At the Committee of Supply debate on March 7, the Ministry for National Development announced measures to assist Singaporeans at different life stages with their housing needs, including the elderly and lower-income families.

Keeping Housing Affordable and Accessible for Singaporeans

Announcing Build-To-Order Projects Six Months in Advance

Currently, HDB announces upcoming Build-to-Order (BTO) projects three months in advance. To facilitate home buyers in planning ahead for their new flat purchase, HDB will announce upcoming BTO projects six months in advance from May 2019 onwards. At the May 2019 sales exercise, HDB will therefore announce the BTO projects to be launched in August and November 2019.

Reducing Balloting Time from 6 Weeks to 3 Weeks to Support Housing Needs of Singaporeans

Table of Contents

HDB has been making steady progress in reducing the BTO balloting time. From the May 2019 BTO exercise onwards, the balloting time will be reduced from 6 weeks to 3 weeks, meeting the challenge set by Minister Lawrence Wong at COS 2018.

Meeting the Needs of the Elderly

MND and MOH have been exploring the concept of assisted living, where housing is integrated with care services. We will be conducting Focus Group Discussions in mid-2019 to seek views on the proposed concept, and are working towards a pilot at Bukit Batok in 2020.

Supporting Lower-Income Families to Support Housing Needs of Singaporeans

Dedicated Team to Support Rental Tenants

HDB will be setting up the Home ownership Support Team (HST), to provide greater support to rental tenants, especially families with children, who are ready to buy a flat. This includes advising them on their housing budget and options, the grants and schemes available to help them, and guiding them through the flat- buying process. If tenants are not yet ready for home ownership, HDB will link them up with the relevant agencies that can help address their needs.

https://www.icompareloan.com/resources/revising-cpf-use/

Enhancements to Step-Up CPF Housing Grant to Support Housing Needs of Singaporeans

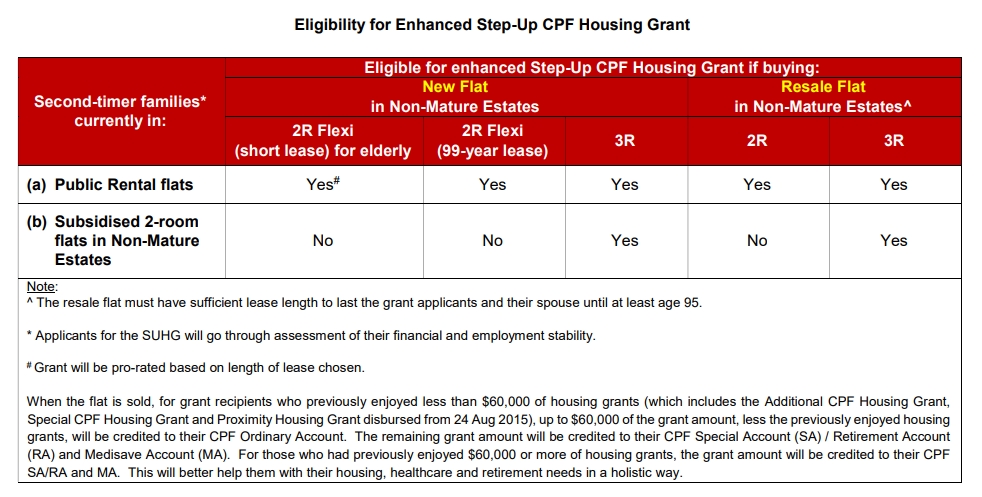

The Step-Up CPF Housing Grant (SUHG) of $15,000 was introduced in 2013 to help lower-income families living in subsidised 2-room flats in the non-mature estates to buy 3-room new flats in the non-mature estates. (Subsidised 2-room flats refers to new or resale flats that were bought with CPF housing grants.)

To provide greater assistance to lower-income families, HDB will extend the coverage of the SUHG to include 3-room resale flats in the non-mature estates. The grant will also be extended to second-timer families living in public rental flats who intend to buy 2-room or 3-room, new or resale flats in the non-mature estates.

Currently, the grant is disbursed before the buyer signs the Agreement for Lease. HDB will now disburse the grant before the key collection for their new flat. This will help to ensure that the buyers are financially ready for home ownership.

The revisions to the SUHG will take effect from the May 2019 sales exercise.

Enhancements to Fresh Start Housing Scheme to Support Housing Needs of Singaporeans

The Fresh Start Housing Scheme was launched in 2016 to help rental families with young children who are second-timers to buy a home of their own. HDB will enhance the scheme to further assist these families:

(i) Set up of Fresh Start Support Programme (FSSP) to help Fresh Start families stay on track in their journey to home ownership. The Support Programme will be run by a service provider appointed by the Ministry of Social and Family Development (MSF). Through closer and more regular contact with families, the Support Programme will allow emerging issues to be addressed early, and ensure that support is provided in a timely manner.

(ii) Special consideration for selected families who applied but did not meet some of the criteria. Some families may not qualify for Fresh Start but demonstrate good potential and motivation for it. Flexibility will be given to these families to join Fresh Start and book a BTO flat. They will also receive more intensive support through the Support Programme.

(iii) To qualify for Fresh Start, one of the current criteria is that the family needs to have at least one Singaporean child below the age of 16. The age limit for the youngest child will now be increased to age 18 to benefit more families.

(a) The new age limit will also be applied to the Parenthood Priority Scheme (PPS) and ASSIST, or the Assistance Scheme for Second-Timers (Divorced/ Widowed Parents), i.e. families will need to have at least one child aged 18 or younger in order to qualify.

https://www.icompareloan.com/resources/mortgage-affordability-lawrence-wong/

Improvements to Rental Blocks and Flats to Support Housing Needs of Singaporeans

As part of HDB’s continued efforts to upgrade older blocks, HDB will carry out improvement works to some rental blocks built in the 1960s and 1970s. These older blocks have long central corridors and units on both sides, which limit the natural ventilation and light in these blocks. HDB intends to improve the airflow and brightness by creating more openings along the corridors, where feasible.

In addition, tenants sharing 1-room rental flats under the Joint Singles Scheme (JSS) will benefit from enhancements to their flats. Since 2015, HDB has built some new rental flats with partitions, to create separate sleeping areas for each tenant for greater privacy. There are about 500 such flats and another 200 are under construction, with more of such flats to be built. Existing JSS tenants who are living in flats without partitions can also ask for partitions to be installed.

Apart from these efforts, HDB will continue to refresh our existing rental housing stock by gradually redeveloping older rental blocks, so that tenants can benefit from newer blocks with better, more updated designs. To promote more inclusive neighbourhoods, HDB will also build more integrated blocks with sold and rental flats. More details will be provided in due course.

Rent Policy Changes to Support Housing Needs of Singaporeans

The rental rates in HDB’s public rental housing are tiered progressively, according to household income. The rents are reviewed when tenants renew their tenancy every 2 years. To encourage tenants to continue increasing their income and saving up while working towards home ownership, HDB will not increase rents for those who have made a downpayment and signed the Agreement for Lease for a flat. They will continue to pay the same rent they were charged at the time when they made the downpayment for their new flat, even if their income increases thereafter. This will take effect for tenancies which commence from 1 Jun 2019.

Supporting Vulnerable Families

To smoothen the housing transition for divorcees, divorcing parties will no longer have to wait until they have obtained the Final Judgement of divorce in order to apply for a flat. Instead, starting from the May 2019 sales exercise, divorcing parties can apply for a new flat from HDB if they have obtained an Interim Judgement of divorce and have settled the ancillary matters on their matrimonial property, and the custody, care and control of their children. Each party will be subject to eligibility criteria like all flat applicants. They must also obtain the Final Judgement of divorce before key collection, and ensure that they remain eligible for the flat that they had booked.

How to Secure the Best Home Loans Quickly

iCompareLoan is the best loans portal for home loans, commercial loans, buyers, investors and real estate agents alike in Singapore. On iCompareLoan, you will be able to find all the latest news and views, informational guides, bank lending rates and property buying trends, and research data and analysis.

Whether you are looking to buy, sell or refinance apartments, condominiums, executive condos, HDB flats, landed houses or commercial properties, we bring you Singapore’s most comprehensive and up-to-date property news and best home loans trends to facilitate your property buying decisions.

Our Affordability Tools help you make better property buying decisions. iCompareLoan Calculators help you ascertain the fair value of a property and find properties below market value in Singapore.

Our trademarked Home Loan Report is Singapore’s first one-of-a-kind analysis platform that provides latest updates of detailed loan packages and helps property agents, financial advisors and mortgage brokers analyse best home loan packages for their clients, so that they may give unbiased home loan/commercial loan analysis for their property buyers and home owners. Our distinguished Panel of Property Agents who are users of our Home Loan report can give the best all-rounded advise to real estate seekers.

All the services of our mortgage consultants are ABSOLUTELY FREE, which means it’s all worth it to secure a loan through us.

Whether it is best home loans, best commercial loans or refinancing of existing loans or SME loans, CONTACT US TODAY!