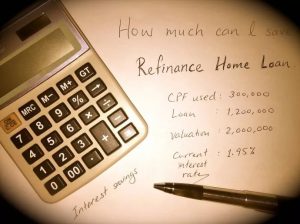

There are many reasons that a refinance of your mortgage loan may be useful for you – both immediately and in the long-term.

By: Hitesh Khan/

One major reason why many refinance, is to improve their cash flow in the here and now.

Table of Contents

You can lower your interest rate by choosing a mortgage rate which offers a better rate than you currently have. You can also consider lowering your payment by stretching out your current balance over a new term, but you must be mindful that age restrictions may apply. And if you do that, you should take heed that it may take longer to pay off your loan.

Even if you monthly payment drops, do keep in mind that the longer you take to clear your mortgage loan, the more interest you will have to pay over the life of the loan. This is the trade-off you have to make between immediate savings and long-term costs.

But if you choose to refinance, you can always choose to accelerate your repayment as your finances improve later in life. There are several reasons why homeowners may think they don’t qualify for a refinance for lower payments. One main reason is, they may believe that their mortgage balance is higher than the current market value of their properties that secures it. The other big reason being, their believe believing that their credit score is bad and won’t qualify them to refinance.

If you refinance to a lower rate, the chances are high that you will end up with a smaller payment. In fact, you can usually refinance for lower payments even if you get a higher rate. That is because in most cases, you will have reset the clock on your mortgage.

One main reason why homeowners should refinance is because of the rising US interest rates.

This is because the US Fed rate hike has an impact on mortgage loans here as Singapore interest rates are closely correlated with those in the US. The SIBOR (Singapore interbank offered rate) has gone up, and this besides denting some of the enthusiasm in the buoyant property market, could pose a big problem for homeowners who are still servicing their mortgage loans. This is because banks and financial institutions calculate lending rates by adding a margin (which covers their costs and their profit) to a published financial index, like the SIBOR or the SOR.

https://www.icompareloan.com/resources/mortgage-calculator-important-tool/

Since the beginning of this year, banks have raised interest rates for both fixed and floating home loan packages by 10 – 30 basis points (bps). Some banks have already upped their mortgage rate to 2.05 per cent, to keep pace with the increasing interest rates.

The 3-month SIBOR has hovered at 1.64 per cent since August. The US Federal Reserve has announced that it may increase its rates further this year, which will inadvertently drive interest rates for mortgage loans here even higher.

Banks, however, are usually slow off the mark in raising the interest rates in response to global news like the US Federal Reserve rate hikes. This lag time is where a mortgage consultant can best help a distressed buyer to finance a new purchase or to refinance their current property.

Mr Paul Ho, chief mortgage consultant said, “there may be a short window of opportunity for home-owners to refinance their home loans before the Federal Reserve interest rates are increased in September.” He added, “the mortgage consultants at iCompareLoan can get the best rates for home owners who want to refinance their home loans by comparing across 16 banks and financial institutions – and best of all, our services are free.”

https://www.icompareloan.com/resources/mortgage-broker-singapore-best-rate/

Today, consumers have a wide range of home loan packages to choose from compared to several years ago. Home loans could also be tied up with other programmes which rewards customers with a higher interest rate on their deposits if they transact more with the bank, such as getting a home loan and crediting their salary with the same bank.

Typically, with mortgage loans you are offered attractive rates for the first three years when you refinance – following which the interest rates are adjusted upwards. This usually coincides with the end of the lock in period, offering borrowers a good opportunity to relook their loans.

At iCompareLoan, we have several affordability calculators which homeowners looking to refinance can use to determine how much loan they qualify for. You can also use our mortgage payment calculator to determine how much you would have to pay every month by taking a mortgage loan with a 3-year lock-down period.

How to Secure a Home Loan Quickly

Are planning to refinance but unsure if you qualify? Don’t worry because iCompareLoan mortgage brokers can set you up on a path that can get you a home loan in a quick and seamless manner.

Alternatively you can read more about the Best Home Loans in Singapore before deciding. Our brokers have close links with the best lenders in town and can help you compare Singapore home loans and settle for a package that best suits your home purchase needs.

Whether you are looking for a new home loan or refinance, our brokers can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the loan. And the good thing is that all their services are free of charge. So it’s all worth it to secure a loan through them.

For advice on a new home loan or Personal Finance advice.

To speak to our Panel of Property agents.

For refinancing advice.