In a note published on June 5, CBRE said that the new commercial property rental framework which stemmed off off a paper put out by the newly established Fair Tenancy Framework Industry Committee, should not be made permanent

On 5th June 2020, the COVID-19 (Temporary Measures) (Amendment) Bill was passed with the intention to alleviate financial concerns and provide additional relief to eligible SMEs, as well as affected landlords and businesses. The key amendments include:

1. Rental support for eligible SMEs

(A) New rental relief framework for eligible SMEs

(i) Government Assistance for Rental Relief

The Government will give about 1 to 2 months’ relief of the rental costs of SME tenants (i.e. with not more than $100 million in annual turnover) with qualifying leases or licenses commencing before 25 March 2020, as follows:

- As part of the Fortitude Budget, the Government will provide additional cash grants equivalent to approximately 0.8 months of rent for qualifying commercial properties, and approximately 0.64 months of rent for industrial and office properties.

- Together with the Property Tax Rebate granted in the Resilience Budget, the Government will provide an equivalent of approximately 2 months of rent for qualifying commercial properties, and approximately 1 month of rent for industrial and office properties.

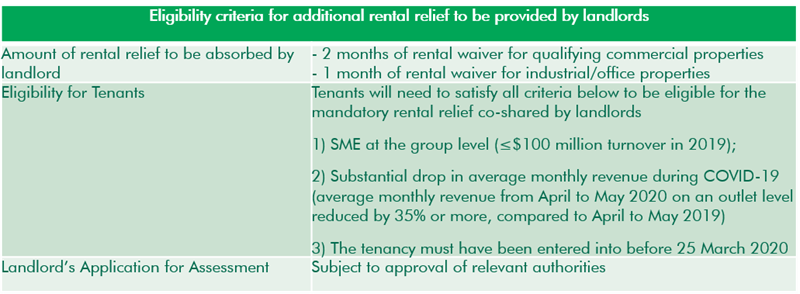

(ii) Additional rental relief to be provided by landlords

SMEs who have seen a significant drop in their average monthly revenue due to COVID-19 will receive an additional 2 months’ waiver of base rental for qualifying commercial properties, and an additional 1 month’s waiver of base rental for industrial and office properties. These additional rental waivers will be borne by the landlord, and will be applied to June and July 2020 for SMEs in qualifying commercial properties, and May 2020 for SMEs in industrial/office properties, as long as their leases or licenses are in force on 1 April 2020.

The landlord can apply for an assessment of the tenant’s or (subtenant’s) eligibility for the relief within a specific time. The case will be examined by an assessor, who will ascertain the tenant’s (or subtenant’s) eligibility.

The landlord may also seek an assessment on the grounds of financial hardship if they are unable to provide the additional rental waiver. This will take into consideration whether his rental income forms a substantial part of his total income and the annual value of his properties. Qualifying landlords will only be required to give half of the additional rental waivers to be provided by the landlords, i.e. 1 month’s waiver of base rental for qualifying commercial properties, and half a month’s waiver of base rental for industrial and office properties.

(B) Relief for tenants unable to vacate business premises due to COVID-19

As part of the amendments introduced, tenants of non-residential properties who are facing difficulties in vacating their business premises upon the end of their lease or license due to the pandemic can serve a notification of relief on the landlord before the expiry of the prescribed period (until 19 October 2020). In such cases, if conditions prescribed by the Minister for Law are met, tenants will not be held liable to their landlords for failure to vacate their premises.

(C) Cap on late payment interest or charges for specific contracts

Previously, arrears resulting from businesses and individuals who are unable to meet certain payment obligations due to COVID-19 continue to accrue and attract late payment interest and charges. To provide additional relief, there is now a cap on these late payment interest and charges. Creditors will also not be allowed to terminate such contracts because of late payments during the prescribed period (until 19 October 2020).

2. Additional loan and cashflow support for landlords and businesses affected by COVID-19

In response to the additional relief measures that landlords are expected to provide tenants, the Ministry of Finance, the Inland Revenue Authority of Singapore, Enterprise Singapore and the Monetary Authority of Singapore unveiled a new support package to help landlords ease cashflow concerns and loan commitments.

Individual landlords are permitted to defer both principal and interest loan payments up to 31 Dec 2020 if they are required under the COVID-19 (Temporary Measures) (Amendment) Act to provide their tenants rental waivers or payment rescheduling. More flexibility is also extended to S-REITs, as they are permitted to further extend the timelines to distribute their taxable incomes.

In addition, the government and banks have assured large corporate and S-REIT landlords that loan covenant breaches will not be automatically enforced and that they can request payment deferrals.

CBRE Research Views on New Commercial Property Rental Framework

Assistance not Interference

Stemming off a paper put out by the newly established Fair Tenancy Framework Industry Committee that called for a fair tenancy law that raised 15 recommendations, this new commercial property rental framework seeks to address the proposals with temporary measures expected to further assist as the unprecedented spread and severity of COVID-19 continues to cast uncertainties on the economy.

New commercial property rental framework should not be a permanent fixture

CBRE Research believes that there should not be any intervention from the government with permanent restrictions imposed on the commercial market. Any measure should be temporary as the pandemic situation brings pressure for all parties. This is to ensure that the commercial market remains a free market and global destination for capital investments.

Public-Private Partnership

On top of the existing financial and statutory assistance covered by the four relief budgets as per announced by the Minister of Finance, these amendments to the COVID-19 (Temporary Measures) Act have mandated landlords to give SME tenants further relief at the landlord’s cost, matching the rental relief provided by the government.

CBRE Research believes that as long as the measures of the new commercial property rental framework remain temporary, they are deemed equitable as the government, landlords and tenants are expected to share the burden of occupancy costs. Further, the new commercial property rental framework can help to provide some certainty and reassurance to both tenants and landlords to tide them over this period. Efforts by the government through various agencies have also been implemented to alleviate loan and financing obligations for all landlords as well as the deferment of distribution for the REITs.

Also, by allowing SME tenants to repay arrears through an extended repayment scheme (the shorter of up to 9 months, or the remaining term of the tenancy) and by putting a cap on the interest payable, this allows some respite on cashflow for tenants during this period.

Mr Desmond Sim, CBRE’s Head of Research for Southeast Asia, said: “Every Form of Assistance is Appreciated”.

“In short, there is an estimated 260,000 SMEs in Singapore that employs close to 2 million people. Contributing close to half (45% (2019)) of the country’s GDP, there is a need for a safety net to ensure business continuity for this sector of the economy, especially in these unprecedented hard times.

While this amendment to the original act is deemed a coercive outreach to building/property owners to share the burden of assisting this sector of the economy through occupancy costs, at the same time, the new rental framework also acknowledges the financial difficulties that some landlords may face and provides some concessions to those who are unable to provide the rental waiver in full. Furthermore, the government rolled out new measures to help landlords in managing cashflow concerns and existing loan commitments.

These measures are intended to establish a baseline position for the handling of tenants’ rental obligations. Landlords and tenants are encouraged to continue to try and work out mutually agreeable arrangements that best addresses their specific circumstances.

As Singapore transitioned into phase one of the post “circuit breaker” period, some companies are still unable to resume business activity. These measures will help these affected SMEs to tide through this period. By offsetting rental costs for SME tenants, this helps to reduce overall cost pressure especially when monthly revenues are affected.”