Angeline C (iCompareLoan.com)

A few months ago, I received a letter from my insurance company, informing me of a revision in the terminal bonus rate for some participating plans due to the “unfavourable economic and investment climate”.

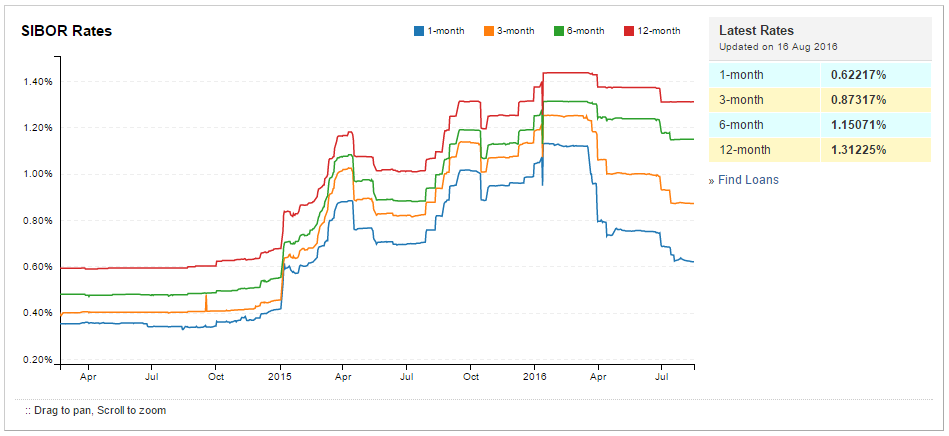

It seems that the recent global economic uncertainty has become a boon also to home owners as mortgage interest rates stay low, there is now an opportunity to refinance your home loan to lower rates as Sibor and Sor is also lowered.

I hold an 18-year endowment plan and the impact on the projected maturity value following this revision would be about -5%.

This was disappointing as the endowment plan is known to be a safer form of saving plan. This is not the first time I received a letter, informing me of a downward revision. In 2013, I was informed that the interest rate on coupons and dividends will be revised lower by 0.5% per annum.

Now, I can only hope that my principal will not be eroded by negative returns as the plan does not have guaranteed returns.

So, are endowment plans still relevant and what should you look out for?

Endowment plans are essentially regular savings plans with the potential for some investment returns usually coupled with a basic insurance component.

It can take various forms, in terms of premium, payment frequency, time period, investment returns and insurance coverage. Thus, you can choose one that is most suited for your funding, lifestyle, income and/or retirement needs. For instance, a young graduate who wants to instill discipline to ensure he/she has savings instead of spending all their salary. Or someone in their 40s, with excess funds saving for retirement.

While various forms of investment are in the market now offering steady income, eg Singapore Savings Bonds, Corporate Retail bonds, endowment plans could still remain an attractive option as a savings plan which imposes discipline on those who tend to spend freely. And while, the endowment plan does include an insurance component unlike traditional savings, investors should not choose an endowment just for insurance as cheaper options like term insurance are available,

Before you sign, things to look out for include: whether the projected returns and principal are guaranteed, track record of insurance provider, as well as sustainability of putting aside a certain amount for a period of time, not the freebies and other promotions!

In marketing materials, insurance providers will typically use a projected return to calculate the expected payout at maturity. This can vary widely among insurance providers and could tempt you to choose the plan which shows the higher payout.

Thus, first determine if the return is guaranteed (usually it is not) and secondly the track record of performance of such plans by the company. Is the projected return realistic compared to past performance and against current market conditions?

Even if the return is guaranteed, it does not mean there is zero risk. The return is backed by the company. Look at how bondholders of companies, which are facing bankruptcy, received a rude shock when they realise that what they thought was low risk guaranteed return investments could result in a high risk of losing their principal investment.

Thus, do your homework. Google the insurance company. What is the financial standing of the company? What is the credit rating, if any? Is the company in losses? In debt? How long has the company been around?

Lastly, as with all long-term plans, make sure you have the cash/future income to service the premium as there is a penalty for early termination and the termination benefit could be a deep discount to the principal paid.

Also look out for waivers for future premium payments in the event of death or total and permanent disability.

And as with all contracts, read the disclaimer.

Caveat Emptor!