Paul HO (iCompareLoan.com)

Overview

Buying a property overseas is a major endeavour. What are the things you have to study before committing to a purchase?

There are only 3 Considerations for overseas property investment: –

- Potential Capital gains.

- Currency gain or loss versus your base currency.

- Investment yield.

- Loan Servicing ability (in the case where a loan is taken)

So in this case, you can see buying an overseas property is not that difficult.

All other comments all fall under the above 3 considerations.

Some will be quick to attack me by saying, what about property types, free hold versus lease hold, legal, etc.?

- These fall under potential capital gains or losses. If you buy a wrong property, there could be capital losses. So this is a subset of “Potential capital gains”.

Some will again say, what if the property is under construction and not completed?

- These will again fall under “Potential capital gains” or losses.

What if I cannot rent out the property?

- These will fall under investment yield, as you will simply have a reduced investment yield.

From our observation, people who have made money in property do so more from property investment capital gains, less so from yield of property via renting the property out. Though this is merely an observation as It could be that people who made money from capital gains are louder than those who are making an “income” from rentals.

Currency Effects on your Property Investments in Thailand – Thai Baht

When you invest in a Thai property, you have to pay in Thai Baht.

How do you calculate your gains or losses?

For example: –

A person who uses Singapore dollars as a base currency and buys a property in Thailand will have to exchange Singapore dollars for Thai baht.

Buy: at B4,800,000 at (S$1 : B24), that is S$200,000.

Sell: at B6,000,000 at (S$1 : B35), that is S$171,429.

In Baht -> you made B1,200,000

In Singapore Dollar -> you lost S$28,571

If you have relocated to Thailand and your daily needs are funded by Baht, then you are probably okay as long as the Baht’s purchasing power is not significantly diminished against other major currencies or trading partners of Thailand, else you will find that you have lost purchasing power when it comes to buying products made outside of Thailand.

If however your lifestyle centers around your base currency and it is Singapore dollars, then you will need to measure your capital gains or losses in your base currency.

Asset diversification and Portfolio management

If you are investing for asset diversification to maintain the overall value of your assets from wild fluctuations, then you should not mind short-term currency movements as one currency’s depreciation is often offset by the rise in other currencies.

What Do Monetary authorities and central banks control?

These central banks and monetary authorities generally control or watch the following: –

- Currency exchange rate

- Capital inflow/outflow control

- Interest Rate

Most governments can only select 1 or 2 to control and not all 3. This is the holy trinity dilemma in monetary policy where the governments cannot control all 3 aspects.

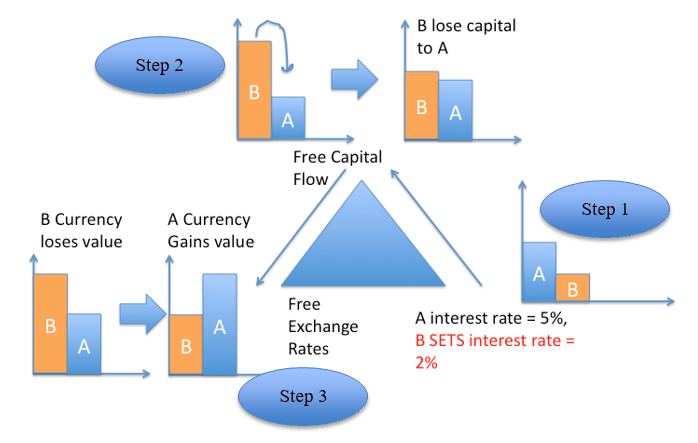

Figure 1: Holy Trinity in Managing a country’s finances, (Reference 1)

Look to the right hand side of Figure 1, if a country A has a 5% interest rate, country B wants to force its only interest rate to 2%. (I.e. SET Interest rate),

If the capital is free to move: –

Country B loses capital to Country A. (Because Country B pays better interest)

If exchange rates are free to move (unpegged): –

Country B’s currency loses value, while Country A’s currency gain value.

Hence how a country’s monetary policy, growth rate can affect its currency value. If a country sets its currency at a certain level that is not supported by the market, there will be a gap between the actual value and real value. Speculators will come in and take profit.

What happened to Thailand during Financial Crisis?

What if a country FIX its exchange rate? What will happen? (Appendix 1)

When a country FIXES its exchange rate, and adopts FREE CAPITAL FLOW it will lose its Monetary Sovereignty of setting interest rates, money supply, etc.

When Thailand slows down and perhaps needs to lower interest rates to stimulate the economy, but just when Thailand wants to do that, foreign funds invested in Thailand pulls out in search of better returns, known as Capital Outflow. When capital pulls out, they are typically pulled from the share market, property market and loans (which is lent to Thai businesses). These caused a severe shock to Thai businesses as funds become scarce. And business indebted to foreign lending will start to suffer. Real businesses suffer, as their access to capital is restricted.

As funds leave Thailand, interest rates have to rise to reflect this loss of funds. As funds leave, the Thai government needs to use reserves to defend the Thai Baht by selling USD to buy Baht, supporting its value. This uses up large amounts of foreign reserves (typically US dollars) that are pitted against hedge funds, ended up gifting the hedge funds tens of billions of dollars in a hopeless defense of the Thai Baht that still saw the Thai Baht devalue in a managed float of its currency peg to ease the defense of the currency using foreign reserves. When the Thai Baht depreciates, Thai businesses increasingly goes bankrupt as they hold large debt, which is US dollar denominated.

This means that, they owe US dollar that is becoming more expensive to service while they earn in Thai Baht which is consequently dropping in value, coupled with a softening economy that made earning the depreciating baht even harder, this is a triple whammy to say the least.

What is different in Thailand today?

Learning from the painful experience of Pegging the exchange rate in 1997, the exchange rate is allow to float freely. This prevents price & value distortion from building up.

For example: –

If the exchange rate is S$1:26, but the perceived fair value is S$1:35, then speculators will be selling Thai assets and using 26 baht to S$1 to exit the Thai Baht in exchange for Singapore dollars. This is because if they do not do so, when fair market value prevails, they will be using 35 baht for a Singapore dollar.

When the Baht is freely floated, there is little price distortion pressure building up as the traded exchange rate reflects the market value more closely.

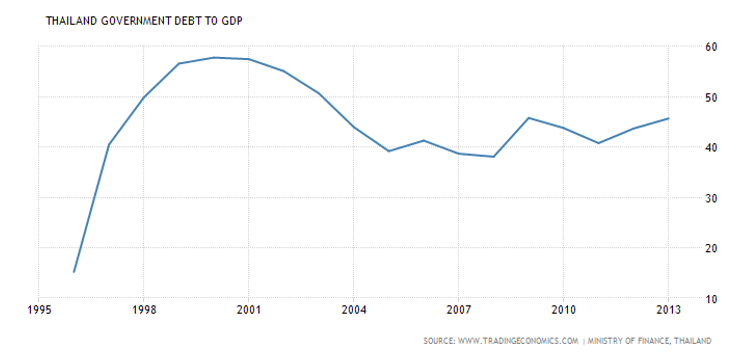

Chart 1: Thai government Debt-to-GDP ratio, 1995 to 2013, Trading Economics

Chart 1: Thai government Debt-to-GDP ratio, 1995 to 2013, Trading Economics

Thai’s Debt-to-GDP ratio is below 50%, nowhere near dangerous. Thai’s foreign reserves can more than pay off its Government’s external Debt if it wants to as it has US$160 billion in reserves while ~US$130 in external debt.

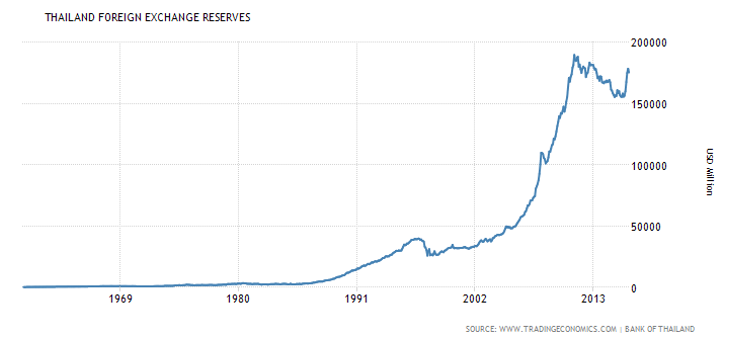

And today’s Thai Foreign reserves are one of Asia’s largest at around US$160 billion.

Chart 2: Thai government Foreign Exchange Reserves in USD millions. Trading economics

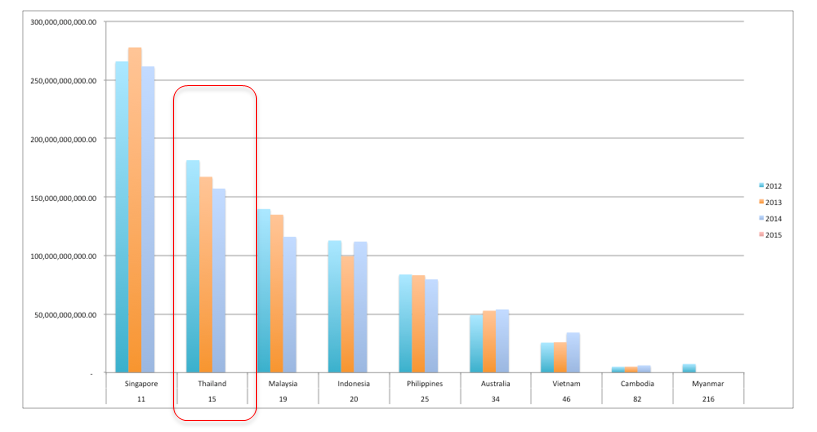

Chart 3: Thai government Foreign Exchange Reserves in USD millions compared to other economies, Trading economics

Chart 3: Thai government Foreign Exchange Reserves in USD millions compared to other economies, Trading economics

Thai government has strong foreign exchange reserve position, which is one of the highest in the developing economies. And it is continuing to run a trade surplus, accumulating Foreign Exchange Reserves.

Chart 4: Thai government Foreign Exchange Reserves in USD millions, Trading economics

Due to free float of Currency exchange, it is able to set its own interest rate more effectively. At a time when the Thai economy is starting to see signs of slowing down while the US economy and US Dollar is showing signs of strength, instead of rising the interest rate to prevent funds outflow and maintain the exchange rate, it surprisingly lowered and kept interest rate at 1.5% to continue to keep borrowing costs low for Thai businesses. Doing so, weakens the Thai baht and could create some capital out flow, which Thailand is able to withstand while it stimulates the Thai economy and further increases Thai’s export competitiveness.

Thai Baht trend versus Singapore Dollar

According to MAS, Singapore manages its Singapore dollar nominal effective exchange rate (S$NEER) against a trade-weighted basket of 15 currencies of its major trading partners. As Singapore is trade dependent where trade accounts for about 200% of its GDP, therefore Singapore regulates its exchange rate to control import inflation.

Hence the Monetary Authority of Singapore (MAS) uses this (S$NEER) to adjust the Singapore dollar strength vis-à-vis the other trading partners so as to manage and regulate inflation in Singapore and to maintain price stability which is essential for businesses to grow.

A neutral stance on Singapore dollars means that it is neither appreciating nor depreciating when compared against a basket of its trade weighted basket of currencies of Singapore’s trading partners.

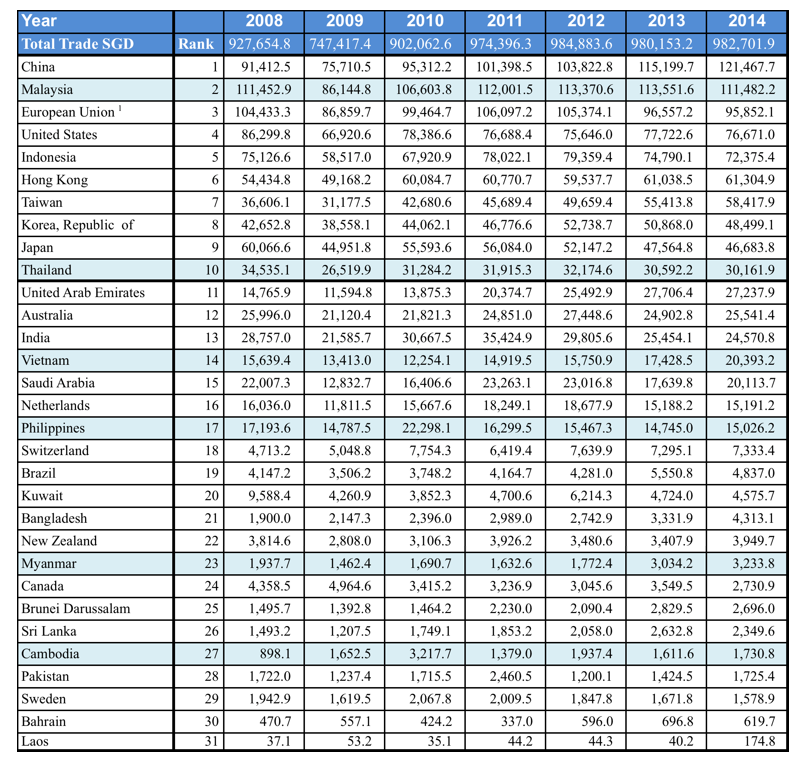

On 14 April 2016, MAS announced that it is taking a neutral stance. As Singapore’s economy is slowing down in 2016, it cannot continue to maintain an appreciative stance as foreign reserves will need to be used to shore up the exchange rate, hence the MAS’ neutral stance on Singapore currency. This means that Singapore dollar is less likely to appreciate a lot against the Thai Baht unless the Baht is depreciating against most currencies. Thailand is Singapore’s 10th largest trading partner.

Here is a look at Singapore’s major trading partners.

Table 1: Singapore’s Major Trading Partners, IE Singapore, Singstats Nov 2015, iCompareLoan.com in SGD.

Thai Baht versus Other regional currencies

A country’s currency is very dependent on its financial and country’s strength. Some of the high level metrics to measure a currency’s susceptibility to being attacked by speculators are: –

- Government absolute debt

- Debt to GDP

- Foreign currency reserves

- Inflation

- Elevated stock market prices and property prices

- Distorted market (i.e. pegged interest rates, pegged currency exchanges, etc.)

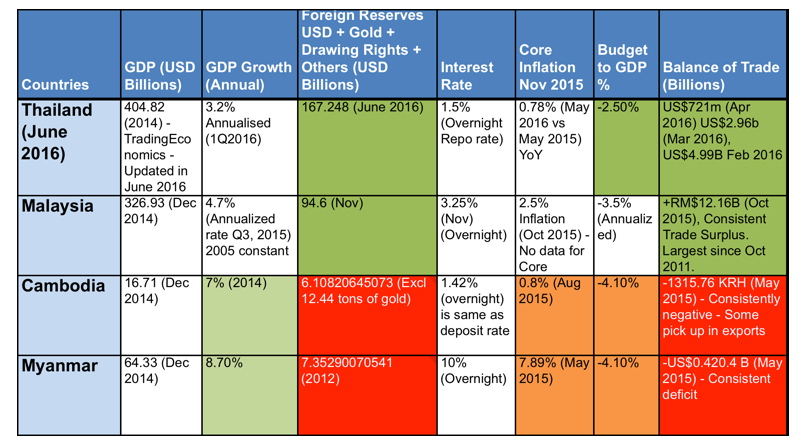

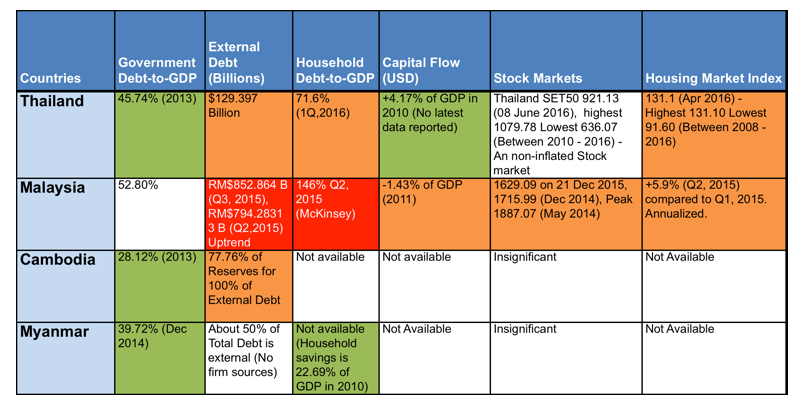

Table 2: Thailand versus Malaysia, Cambodia, Myanmar Governmental strength

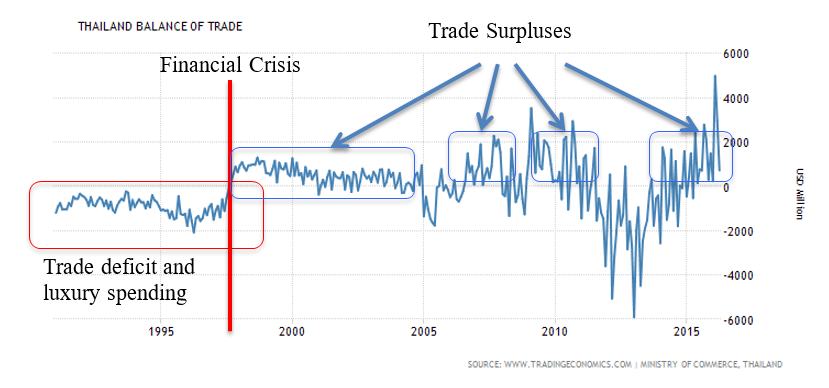

Thailand has the biggest economy out of these 4 countries, a high foreign reserve and a manageable budget deficit of 2.5% (Most countries run budget deficits). It runs a trade surplus for the last many months and has run surpluses for most parts of the last 10 years.

Table 3: Thailand versus Malaysia, Cambodia, Myanmar Governmental strength

Table 3: Thailand versus Malaysia, Cambodia, Myanmar Governmental strength

Cambodia and Myanmar are undeveloped economies, hence a debt of 20 to 40% of GDP is considered high. A more developed economy such as Thailand with less than 50% government debt-to-GDP is considered low. The external debt is also manageable. Thailand’s household debt is rising to 71.6% (1Q, 2016), this is nonetheless still manageable and house price index also is high, but this is to be expected during prolonged economic growth.

Capital flow in 2016 is not comprehensive, but we can only surmise that it might be currently neutral or negative. If there is a capital outflow, this is indeed good news as this shows that the Thai economy is weathering the outflow of capital well without shocks to its economy.

Thailand’s stock market is not at its peak (as at June, 2016), hence there is not enough “fuel” to ignite or to short, i.e. in short, not enough arbitrage opportunity, and hence less risky. Property index is high but it may not necessarily indicate an overprice situation as Thailand is a major tourism destination and becoming more internationally connected, and properties are illiquid and is unlikely to lead to much currency depreciation pressure.

Of course there are many more factors to consider whether a currency will remain strong or weak, such as: –

- Politics

- Social factors (Social equality)

- Technology innovation

- Environmental factors (natural disasters, pollution, etc.)

- Legal

All these affect the currency values, especially political events, nonetheless Thais have never been known to attack foreigners in any internal political conflicts.

Where will Thai Baht head versus Singapore dollar

The Thai economy is still headed for a growth in the vicinity of 3% in 2016 and beyond, while Singapore is headed for below 2% growth. Singapore’s neutral currency stance means that it is unlikely to appreciate strongly against Thai Baht which has one of the lowest budget deficit in the region, a strong foreign reserves, manageable government debt-to-GDP.

Thailand also has low interest rates to stimulate and support their local companies. Although corporate indebtedness is hard to track, the removal of a pegged currency exchange relieves much of the built-up risk of US dollar debt and Baht earnings that can put businesses at huge risks.

The fact that Thailand maintained a low domestic interest rate and is able to persist so speaks volume about its financial strength. And today Thailand is the strongest economy in the Indochina region with a strong trade surplus and has transformed itself from being a pure agrarian country into an industrialised country.

Figure 1: What did Thailand Export in 2014, The Atlas of Economic complexity, Reference 2.

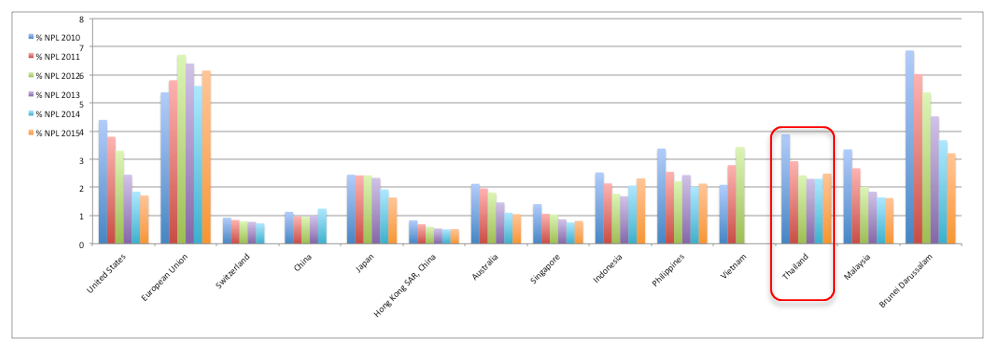

Banks Non-Performing Loans to Total Gross Loans

Chart 5: Selected Country’s Banks Non-performing loans to total gross loans, Worldbank, iCompareLoan.com

Thailand’s Non-performing loan is less than 3%, hence is considered manageable.

Overall, Thai Baht currency trend vis-à-vis that of Singapore dollar is neutral, perhaps it may slip in value with continued global economic weakness, but it should be quite stable against the Singapore dollar considering that MAS takes a neutral stance against its trade weighted basket of currencies. The Thai economy, Singapore’s economy is headed for slower growth along with the rest of the world.

REFERENCES

- Holy Trinity in Managing a country’s finances, https://en.wikipedia.org/wiki/Impossible_trinity)

- What did Thailand Export in 2014, The Atlas of Economic complexity, http://atlas.cid.harvard.edu/explore/tree_map/export/tha/all/show/2014/

OTHER REFERENCES

- A Good look at the Thai Financial Crisis, By Narisa Laplamwanit, http://www.columbia.edu/cu/thai/html/financial97_98.html

APPENDIX 1: Impossible Trinity

https://en.wikipedia.org/wiki/Impossible_trinity

In particular, the East Asian crisis (1997–98) is widely known as a large-scale financial crisis caused by the combination of the three policies which violate the impossible trinity. The East Asian countries were taking a de facto dollar peg (fixed exchange rate), promoting the free movement of capital (free capital flow) and making independent monetary policy at the same time. First, because of the de facto dollar peg, foreign investors could invest in Asian countries without the risk of exchange rate fluctuation. Second, the free flow of capital kept foreign investment uninhibited. Third, the short-term interest rates of Asian countries were higher than the short-term interest rate of the United States from 1990–99. For these reasons, many foreign investors invested enormous amounts of money in Asian countries and reaped huge profits. While the Asian countries’ trade balance was favorable, the investment was pro-cyclical for the countries. But when the Asian countries’ trade balance shifted, investors quickly retrieved their money, triggering the Asian crisis. Eventually countries such as Thailand ran out of dollar reserves and were forced to let their currencies float and devalue. Since many short term debt obligations were denoted in US dollars, debts grew substantially and many businesses had to shut down and declare bankruptcy.

APPENDIX 2: Country’s Political Background

Malaysia

PM Najib Razak’s woes with allegations of corruption with 1MDB continues. UMMO (Malaysia’s rulling party) is fragmented into Pro-Najib camp and Pro-muhideen yassin (former Deputy of UMMO) camp. There is also alledged tension between the Johor sultan and Najib which rumoured that PM is not welcomed in Johor, which was later denied by Johor Menteri Besar press secretary Asri Khalbi. (http://www.malaysia-chronicle.com/index.php?option=com_k2&view=item&id=570552:najib-banned-in-johor?-posting-about-alleged-snub-from-sultan-goes-viral&Itemid=2#axzz3uqh75BSX)

There were still a lot of lingering contempt for the Najib government for the black-out during election, which saw UNNO narrowly win the election despite losing the popular vote. The Bersih movement was formed (https://en.wikipedia.org/wiki/Bersih). And unless the ruling government seriously address these irregularities, this could be a future source of instability which could derail any potential economic development.

Malaysia is currently still running smoothly some say, despite of the government, not because of the government. Malaysia could continue years of being rudderless which sees state government taking charge of economic development initiatives rather than taking orders from the federal government.

Near term economic trend is negative while personal safety still ranks higher than countries such as Thailand, Philippines, Myanmar, vietnam and Cambodia.

Philippines

Philippines’ political system is more or less stable after its people’s power movement (Also known as EDSA revolution) in 1986 which overthrew the Ferdinand E. Marcos government. https://en.wikipedia.org/wiki/People_Power_Revolution

Since the EDSA revolution, there have been many smooth transitions of power. Hence the political environment of Philippines is considered stable. However it scores poorly on effective governance.

Politic’s influence on economics is deemed stable and neutral.

Vietnam

Vietnam is a Single party socialist republic. For now, it has enjoyed years of political stability. However a single party dominant state is always a source of potential instability as the checks and balances remain weak. Proponents for checks and balances are often put into jail, simmering discontent cannot be easily diffused. However vietnam is currently a safe destination to travel to.

Politics influence on economics is deemed neutral.

Myanmar

Myanmar recently held the elections where “Aung San Suu Kyi’s National League for Democracy (NLD) has won a landslide victory in Myanmar after general elections on 8 November. It was the country’s first national vote since a nominally civilian government was introduced in 2011, ending nearly 50 years of military rule.” (BBC)

Nonetheless the complicated political structure retains much of the military power within the army. Aung San Suu Kyi may not have true power, moreover she is banned from becoming President (under the constitution) as her husband is british. She has to rule through proxy.

The army has also hijacked the parliament with a guaranteed 25% of all seats automatically assigned to the army and have put in safe guards against a democratically elected government changing the constitution. On top of that, the army retains control of some important ministries.

While the political development is positive, it is uncertain if the army will hand over power. Even if the army hands over power, it is uncertain how much actual power Aung San Suu Kyi will have to steer the country to prosperity.

Political development trend is hopeful for economic development and investments.

Cambodia

Cambodia’s Hun Sen is one of the longest serving prime minister. The country is largely stable through iron fisted control. There is not much hope in Cambodia for political reform as Hun Sen has been known to hold on to power despite losing elections.

Political will is opening up to economic reforms, however Cambodia remains a repressive regime with a dictator at the helm.

Polical infleunce on economics is neutral with elements of instability as Hun Sen ages.

Thailand

Despite the widespread corruption allegation of the Thaksin government and the subsequent Thaksin proxy governments, it does not justify a bloodless military coup bringing down a democratically elected government. Having military men in parliament is already bad enough as it is, having military men rule the country is the worst that can happen to any country. The military men yet delayed handing back power as the election is yet again delayed.

There is simmering discontent between the Phue Thai Party’s supporters and proponents of the military coup.

Violence and protests could erupt anytime. However Thailand’s protests have not been known to attack foreigners. Politics influence on economics is negative, personal safety is neutral.

APPENDIX 3: Definition of Capital Account, https://en.wikipedia.org/wiki/Capital_account

- Foreign direct investment(FDI) refers to long-term capital investment, such as the purchase or construction of machinery, buildings, or whole manufacturing plants. If foreigners are investing in a country, that represents an inbound flow and counts as a surplus item on the capital account. If a nation’s citizens are investing in foreign countries, that represents an outbound flow and counts as a deficit. After the initial investment, any yearly profits that are not reinvested will flow in the opposite direction but will be recorded in the current account rather than as capital.[1]

- Portfolio investmentrefers to the purchase of shares and bonds. It is sometimes grouped together with “other” as short-term investment. As with FDI, the income derived from these assets is recorded in the current account; the capital account entry will just be for any buying or selling of the portfolio assets in the international capital markets.[1]

- Other investmentincludes capital flows into bank accounts or provided as loans. Large short-term flows between accounts in different nations commonly occur when the market can take advantage of fluctuations in interest rates and/or the exchange rate between currencies. Sometimes this category can include the reserve account.[1]

- Reserve account. The reserve account is operated by a nation’scentral bank to buy and sell foreign currencies; it can be a source of large capital flows to counteract those originating from the market. Inbound capital flows (from sales of the nation’s foreign currency), especially when combined with a current account surplus, can cause a rise in value (appreciation) of a nation’s currency, while outbound flows can cause a fall in value (depreciation). If a government (or, if authorized to operate independently in this area, the central bank itself) does not consider the market-driven change to its currency value to be in the nation’s best interests, it can intervene.[2]