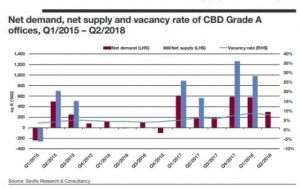

Savills a leading real estate services company on August 8 forecasted that nearly 800,000 sq ft of Grade A CBD office space will hit the office sector in 2018. The supply in the office sector will come mainly from Frasers Tower at Cecil Street said the Research.

The supply of Grade A office space this year is a drastic climbdown from the 2.25 million sq ft recorded for 2017. Therefore, although demand for office sector this year may be lower than last year, the deceleration rate in new supply plus the unexpected savior in the secondary market that came in the form of co-working space operators gave landlords the confidence to raise asking rents.

The supply of Grade A office space this year is a drastic climbdown from the 2.25 million sq ft recorded for 2017. Therefore, although demand for office sector this year may be lower than last year, the deceleration rate in new supply plus the unexpected savior in the secondary market that came in the form of co-working space operators gave landlords the confidence to raise asking rents.

Savills recalled that during the 2016 to early-2018 period, tenants were committing to new buildings that were completing either in 2017 or 2018. It noted that their move was driven by the early bird sign on rents in these new builds as well as the incentive to move because their existing space and fi t out had already become well depreciated. Then, the move was what we call a flight to new builds. Today, the storyline has taken a short detour, said Savills.

“It is that of the flight from new to newer builds. Tenants who are already occupying Grade AAA space feel that their landlords are not budging from significantly higher renewal rental rates. Some are voting with their feet by agreeing to move to new office completions in 2020. Although the forward rental rates for these future buildings are not low, nevertheless, it is still at a steep discount to the renewal rents in tenants’ existing Grade AAA buildings.

“Landlords of their existing premises are not perturbed by this because their tenants’ departures are still some way off. The pressure on landlords of existing buildings to lower rents will begin to build in late-2019 when the new buildings completing in 2020 begin an aggressive campaign to sign on tenants. However, even if rents were lowered, it could be from a much higher base than today’s rates. This is the expected outcome because the relative lull in new supply between now and 2020 plays into the hands of landlords of both existing buildings and those in the pipeline.

So, as landlords of existing Grade AAA space consistently push the envelope for higher renewal rents, the push factor on their tenants increases and this gives landlords of buildings completing in 2020 and beyond greater confidence to stick to their asking rents. These asking rents of buildings in the pipeline were punched into their Excel spreadsheets a few years ago and are by no means low. However, if landlords of existing stock use this supply lull to reset renewal rents to a level that is very much higher than the desktop-processed rents for new builds completing in 2020 and beyond, it will end up as a win-win situation for both.”

Nevertheless, it does not mean that tenants’ spatial requirements are inelastic to rents, the Research on office sector said. It noted that for the period 2017 to H2/2018, quite a few renters either did not increase their footprint when they moved to new premises or shrunk it slightly.

https://www.icompareloan.com/resources/office-space-demand/

Therefore, while rents in the office sector remain elevated and landlords’ optimism continues to grow, one has to be mindful of the roadmap that led market rents to where they are today.

Table of Contents

That is, in the secondary market, demand was high – for co-working space and then for the newly completed buildings in the 2016-Q1/2018 period – from tenants who had already fully depreciated their office fit-outs and fixtures and thus were unfettered to move, and from those in the growing Telecommunication-Multimedia Technology (TMT) sectors.

For the next two years, however, demand from co-working space operators is expected to be more subdued, and only demand from tenants who are thinking of moving to new buildings will remain, Savills said.

One scenario that could provide an upside surprise in the office sector would be if a multinational(s), most likely from the TMT sector, decides to take up a large space in an office building, it noted.

“CBD rents remain on a firm upward trajectory where they are likely to remain over the second half.” said Alan Cheong, Savills Research.

https://www.icompareloan.com/resources/commercial-office-spaces/

However, these events are binary in nature and hard to pin down with a high degree of accuracy. Given the current dynamics, we hold to our previous forecast for CBD Grade A office rents to rise 10% YoY this year and another 10% for 2019.

An earlier research report by JLL noted that demand in the office sector remains strong in Singapore fueled by flexible space operators.

“Office space demand was the strongest in Singapore and Jakarta, where occupiers moved into new supply. Technology, e-commerce and flexible space operators were key demand drivers,” the report noted.

In Singapore, Grade A CBD office net absorption reversed the declining trend of 2015 and 2016 to hit a three-year high in 2017, the report pointed out.

“Much of this net absorption was fuelled by occupiers moving into their premises in recently completed buildings such as Guoco Tower, Marina One and UIC Building. This was, in turn, underpinned by the pick-up in leasing activity on the back of the brighter economic conditions that lifted market sentiment and business confidence and encouraged take-up,” said JLL Singapore head of research Tay Huey Ying.

How to Secure a Commercial Loan Quickly

Do you need a commercial loan for properties in the office sector, or are unsure if you qualify for one? iCompareLoan mortgage brokers can set you up on a path that can get you a commercial loan in a quick and seamless manner. Our brokers have close links with the best lenders in town and can help you compare Singapore commercial loans and settle for a package that best suits your purchase or investment needs.

Whether you are looking for a new commercial loan or to refinance, our brokers can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the loan. And the good thing is that all their services are free of charge. So it’s all worth it to secure a loan through them.

For advice on a new commercial loan or Personal Finance advice.

To speak to our Panel of Property agents.