High end properties – 3 Commercial Conservation Shophouses and a Terrace House in D1 & D2 – for sale for S$38.36 million

Knight Frank Singapore announced on March 2nd that it has been appointed by a trust company to offer a portfolio of 3 conservation shophouses and a terrace house for sale via Expression of Interest (EOI), for S$38.36 million.

The high end properties can be purchased individually or as a portfolio.

The commercial shophouses are located within District 1 and 2, at Ann Siang Road and Keong Saik Road respectively. The only residential property for sale is situated at Neil Road.

Commercial conservation shophouses, particularly in prime central locations are highly sought after by investors as they are tightly held and rarely available.

No ABSD for the high end properties

All 3 shophouses are zoned Commercial under the Master Plan 2019. As the shophouses are commercial properties, the sale is open to both locals and foreigners, with no Additional Buyer’s Stamp Duty imposed on the purchase of the properties.

13 & 18 Ann Siang Road

The two 999-year leasehold shophouses are prominently located near the junction of Ann Siang Road and Ann Siang Hill, a busy street with an abundance of eateries, trendy bars and associations. The 2 intermediate shophouses are also within the Telok Ayer Conservation Area.

The location is easily accessible, with the upcoming Maxwell MRT station just 250 metres away.

13 Ann Siang Road is a 2-storey shophouse with attic. It has a land area of approximately 116.1 sq m (approx. 1,250 sq ft) and built-up area of approximately 229.3 sq m (approx. 2,468 sq ft). Retrofitted some years ago, it is fully tenanted.

18 Ann Siang Road is a 3-storey shophouse with basement. It has a land area of approximately 127 sq m (approx. 1,367 sq ft) and built-up area of approximately 401.92 sq m (approx. 4,326 sq ft). The ground floor space of the shophouse is currently leased as an F&B outlet, while the upper floors are leased to a consultancy firm.

The guide prices for 13 Ann Siang Road and 18 Ann Siang Road are S$9.1 million (approx. S$3,687 psf) and S$13.8 million (approx. S$3,190 psf) respectively.

3 Keong Saik Road

3 Keong Saik Road is a 3-storey corner shophouse off Neil Road, in the Bukit Pasoh Conservation Area. The freehold shophouse is within walking distance to a wide array of F&B outlets and boutique hotels in the neighbourhood. The Working Capitol operates co-working spaces in the adjacent block of shophouses. The property is also within walking distance to Outram Park MRT station.

3 Keong Saik Road is a 3-storey corner shophouse off Neil Road, in the Bukit Pasoh Conservation Area. The freehold shophouse is within walking distance to a wide array of F&B outlets and boutique hotels in the neighbourhood. The Working Capitol operates co-working spaces in the adjacent block of shophouses. The property is also within walking distance to Outram Park MRT station.

The shophouse has a land area of approximately 119.61 sq m (approx. 1,287 sq ft) and built-up area of approximately 300.64 sq m (approx. 3,236 sq ft). It is currently leased as service offices.

The guide price for the Keong Saik Road shophouse is S$9.6 million (approx. S$2,967 psf).

141 Neil Road

The only residential property in this portfolio is 2-storey, intermediate terrace house with attic. The rare gem in the Blair Plain Conservation Area is not commonly available for sale, as such houses are usually held as heritage family homes. It has a land area of 296.6 sq m (approximately 3,193 sq ft) and built-up area of approximately 447.2 sq m (approximately 4,816 sq ft). The interior of the freehold house remains in its unique, original condition, with many intricate motifs and decorative floor tiles.

The only residential property in this portfolio is 2-storey, intermediate terrace house with attic. The rare gem in the Blair Plain Conservation Area is not commonly available for sale, as such houses are usually held as heritage family homes. It has a land area of 296.6 sq m (approximately 3,193 sq ft) and built-up area of approximately 447.2 sq m (approximately 4,816 sq ft). The interior of the freehold house remains in its unique, original condition, with many intricate motifs and decorative floor tiles.

The house is within a 5-minute drive to the Central Business District and is walking distance to Outram MRT station and the upcoming Cantonment MRT station.

The guide price for the property at Neil Road is S$5.86 million.

Ms Mary Sai, Executive Director of Investment and Capital Markets, Knight Frank Singapore, says, “Despite the Covid-19 outbreak, real estate transactions have continued, especially for properties with freehold or 999-year tenures that are in prime locations. Unsurprisingly, this may be because they are largely deemed as assets with the potential for appreciation over the long term. We believe the response from savvy investors and buyers for the properties will be encouraging.”

Mr Ian Loh, Head of Investment and Capital Markets (Land, Building & Collective Sales), Knight Frank Singapore, shares, “Recent freehold, commercial shophouse transactions in District 1 and 2 have been in the range of S$3,500 psf to S$3,900 psf. With rental income and pragmatic guide prices, these properties are appealing assets to acquire.”

The EOI for the high end properties will close on Wednesday, 15 April 2020, at 3pm.

Mr Paul Ho, Chief Mortgage Consultant at iCompareLoan, said “despite the property curbs introduced by the Government in the past few years, Singapore is still an attractive residential market for investors.”

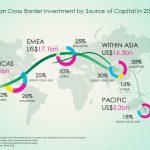

Although the property market exuberance has been curbed to some extent with the property cooling measures introduced in several round in the past few years, Singapore as a property market investment destination still remains among the top – shoulder to shoulder with other cities in the world like London, New York, Shanghai and Sydney.

“We have to be mindful that there is a lot of excess capital fluidity here and with interest rates at below 2%, Singapore has one of the lowest interest rates for home loans in the region,” he added.

The biggest gainers following the new property cooling measures is likely be owners of strata portfolio of offices and shophouses approved for commercial use. The property cooling measures affected almost all categories of buyers and is predicted to achieve its intended objectives of cooling demand and moderating price growth.

One report said investors looking for alternatives to park their money in the wake of property cooling measures, would divert their attention to the strata office and shophouse markets as they are not subjected to this round of purchase or sales restrictions/encumbrances.

Shophouses are perceived as attractive investments because they can hold their values because of their central locations and the freehold/999-year-leasehold of many of these properties. Shophouses are also valued because they give prominent presence to a business entity for them to be visible in a highly competitive environment.

The high end properties will be especially attractive to investors because of its location, as investment properties of such nature are scarce.