Medishield Life 2018 was the year of a turning point for Singapore. It is the year where Singapore enters into the so-called ‘demographics time bomb’. For the first time in Singapore’s history, the number of elderly Singaporeans aged 65 and above will match that of youths aged 15 and below. Singapore is already the oldest society in South-east Asia and continues to follow the ageing trend of developed economies. Anyway all these are excuses, we spend more money on military than we spend on education. The total cost of taking care of citizens are only a fraction of the military spending and Singapore hides some of its surpluses from land sales and classify them as “reserves” rather than revenues, telling you that they cannot afford to care for you, asking you to pay more.

Insurance is often made to seem too complex, because the more complex it sounds, the more margins the insurers can embed into their products, and the more costly insurance you will end up paying.

Read Insurance 101 to plan better.

Source: TODAYOnline, UOB

The reality is that Singapore’s aging population is a potential time bomb for both the Singapore government as well as Singaporeans. To meet with the growing medical needs, Ministry of Health (MOH) is introducing some new changes to MediShield Life coverage starting from November 2018.

Medishield Life – Changes in Coverage From November 2018

MOH announced that MediShield Life will have its coverage extended into three new areas to better protect Singaporeans against large medical bills.

-

Claim Against Admission Into Community Hospital

Table of Contents

Past: MediShield Life members can only claim against MediShield Life for community hospital stay if he/she has been transferred from an acute hospital. Acute hospital refers to the following list of hospitals in Singapore:

Now: MediShield Life members who are directly admitted to a community hospital from the emergency department of any public hospital can now claim up to $350 a day from MediShield Life. For example, patients who suffer from urinary tract infection or treatment of non-surgical wounds can benefit from this.

Impact: According to MOH, this will allow for care to be provided in the most appropriate setting. In addition, those who suffer from conditions like urinary tract infections and non-surgical wound care that requires inpatient medical care or inpatient rehabilitation to improve their ability to perform daily activities will be able to benefit from this addition.

-

Extended Coverage For Long-Term Parenteral Nutrition Patients

Past: No such coverage for MediShield Life members.

Now: MOH is introducing new coverage for long-term parenteral nutrition patients. Long-term parenteral nutrition patients refer to patients who need to be fed intravenously through their blood to bypass their digestive system.

In order to qualify, a MediShield Life member needs to have a disease that does not allow their bodies to absorb the nutrients from food and requires him/her to use parenteral nutrition.

For anyone who is a long-term parenteral nutrition patient that require such care for 90 days or longer, MediShield Life members can now claim up to $1,700 per month from MediShield Life. You can also withdraw up to $200 per month from MediSave to purchase parenteral nutrition bags and consumables.

Impact: With an aging population, MOH foresees more Singaporeans who will suffer from long-term parenteral nutrition problems. Thus, MOH is introducing this new coverage to meet with a growing need of MediShield Life members.

-

MediShield Life Coverage For Surgical Interventions (Congenital Condition)

Past: Previously, surgical interventions for two rare congenital conditions (i.e. Trisomy 18 aka Edwards Syndrome and Alobar Holoprosencephaly) were excluded from MediShield Life coverage.

Now: MOH noted that recent international studies have shown that surgical interventions can now improve the quality of life and survival of patients suffering from the two rare congenital conditions of Trisomy 18 and Alobar Holoprosencephaly. As such, MOH will now include surgical interventions for both congenital conditions into the MediShield Life coverage.

Impact: For Singaporean parents who have kids suffering from Trisomy 18 or Alobar Holoprosencephaly will have some financial relief taken off their shoulders with the inclusion of surgical interventions into MediShield Life coverage.

The Pitfalls Of MediShield Life

-

New Coverage Of MediShield Life Only Covers A Small Number Of Singaporeans

With the new changes to MediShield Life coverage, does it mean that Singaporeans can fully rely on MediShield Life as your single source of insurance? Unfortunately, the answer is no. While the additional coverage is something to rejoice about, not many Singaporeans will benefit from it.

According to MOH, around 2,000 Singaporeans will benefit from the extension of claim for admission into community hospital. The extended coverage for long-term parenteral nutrition patients will only cover around 20 patients per month. The coverage for surgical intervention for congenital condition of Trisomy 18 and Alobar Holoprosencephaly will only affect 10 patients per month.

-

MediShield Life Has A Deductible Element

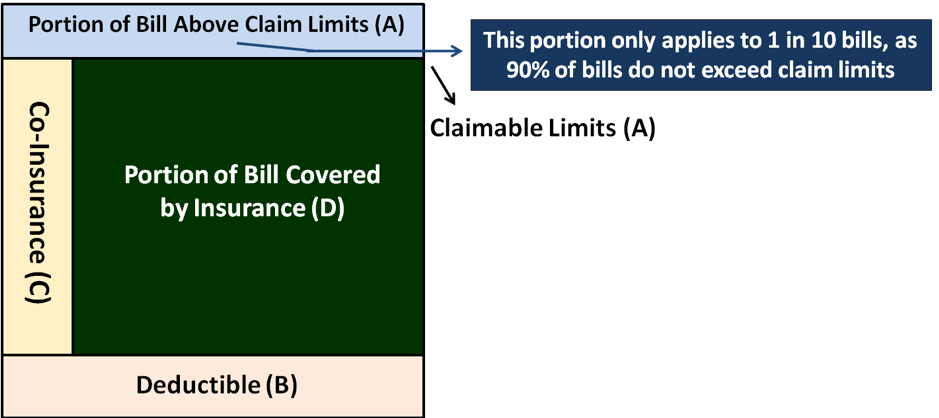

For Singaporeans who are not familiar with MediShield Life, it might surprise you that MediShield Life has a deductible element. Wait. What is a deductible? To put deductible into simple layman term, it refers to the portion of your medical bill that you need to pay first before you can make a claim against MediShield Life. The deductible for MediShield Life is around $1,500 to $3,000 for each policy year. This means that if your post-subsidy bill is below the deductible amount, you can’t claim against MediShield Life.

Source: MOH

-

MediShield Life Also Has A Co-Insurance Element

After paying for the deductible, it doesn’t mean that you can now start claiming against MediShield Life. There is another element that you need to take into consideration, i.e. the co-insurance element. Co-insurance is the amount of the post-subsidy medical bill that you need to pay together with MediShield Life. The co-insurance amount is usually between 10% (for smaller bill size) and 3% (for larger bill size).

| Claimable Amount for Inpatient and Day Surgery | Co-insurance (Percentage of Claimable Amount) |

| $0 – $5,000 | 10% |

| $5,001 – $10,000 | 5% |

| >$10,000 | 3% |

| Co-insurance for all Outpatient Treatments | 10% |

-

MediShield Life Has A Policy Year Claim Limit

Another pitfall that you need to watch out about MediShield Life is the yearly claim limit. Under MediShield Life, the maximum claim limit per policy year is set at $100,000. While there is no lifetime claim limit, the yearly claim limit means that you cannot claim more than $100,000 per policy year. In addition, there is also a claim limit on each of the type of treatment that you are claiming for.

Source: MOH

-

MediShield Life Is Designed For B2 And C Wards In Public Hospitals

By now, you should have realised that there is more than meets the eye when you want to claim against MediShield Life. It is not so simple as just submitting your post-subsidy medical bill to MediShield Life and wait for them to reimburse you.

When MOH first designed Medishield Life, they designed it for Singaporeans who are seeking medical care at B2 and C class wards in public hospitals. If you are planning to seek treatment at B1 or A class wards or private hospitals, you will only get subsidized for a reduced portion of your medical bill.

MediShield Life Pitfalls – What should Singaporeans do?

Supplement MediShield Life With Integrated Shield Plan (IP)

Since MediShield Life is not enough for Singaporeans’ healthcare needs and comes with so many pitfalls, it is important that you enhance your insurance coverage with another insurance. One way every Singaporean can do to enhance MediShield Life is to supplement it with an Integrated Shield Plan (IP). The government wants you to pay more, passing more cost to Singaporeans and shirking their responsibilities to care of its nation. What can we do? Singaporeans are destined to pay more. Can you imagine that medicine from a reputable private hospital in Malaysia is cheaper than a public hospital in Singapore. The escalating medical cost is the culprit and I think the Singapore government needs to come clean on it.

What Is An IP?

IP is a type of private healthcare insurance that helps policyholders to defray the cost of medical treatment, be it from public or private hospital. There are a few different types of IPs that you can purchase: Standard IP, Class A plan and private hospital plan.

Standard IP covers for medical costs up to Class B1 wards at public hospitals. As the name suggests, Class A plan covers for medical costs up to Class A wards at public hospitals. Private hospital plan allows you to seek treatment from private hospitals and claim the higher bill size from your insurer.

Where And Who Can You Buy IP From?

In Singapore, there are different IP providers that you can buy an IP from: Aviva, AIA, AXA, Great Eastern, NTUC Income, Prudential and Raffles Health Insurance. Each of them offers all three types of IPs.

How Can You Pay For IP?

Payment of your IP premiums can be either done in cash or through your MediSave. However, there is a cap on how much premium you can pay through your MediSave. This is capped by the Additional Withdrawal Limits, which is the maximum amount you can use from your MediSave to pay for your IP.

| Age | Additional Withdrawal Limit |

| 40 and below | $300 |

| 41 to 70 | $600 |

| 71 and above | $900 |

What To Look Out For In An IP?

Although IPs are meant to enhance coverage of your MediShield Life, it doesn’t mean that you don’t have to pay a single cent for your hospital bills. However, you can purchase additional riders to remove the deductibles element. Unfortunately, all IPs now come with a co-insurance element of at least 5% as part of MOH’s strategy to reduce unwarranted overconsumption of healthcare services. On a whole, if you buy an IP rider, you will be able to have 95% of your medical bills covered with a 5% co-insurance that is capped at $3,000 annually.

If all these sounds too complicated? It is because they do not want you to understand it. Read Insurance 101 to get the basic understanding of all you need to know about insurance.