy Christine Sun.

There were about About 1,735 HDB rentals in June.

This is 5.8 per cent down from 1,841 units in May. Rents are generally down for all HDB flat types except for HDB 5 rooms, which were up 0.1 per cent.

“Buyers looking at entry-level private properties may potentially consider HDB properties instead, as the latter are not affected by the latest cooling measures and loan restrictions,” said Kenneth Szeto, partner at Withers KhattarWong.

Szeto added that the new LTV limitation “is expected to rein in buyers’ demand for both new launch properties as well as resale properties, just as the asking prices in the market are starting to gather momentum after four consecutive years of flat-lining or decline.”

https://www.icompareloan.com/resources/new-launch-condo-home-loans-cooling/

Market observers have also said that there is a chance that the collective sales market will be dampened by the new property cooling measures as developers become wary of end-demand and are hurt by the 5 per cent non-remittable ABSD on land purchase. This is expected to have an impact on their offer prices.

The new property cooling measures are not bad news for all segments of the real estate market. The HDB resale market is expected to get a boost from this measure.

International Property Advisor Ku Swee Yong said: “The Loan-To-Value ratio limit will be dropped by 5 per cent, meaning we have to take out more equity upfront – more cash and more CPF upfront. And therefore buyers…will probably find it difficult to buy the large size unit that they want. They may have to trim down their expectations. In fact for some of these buyers they may then swing over to the HDB resale market, because the curbs are not put on to the HDB market at all.”

Strata-office and shophouse markets could emerge as the other biggest gainers of the new property cooling measures.

JLL said: “The biggest gainers following this set of measures will likely be owners of strata-offices and shophouses approved for commercial use. The government’s swift response to curb home price growth has tampered the prospects of residential properties as attractive investments. Investors looking for alternatives to park their money could divert their attention to the strata office and shophouse markets as they are not subjected to this round of purchase or sales restrictions/encumbrances.”

The residential leasing market which has seen lackluster action so far, might also stand to benefit as some foreign owners of collective sale sites who might now look to rent instead of own their place of residence to avoid the higher ABSDs. Some local owners of collective sale sites could also look to rent as an interim measure while they wait in hope of private home prices to correct.

If you are concerned about how the new property cooling measures will affect you, our Panel of Property agents and the mortgage consultants at icompareloan.com can advise you. The services of our mortgage loan experts are free. Our analysis will give industrial property loan seekers better ease of mind on interest rate volatility and repayments.

Just email our chief mortgage consultant, Paul Ho, with your name, email and phone number at paul@icompareloan.com for a free assessment.