Strong insurance demand for vehicles, property, health and other insurances across Singapore are driving the revenues of insurance companies in the country. Growing life expectancy, tax incentives on insurance products, favorable savings associated with insurance are further encouraging the customers across insurance segments.

On the global front, the world market and the strong insurance demand is dominated by vehicle insurance with the market for motor vehicle insurance is expected to register growth at a CAGR of 6.45% during the forecast period owing to increasing regulatory requirement for vehicle insurance.

Table of Contents

Singapore’s insurance industry is facing stiff competition as a result of strong insurance demand and companies not only compete with each other, but also compete with the risk retention groups, government, and self-insurance. The companies generally compete mainly based on two factors including the quality of the services and price that they provide. Many large organizations self-insure for most of their employee benefits like health coverage that lowers market scope for insurance companies.

Economic growth, rising government spending, technological innovations and increased consumer awareness about insurance products are key market drivers in Singapore. The government’s policy of insuring the uninsured has progressively pushed the insurance penetration in Singapore and the proliferation of insurance schemes.

The increasing number of digital distribution channels is favoring the insurers to easily obtain insurance policies. Insurtech, messaging platforms, and online sales channels are contributing to the insurance landscape in the country.

Through different distribution channels, insurance companies in Singapore are providing a wide variety of products with varying levels of complexity that are designed for different groups of businesses, individuals and other organizations. This will provide ways to meet the emerging demands of every end-use customer and propel net sales.

Local market players in the country are focusing on marketing their competitive edge by rolling out more plans customized to diverse sectors and developing more innovative digital features.

The Singapore Insurance Market, Size, Share, Outlook and Growth Opportunities 2020-2026 presents a comprehensive analysis of the country’s Insurance activities. The report focuses on market dynamics, recent trends, and insights on the insurance market.

The report covers the 2019 scenario and growth prospects of the Insurance Market for 2020-2026. Insurance Market research identifies that the competition continues to intensify year-on-year with emerging applications.

Singapore Life Insurance Premiums, Singapore Motor Vehicle Insurance, Singapore Property Insurance, Singapore Personal Accident Insurance, Singapore Health Insurance, Singapore General Liability Insurance, Singapore Credit/Financial Guarantee Insurance, and Other Insurance Markets are analyzed and forecast to 2026 in the report.

Singapore population and economic outlook are also presented in the report to provide insights and forecasts of macroeconomic factors shaping the future of Insurance markets.

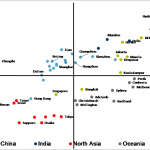

Singapore Insurance Market is compared against five of its competitive markets in the region to analyze the role of Singapore on the regional front and benchmark its operations.

Global Insurance, Asia Pacific, Europe, Middle East Africa, North America, and South and Central America Insurance market outlook is also presented in the report to provide a global perspective of the industry.

Business and SWOT profiles of three of the leading Insurance companies in Singapore are detailed in the report along with strategic initiatives, recent developments and their impact on overall market growth. The report also analyzes the competitive landscape of companies in the Singapore insurance market.

Mr Paul Ho, chief mortgage offier at iCompareLoand, said: “Strong insurance demand is good. It provides an avenue for investors who are short of money to cash in their life assurance policies. Although this is not a wise thing to do in most cases, it is better to borrow against the value of a policy than forfeit the policy and its risk cover and/or investment potential.”

He added, “You incur losses when you cancel a policy by allowing it to lapse or when you cash it in (surrender it) before it reaches maturity. These losses can be significant, particularly if the policy covers you against dying or being disabled.”

Universal policies, which give you both risk assurance and an investment portion, are the policies most seriously affected by the costs of lapsing or surrendering, but you could pay significant penalties if you cash in an ordinary investment policy too.

The consequences of using a life assurance policy as a quick source of cash include:

- You will probably receive a reduced investment value, because there are penalties for early withdrawals. These are known as early surrender penalties.

- The underlying costs of a new policy – when you are in a position to replace the old one – may be higher than those of the old policy.

- In the case of a smoothed/stable bonus policy, you may lose guarantees on the capital, as well as pay additional penalties if investment markets are in the doldrums, because the life company will take the underlying, lower values of your policy into account.

- Taking out a new risk assurance policy on your life may cost you far more. In fact, you may not be able to get a new policy when you are older and your state of health has changed for the worse.

- The premiums on risk assurance against death and/or disability may increase more rapidly with a new policy. If your existing policy is what is called a “robust” policy, it has a guaranteed level premium. However, such policies supply the level premium at a cost: your premiums are loaded in the early years (in other words, you pay more than you would otherwise), so you can enjoy what is effectively a discount in later years. If you cancel halfway through the policy term, you have already paid the higher premiums, but you lose the benefit of the premium remaining unchanged (and therefore relatively low) in the long term.

Then there are risk policies that work the opposite way: they give you low premiums to start with, guaranteed for a limited period. They are often called “fragile” policies, because the premiums are likely to increase after the guarantee period – usually no more than a year. For example, if a life assurance company has more claims than expected in a single year, it will increase the premiums the following year, and fragile policies offer no protection against this.