Preliminary data from the Monetary Authority of Singapore (MAS) showed that housing loans fell in Singapore for a third month in April.

The fall in housing loans resulted in a continued drop in consumer loans. Bridging loans and mortgages booked in April on a net basis amounted to $202.76 billion, lower than the $203.38 billion posted in March.

With housing loans accounting for about three-quarters of consumer lending, overall consumer loans fell to $264.57 billion in April from $264.67 billion in March.

Table of Contents

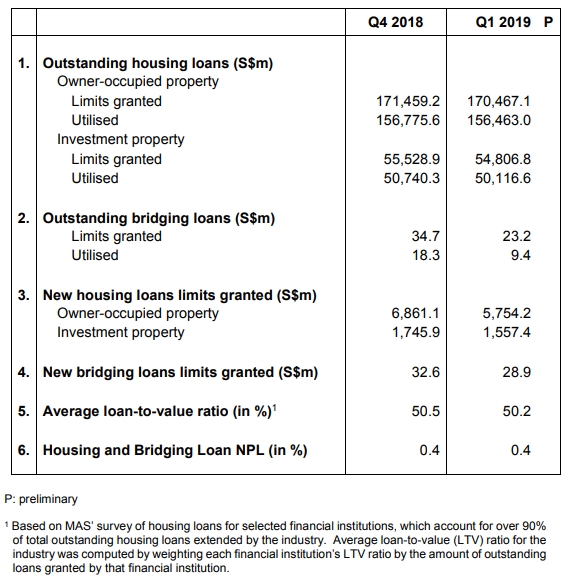

MAS’s Data on Housing Loans and Bridging Loans for Q1 2019:

A study by Credit Bureau Singapore (CBS) in January 2019 found that seven months after MAS announced the latest housing curbs on property purchases, buyers are taking up lesser housing loans.

https://www.icompareloan.com/resources/refinance/

The CBS study follows the recent guidelines change by MAS in July 2018, which saw the Additional Buyer’s Stamp Duty (ABSD) rates being raised and the Loan-To-Value (LTV) limits on residential property purchases. being tightened.

The ABSD rates for Singapore Citizens and Singapore Permanent Residents (SPR) purchasing their second and subsequent residential property were raised by 5 per cent for all individuals and 10 per cent for entities. LTV limits were tightened by 5 per cent for all housing loans granted by financial institutions.

https://www.icompareloan.com/resources/investigating-mortgage-options/

Statistics shows lesser mortgage loans

The CBS study showed that based on new mortgage loan applications show that in December 2018, there were 4,423 new applications. This represents a 64.9 per cent decline from 12,619 applications in July 2018 and a 54.0 per cent decline from 9,611 applications in December 2017.

CBS is Singapore’s consumer credit bureau which provides objective and accurate information to credit providers in the financial services industry to strengthen their risk assessment capabilities. By enabling clients such as banks, credit card companies and institutions to make better lending decisions, CBS aims to enhance Singapore’s risk management capability.

As the leader in managing consumer credit information, CBS also seeks to enlighten, empower and engage consumers to manage and protect their financial health. CBS maintains data accuracy and integrity by using advanced technology to update millions of consumer information.

Throughout its operations, CBS observes a strict Code of Conduct that its members comply with. This ensures the highest moral and ethical standards in data handling in all business activities. Established in 2002, it is a joint venture between The Association of Banks in Singapore (ABS) and Infocredit Holdings Pte Ltd.

Seasonal fluctuations with lesser mortgage loans

Said CBS Spokesman: “With the drop in mortgage loan applications, we note that the measures put in place have exhibited seasonal fluctuations in the housing market and slower take-up rates for new launches.” (Aggregated monthly instalments are amounts for each facility provided by the Members of CBS for the previous month and aggregated amounts for the preceding 5 months.)

In addition, CBS has introduced version 3.0 enhanced credit bureau report in August 2018 that includes additional information. They are the individuals’ full addresses, aggregated monthly instalments* and new property types. (More specific classification of property types will be displayed in credit report. This enhanced granularity will provide more detailed identification of credit facility by property type.)

In a lesser housing loans environment, more clarity and details needed

CBS Spokesman said then: “CBS’ credit report now provides more insights and value added data to consumers to allow them to be better informed of their credit situation – they can now view the monthly instalment amounts for every credit facility owned for the previous month and aggregated amounts for the preceding 5 months.

“Also, with new property types added to the report, there is greater clarity and detail in identifying each credit facility by property type. We encourage more consumers to get a copy of their report to help them take steps to make better borrowing decisions.”

With lesser housing loans also comes decrease in buyers holding more than one mortgage loan

The CBS study has also revealed that in November 2018, 60,746 buyers held more than one mortgage loan. This represents a 4.5 per cent decrease from 63,585 buyers in July 2018 and a 6.1 per cent decrease from 64,680 buyers holding more than one mortgage loan in November 2017.

CBS said that member banks and financial institutions that disburse mortgage loans include: Bank of China, Bank of East Asia, CIMB, Citibank, DBS, Hong Leong Finance, HSBC Singapore Ltd, Maybank Singapore Ltd, ICBC, OCBC, RHB, SBI, Standard Chartered, SIF Ltd, Singapura Finance and UOB.

Consumers who request for a copy of their credit report will be able to view their aggregated monthly instalments and new property types. Full addresses will also be visible to consumers.

How to Secure a Home Loan Quickly

Do you want to buy a private property, but are ensure of funds availability for purchase? Don’t worry because iCompareLoan mortgage broker can set you up on a path that can get you a home loan in a quick and seamless manner.

Our brokers have close links with the best lenders in town and can help you compare Singapore home loans and settle for a package that best suits your home purchase needs, regardless of if it is a 99 year leasehold property or not. Find out money saving tips here.

Whether you are looking for a new home loan or to refinance, the Mortgage broker can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the best home loans in Singapore. And the good thing is that all our services are free of charge. So it’s all worth it to secure a loan through us.

For advice on a new home loan.

For refinancing advice.