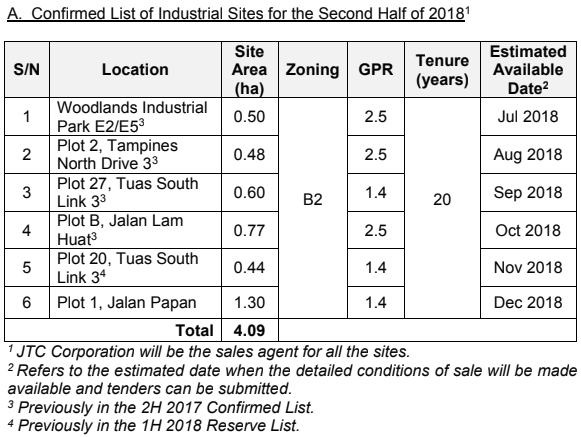

The Ministry of Trade and Industry (MTI) today launched its Industrial Government Land Sales (IGLS programme) for the second half of 2018 (2H 2018). There will be 6 sites in the Confirmed List and 7 sites in the Reserve List, with a total site area of 12.59 ha.

As one of the land sales agent for the IGLS programme, JTC releases land for development via public tenders. The sites are launched via the confirmed list or the reserve list.

Table of Contents

Under the Reserve List of the IGLS programme, the Government will put up a site for tender if an interested party submits an application with an offer of a minimum purchase price that is acceptable to the Government; or if there is sufficient market interest in the form of more than one unrelated party submitting minimum purchase prices that are close to the Government’s Reserve Price for the site within a reasonable period.

Business-2 sites have a 20-year tenure with a maximum permissible gross plot ratio of 2.5. MTI said parties who are interested in sites on the Reserve List can apply to JTC Corporation.

In December 2017, the government announced that it as trimming its industrial land supply for the first half of 2018, after industrial prices and rents showed themselves to be responding as hoped to the government’s supply spike in recent years.

MTI said that the Government will continue to release sufficient land through the IGLS programme to ensure an adequate supply of industrial space in Singapore.

diIndustry experts noted at that time that the IGLS programme for the first half of 2018 reflected the government’s sensitivity to the still fragile state of the industrial property market, in spite of the uplift in economic and trade conditions.

JLL head of research and consultancy Tay Huey Ying noted that “The measured H1 2018 IGLS programme is seen as a positive for the industrial property market as it would allow the market time to soak up the available space amid the more upbeat economic outlook. This would help to mitigate any downward pressure on industrial rents and prices in 2018.”

Others however noted that the recovery in the industrial market is “uneven” as some firms are still looking to consolidate or downsize their space requirements to remain cost-efficient. Supply completions for 2018 are expected to taper off due to construction of new properties, putting a squeeze on cost competitiveness on industrial land.

In 2012, the Government halved the IGLS tenure to 30 years (from the previous 60 years) to make it cheaper, It said the move will increase government flexibility for land redevelopment. Shorter tenures should make Industrial Government Land Sales sites extra affordable and adaptable, claimed the government.

Several industry players claimed then that the reduced IGLS tenures could scare off industrialists. They said the shorter-leased sites will have diminished long-term values and require a tougher loans process.

In March 2018, former Minister for Trade and Industry Lim Hng Kiang explained how the Industrial Government Land Sales is part of the solution to ensure that industrial land costs remain competitive.

“For companies in the manufacturing sector, rental costs constitute a relatively small proportion of business costs, and is usually less than 2.0% on average. We have nonetheless taken measures to ensure that industrial land costs remain competitive.

First of all, JTC Corporation benchmarks its land prices internationally to ensure that they are competitive.

Second, the Government releases land for private-sector industrial developments through our half-yearly Industrial Government Land Sales Programme to ensure that there is sufficient land and industrial space to meet demand, support economic growth, and maintain the stability of the industrial property market.

With an increase in the supply of land and industrial space, the industrial price index has decreased by 16.6% from its peak in 2014, while the industrial rental index has declined by 13.4% from its peak in 2014.

Third, we have also made public the statistics on industrial space prices, rents, as well as occupancy rates to improve transparency and help companies make informed decisions.

We must continue to take bold strides to seize opportunities to innovate, and not let our domestic constraints of a tightening labour market and scarcity of land hold us back.”

In 2016, the Government announced that industrial land and properties previously under the Housing & Development Board (HDB) will be transferred to JTC Corporation (JTC) by the first quarter of 2018. About 10,700 industrial units and 540 industrial land leases were transferred from the HDB to JTC in this period. The move was implemented to improve the support for small- and-medium enterprises in terms of their land space needs as their businesses grow.

JTC and HDB said in a joint press release then that the consolidation of industrial land and properties under JTC will allow tenants to have a “one-stop access” to the full range of public sector industrial facilities available and that the consolidation will enable the pooling of similar capabilities and resources under one agency for better planning and operational efficiency.

It was also touted to enable more comprehensive master-planning of new industrial districts and better clustering and integration of complementary activities along the value-chain.

If you are searching for an industrial property, our Panel of Property agents and the mortgage consultants at icompareloan.com can help you with affordability assessment and promotional loans. The services of our mortgage loan experts are free. Our analysis will give industrial property loan seekers better ease of mind on interest rate volatility and repayments.

Just email our chief mortgage consultant, Paul Ho, with your name, email and phone number at paul@icompareloan.com for a free assessment.