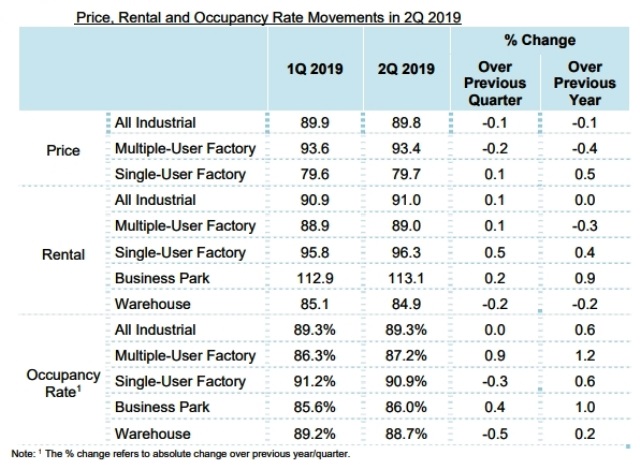

In 2Q 2019, the occupancy rate of overall Singapore industrial property market remained unchanged compared to the previous quarter said JTC. Prices and rentals of industrial property market remained relatively stable for most market segments.

JTC said that it will continue to monitor the Singapore industrial property market closely to ensure a stable and sustainable supply of land and space to support the needs of industrialists.

Table of Contents

Moving forward, JTC said that it will continue to develop new industrial facilities and estates that will meet the needs of industrialists, support their transformation and upgrading, and enhance their productivity and competitiveness.

Commenting on the occupancy rate of overall Singapore industrial property market for Q2, CBRE said that despite the cloudy trade outlook, the Singapore industrial market still exhibited signs of resilience in Q2 2019.

Ms Brenda Ong, Executive Director of Industrial & Logistics Services at CBRE, said: “For the first time in 17 consecutive quarters, the JTC All Industrial Rental Index saw its first uptick of 0.1% q-o-q, as opposed to last quarter when it remained unchanged. This was on the back of a healthy occupancy level of 89.3%, unchanged from the previous quarter.”

She added: “The factory submarket showed some improvements in occupier performance this quarter. The JTC Single-user Factory Rental Index rose by 0.5% q-o-q while the JTC Multiple-user Factory Rental Index inched upwards by 0.1% q-o-q. While this was a surprising improvement from the previous quarters*, CBRE is of the view that this may not be sustainable – given the weak macroeconomic indicators.”

CBRE noted that the previous quarter witnessed sluggish performance whereby the JTC Single-user Factory Rental Index eased 0.6% q-o-q and the JTC Multiple-user Rental Index edged downwards by 0.1% q-o-q.

“Against the introduction of 1.70 mil sq ft of net supply during this quarter, the occupancy rate for single-user factories dipped by 0.3 percentage points to 90.9%. On the other hand, multiple-user factory occupancy rates rose by 0.9 percentage points to 87.2%. This could have been the result of JTC’s efforts to limit the speculative supply in the market.

The performance of the warehouse sector showed a slight slowdown in this quarter, as illustrated by a dip of 0.2% q-o-q in the JTC Warehouse Rental Index. The warehouse occupancy rate fell 0.4 percentage points to 88.7%. Consequently, it has been observed that landlords are taking a more flexible stance in rental negotiations to improve occupancy.

A total of 40.02 mil sq ft of vacant factory space and 13.15 mil sq ft of vacant warehouse space correspond to vacancy rates of 10.3% and 11.3%, respectively. It should be noted that a large portion of these vacant spaces are small and fragmented, which do not cater to occupiers who mostly prefer large, contiguous spaces.

Meanwhile, conventional factory space will continue to face difficulties in finding tenants. As such, the industrial market might remain a two-tiered market, with assets of better specifications performing better in terms of rents and occupancy rates.”

Leading real estate observers have said that they were optimistic that the Singapore industrial property market will likely bottom within the next 12 months, barring any unforeseen external shocks. They took into account the tapering pipeline supply that will allow demand to play catch up amid the positive economic outlook, barring any unforeseen external shocks.

Researchers noted in recent months that Singapore industrial rents stagnated during 2018 due to the supply overhang from the preceding years. It believes that in 2019, the tapering of supply will lend support to the market and lead to marginal increases in rents despite the slowdown in manufacturing growth.

https://www.icompareloan.com/resources/industrial-property-market-sector/

One research said that factory rents could see an increase of 0.5%, while warehouse rents may rise by 1.0% as demand for warehouses has picked up due to rising competition in the e-commerce space. It added that business park demand will be sustained by cost-conscious companies who do not need to be in the CBD. Rents for business parks in the city fringe are projected to rise by 2.0%, while rents for business parks in outlying areas are expected to increase by a smaller 0.5%.

There are already signs of an uplift in economic and manufacturing sector performances, which may point to an imminent bottoming of the Singapore industrial property market.

How to Secure the Best Home Loans Quickly

iCompareLoan is the best loans portal for home-seekers, buyers, investors and real estate agents alike in Singapore. On iCompareLoan, you will be able to find all the latest news and views, informational guides, bank lending rates and property buying trends, and research data and analysis.

Whether you are looking to buy, sell or refinance apartments, condominiums, executive condos, HDB flats, landed houses or commercial properties, we bring you Singapore’s most comprehensive and up-to-date property news and best home loans trends to facilitate your property buying decisions.

Our Affordability Tools help you make better property buying decisions. iCompareLoan Calculators help you ascertain the fair value of a property and find properties below market value in Singapore.

Our trademarked Home Loan Report is Singapore’s first one-of-a-kind analysis platform that provides latest updates of detailed loan packages and helps property agents, financial advisors and mortgage brokers analyse best home loan packages for their clients, so that they may give unbiased home loan/commercial loan analysis for their property buyers and home owners. Our distinguished Panel of Property Agents who are users of our Home Loan report can give the best all-rounded advise to real estate seekers.

All the services of our mortgage consultants are ABSOLUTELY FREE, which means it’s all worth it to secure a loan through us.

Whether it is best home loans, best commercial loans or refinancing of existing loans or SME loans, CONTACT US TODAY!