The world is not a fair place. For example, when you buy an orange, they sell you an orange at one dollar ($1). When you buy a carton of 100 oranges, they sell you at sixty dollars ($60). If you can only afford to buy always one orange at a time, you will end up paying $100 for 100 oranges.

How do the rich do it? They would perhaps consume only one orange, but they buy 100 oranges anyway for $60 and they will sell 99 oranges at $1 to get $99. So they get to eat one orange for free, earn $39 ($99 – $60).

Another example would be how the rich develops a plot of land, builds 200 condominiums, sell 150 units and reserves 50 units for themselves and their families. The profit from the sale would often mean that the 50 units are free or almost free.

The same would almost always hold true, the larger units have a higher price point, but the per square foot price is less. For example a landed property with 1600 square feet of land and 2500 square feet of built-up area is sold for maybe $2m ($800 psf. on built-up area), while a condominium in a similar area is going for maybe $1m for 900 square feet ($1111 psf. on built-up area).

This again would hold true in mortgage financing or refinancing. Many banks offer cheaper rates for loan size bigger than $500,000 or $1,500,000. Although ultimately someone with a larger loan always pay more in interest rates, but they will almost always enjoy a lower interest rate.

How do smaller property developers raise funds?

Many developers are now raising funds for yet to be completed property developments. In the past they could easily borrow from the banks, but since the banks are reducing their risk appetite, developers are now borrowing from the public by a variety of means, such as through crowd funding or structuring debt for sale through various fund raising vehicles.

A typical investment product would look like this: –

- Minimum $10,000 of investment.

- Guaranteed 30% returns over 2 years.

- At the end of the 2 years, the developer returns you $13,000.

Many people will ask, it is too good to be true, is it a scam? How is it possible that they can get such a high return and pay you?

Before reading on, write down what you think on a piece of paper, then read on.

Is 30% guaranteed return over 2 years too good to be true?

Yes, some of them are scams, while some are not. Let us investigate a case where it is not a scam.

In fact, 30% guaranteed return over 2 years works out to be: –

- (13,000 / 10,000)^ (1/2) – 1 = 14.02% Per annum.

It is very good compared to fixed deposit that is 100% guaranteed under the deposit insurance scheme, but only gives you 1 to 3% generally.

- But 14.02% per annum is not a good return. Why?

- Guaranteed return – but by who? Is the guarantee still valid upon bankruptcy?

Just to make an over simplified illustration for a 2-year project. A developer who buys land and builds property projects tends to borrow 50 to 70% of the total value of the project. Once they sell the units, the progressive payment from the buyers would pay for the building cost, hence the leverage could even be higher.

- Let’s say developer cost = $100 million.

- Developer selling price = $120 million.

- Profit = $ 20 million.

If 70% borrowing is used, that means the developer comes up with $30 million and borrows $70 million. By using just $30 million, the developer makes $20 million.

- (Equity) Capital required is $30 million while profit is $20 million.

- Returns = $20m / $30m = 66.67% over 2 years. (29.09% per annum)

So the developer is making 29.09% while paying you only 14.02%. So the developer is merely borrowing cheaply from consumers while making the excess returns for themselves.

So I would say that the 14.02% is not a good deal for me. Certainly when it is a structured debt with guaranteed returns, without any benefit to the upside.

The reason is, all developers set up new companies to handle the property development projects. If these property developers go bankrupt, you will lose your $10,000 investment/loan (very few gets their money back), if these property developers succeed, you will only get 14.02%.

- BIG LOSS, Small gains. (High risk versus low return)

If you want to participate at all, why not participate in the equity/shares of these developers? Some property funds are available. If these developers go bankrupt, you lose your $10,000, if they succeed on target, you make 29.09% return per annum.

- BIG LOSS, BIG GAINS. (Even risk versus return)

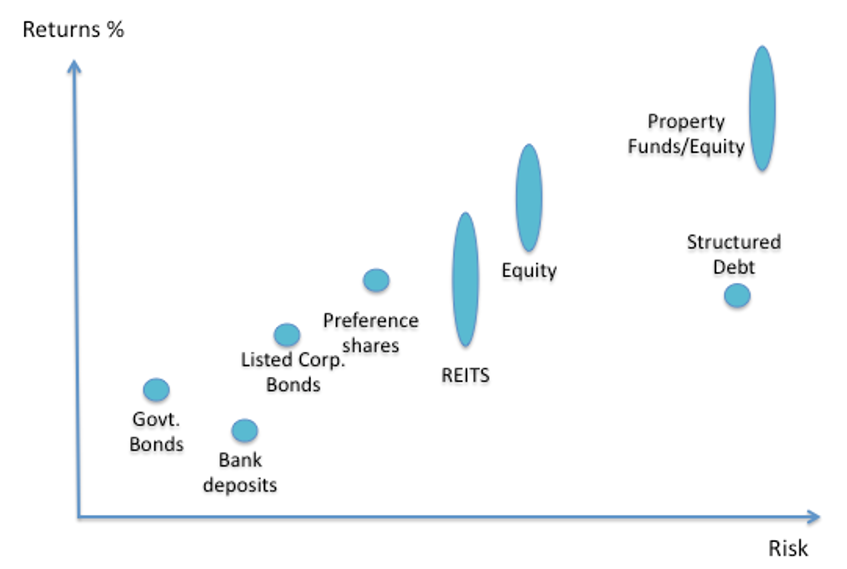

Chart 1: iCompareLoan’s view of Risk versus Returns

Summary

While some people claim that a 14.02% per annum return (30% over 2 years) is too good to be true. I would say that, it is too bad to be true.

If you feel that 30% return over 2 years sound like a scam, how about we offer you the same product, reduce the return to 18% over 2 years and sell that to you? Does that sound a lot better and make you sleep better at night? Perhaps you might even end up feeling better buying a product with 18% return instead of the same product at 30% return. Thereby saving the developer even more money. Does that sound irrational? This is your mind playing tricks on you.

Not all high return schemes are scams. In fact some so-called high return schemes have such low returns in my opinion where they offer you SMALL GAIN, BIG RISK. For the same amount of risk, I would definitely demand a higher return.

This is also why the rich gets richer, because the rich knows how to appeal to your irrational mind of fear and greed and lack of investment choices.

So the next time you see a guaranteed return scheme, think twice and find out how they make their money and if they are offering you too high or too low.

While talking is very easy, changing your mindset about investment is the first step in the right direction towards understanding how the rich think, and perhaps stand a better chance becoming one of them.