Are you on the lookout for a cheap refinancing option to switch out from your existing home loan? Well, then this guide is what you are looking for. This guide is a follow-on to earlier best SCB home loan guide. In this guide, we will analyse the trend of home loans from SCB and how they have evolved over the past two years. We will also show you why SCB home loan is now one of the best option you have for refinancing and one trick on how you can get more interest savings when you refinance with SCB. Go to Enquire on SCB home loans now.

SCB Home Loan Trend Over The Past Two Years

Over the past two years, one interesting trend that we have observed is that SCB has been moving from Fixed Deposit Rates (36M FDR) to Singapore Interbank Offer Rate (SIBOR) and fixed interest rate packages. We think that the reason is because of an industry-wide trend. Over the past two years, the whole industry has been moving towards SIBOR pegged home loans. In recent months, some of them have started offering more fixed interest rate packages, which SCB is also following suit in its more recent packages.

| Interest Rate Type | Date | Package Name | First Year Rate | Second Year Rate | Third Year Rate | Fourth Year Rate | Fifth Year Rate |

| Fixed Rate | Feb-20 | SCB – 2 years fixed rate (Completed Property) | 1.78 | 1.78 | 3M SIBOR + 0.6 % | 3M SIBOR + 0.6 % | 3M SIBOR + 0.6 % |

| Fixed Rate | Feb-20 | SCB – 2 years fixed rate (Completed Property) – Min loan $1.5mil (with Min $200k AUM) | 1.75 | 1.75 | 3M SIBOR + 0.6 % | 3M SIBOR + 0.6 % | 3M SIBOR + 0.6 % |

| Fixed Rate | Feb-20 | SCB – 2 years fixed rate (Completed Property) | 1.75 | 1.75 | 3M SIBOR + 0.6 % | 3M SIBOR + 0.6 % | 3M SIBOR + 0.6 % |

| Fixed Rate | Aug-19 | SCB – 2 year fixed rate | 1.95 | 2.15 | 3M SIBOR + 0.5 % | 3M SIBOR + 0.5 % | 3M SIBOR + 0.5 % |

| Floating Rate | Mar-19 | SCB – 2 Years Lock in 1M SIBOR Completed | 1M SIBOR + 0.3 % | 1M SIBOR + 0.3 % | 1M SIBOR + 0.35 % | 1M SIBOR + 0.35 % | 1M SIBOR + 0.35 % |

| Floating Rate | Mar-19 | SCB – 1M SIBOR BUC min 100k | 1M SIBOR + 0.35 % | 1M SIBOR + 0.35 % | 1M SIBOR + 0.35 % | 3M SIBOR + 0.5 % | 3M SIBOR + 0.5 % |

| Floating Rate | Mar-19 | SCB – 3M SIBOR BUC min 100k | 3M SIBOR + 0.3 % | 3M SIBOR + 0.3 % | 3M SIBOR + 0.3 % | 3M SIBOR + 0.3 % | 3M SIBOR + 0.3 % |

| Floating Rate | Feb-19 | SCB – 3M SIBOR BUC- 100k | 3M SIBOR + 0.35 % | 3M SIBOR + 0.35 % | 3M SIBOR + 0.35 % | 3M SIBOR + 0.5 % | 3M SIBOR + 0.5 % |

| Floating Rate | Feb-19 | SCB – 1M SIBOR BUC | 1M SIBOR + 0.35 % | 1M SIBOR + 0.35 % | 1M SIBOR + 0.35 % | 1M SIBOR + 0.35 % | 1M SIBOR + 0.35 % |

| Floating Rate | Feb-19 | SCB – No Lock in 36M FDR BUC min $1.5m | 36M FDR + 0.93 % | 36M FDR + 0.93 % | 36M FDR + 0.93 % | 36M FDR + 0.93 % | 36M FDR + 0.93 % |

| Floating Rate | Feb-19 | SCB – No Lock in 36M FDR w/MOA BUC min $500k | 36M FDR + 1.03 % | 36M FDR + 1.03 % | 36M FDR + 1.03 % | 36M FDR + 1.03 % | 36M FDR + 1.03 % |

| Floating Rate | Feb-19 | SCB – 2 Years Lock in 3M SIBOR Completed | 3M SIBOR + 0.15 % | 3M SIBOR + 0.15 % | 3M SIBOR + 0.5 % | 3M SIBOR + 0.5 % | 3M SIBOR + 0.5 % |

| Floating Rate | Jan-19 | SCB – 2 Years Lock in – Fixed Deposit Rate (Completed Property) | 36M FDR + 1.03 % | 36M FDR + 1.03 % | 36M FDR + 1.03 % | 36M FDR + 1.03 % | 36M FDR + 1.03 % |

| Floating Rate | Nov-18 | SCB – 2 Years Lock in – 36M FDR Completed Loan min $1.5m | 36M FDR + 0.88 % | 36M FDR + 0.88 % | 36M FDR + 0.88 % | 36M FDR + 0.88 % | 36M FDR + 0.88 % |

| Floating Rate | Oct-18 | SCB – 2 Years Lock in – 36M FDR Completed Loan Above 1,500,000.00 | 36M FDR + 0.98 % | 36M FDR + 0.98 % | 36M FDR + 0.98 % | 36M FDR + 0.98 % | 36M FDR + 0.98 % |

| Floating Rate | Oct-18 | SCB – 3M SIBOR BUC | 3M SIBOR + 0.25 % | 3M SIBOR + 0.25 % | 3M SIBOR + 0.45 % | 3M SIBOR + 0.45 % | 3M SIBOR + 0.45 % |

| Floating Rate | Oct-18 | SCB – 1M SIBOR BUC LOAN>=500k | 1M SIBOR + 0.3 % | 1M SIBOR + 0.3 % | 1M SIBOR + 0.35 % | 1M SIBOR + 0.5 % | 1M SIBOR + 0.5 % |

| Floating Rate | Jul-18 | SCB – 2 Years Lock in – 36M FDR – w/MOA Completed Loan Above 1,500,000.00 | 36M FDR + 0.88 % | 36M FDR + 0.88 % | 36M FDR + 0.88 % | 36M FDR + 0.88 % | 36M FDR + 0.88 % |

| Floating Rate | Jul-18 | SCB – No Lock in 36M FDR w/MOA BUC min $500k | 36M FDR + 0.98 % | 36M FDR + 0.98 % | 36M FDR + 0.98 % | 36M FDR + 0.98 % | 36M FDR + 0.98 % |

| Floating Rate | Jul-18 | SCB – No Lock in 36M FDR BUC min $1.5m | 36M FDR + 0.88 % | 36M FDR + 0.88 % | 36M FDR + 0.88 % | 36M FDR + 0.88 % | 36M FDR + 0.88 % |

| Floating Rate | Apr-18 | SCB – 2 Years Lock in 3M SIBOR Completed | 3M SIBOR + 0.25 % | 3M SIBOR + 0.25 % | 3M SIBOR + 0.3 % | 3M SIBOR + 0.45 % | 3M SIBOR + 0.45 % |

| Floating Rate | Apr-18 | SCB – No Lock in 36M FDR BUC min $500k | 36M FDR + 0.98 % | 36M FDR + 0.98 % | 36M FDR + 0.98 % | 36M FDR + 0.98 % | 36M FDR + 0.98 % |

Table 1 – SCB home loan trend

SCB Home Loan Is Top Three Cheapest Options In The Market

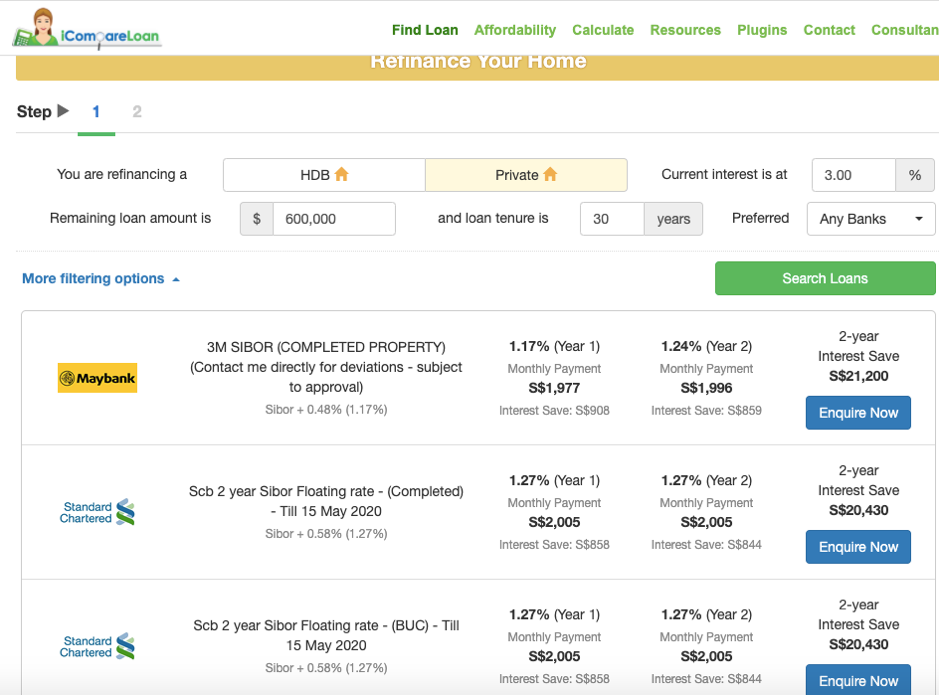

Right now, SCB home loan is one of the lowest in the market. According to our proprietary loan comparison engine, SCB is among the top three cheapest loans for refinancing.

In fact, out of the top three refinance home loans, SCB took two of the spots with its SIBOR pegged loan. Based on the current SIBOR rate, the interest on both SCB home loan is 1.27% per annum for the first two years. This applies for both HDB properties as well as private properties. The only home loan package that beats SCB is the home loan from Maybank. However, it only applies for completed properties, which means that SCB home loan is the best home loan available if your property is still under construction (BUC).

Figure 1 – SCB home loan among the top three cheapest home loans on iCompareLoan at the time of publishing.

Pair Your SCB Home Loan With SCB MortgageOne For More Interest Savings

If you are considering to pick up a SCB home loan, then you definitely should consider pairing your SCB home loan with SCB MortgageOne. For those of you who don’t already know about SCB MortgageOne, it’s actually a special deposit account where you can earn special interest rate on your savings. The interest earned on your savings can then be used to offset what you are paying on your SCB home loan.

The unique thing about SCB MortgageOne is that 2/3 of your savings in the special deposit account will earn interest rate that is equivalent to your home loan. This means that if your home loan interest rate is 1.27%, 2/3 of your savings in SCB MortgageOne will also earn 1.27% interest rate. The remaining 1/3 will earn 0.25% base interest. The total interest amount that you earn on your savings in SCB MortgageOne can then be used to offset your SCB home loan interest payment.

You can hardly find a bank that offers you such attractive interest rate on your savings. So, if you ask us, we think it’s a pretty good deal to take up. After all, you are getting one of the lowest home loan rates with your SCB home loan on top of the extra savings from SCB MortgageOne.

How To Refinance With SCB Home Loan?

If you have an existing home loan that you would like to refinance with SCB to enjoy lower interest rate, then you have come to the right place. Simply head over to iCompareLoan to enquire now to start enjoying interest rate savings from today.

Have any thoughts on SCB home loan that you want to share with the community? Let us know what you like or dislike about home loans from SCB on our Facebook page right this instant.