Many people fret that investing in overseas property is complicated; actually it is really very simple.

There are only 3 Considerations for overseas property investment: –

- Potential Capital gains.

- Currency gain or loss versus your base currency.

- Investment yield.

- Loan Servicing ability (in the case where a loan is taken)

These 3 considerations would hold true in any country you choose to invest in.

What plays the most important part in Potential Capital gains is: –

- Buying from a reputable developer.

- Buying in a good and right location.

- Buying in the right country.

- Managing currency exchange rate country risks.

Investment yield serves to help finance any potential bank loan repayment and gives you some income or help you servicing your repayment while you wait for your property to exit with a higher value.

Why Country Risks and Currency Risks are the bulk of your risks?

Country risks and Currency exchange risks are the biggest risk in any property investment. If a currency is depreciating, you are like going onto a sinking ship as assets will be worth less in Singapore Dollars after exchanging it back to Singapore dollars.

For example: –

A person who uses Singapore dollars as a base currency and buys a property in Thailand will have to exchange Singapore dollars for Thai baht.

Buy: at B4,800,000 at (S$1 : B24), that is S$200,000.

Sell: at B6,000,000 at (S$1 : B35), that is S$171,429.

In Baht -> you made B1,200,000

In Singapore Dollar -> you lost S$28,571

If a country is financially weak, then speculators such as George Soros will be like a hyena sensing “blood” of a wounded animal, attacking it for profit. Speculative attacks on a country will destabilize it, causing share markets to collapse (speculators can sell short and make huge winning bets) and cause the currency to fall and companies to fail amidst the liquidity crunch. A fall in currency value can also be a windfall for the speculators. But the innocent investor will be caught off guard and see their investment evaporate in value.

Is Thailand a Safe Country to invest in?

What images flashes through your mind when I mention the country Thailand?

- Holiday, villas, beach resorts.

- Thai fragrant rice.

- 1997 Financial Crisis?

In 1997, Thailand succumbed to speculative attacks on its currency and went into recession.

What went wrong in 1997?

In 1997 before the crisis, Thailand was enjoying the good times. Thailand was running a trade deficit as people were spending on luxury goods that was funded largely by debt. They felt that the good times would last. Trade deficit was high.

The Thai Baht was pegged to the US dollar. And there is Free Capital movement. Let’s say in the USA, people can get 3% interest rate, but in Thailand they can get 5%, then money will flow into Thailand. This hot money causes stocks to rise, property prices to rise and created a bubble.

Why? This is because if the Thailand government guarantees a pegged exchange rate of baht to the USD, then there is no risk for funds to make a better return by putting the money into Thailand to make extra returns.

In 1997, the good times came to an abrupt end, as speculators triggered and made funds outflow worse. Many Thai businesses had already built up huge debt in US dollars, they quickly suffered and go bankrupt as US dollars got more expensive, while their earnings in Baht was dropping, making servicing the debt quite an impossible task.

The Thai government lost tens of billions of US dollars in foreign reserves trying to defend the Baht against the speculators. Doom and gloom surrounded Thailand.

Today’s Thailand is different

Thai Baht is no longer pegged to the US dollars. It is freely floated. This means baht can go up and down, but this reduces any built-up price differences which can make it attractive for speculators to come in to Short the Baht.

While Thailand is slowing down, it is still growing at about 3% GDP growth. A respectable figure.

Thailand runs mostly trade surpluses in the past 10 years and is very strong with exports.

Today Thailand has one of the highest foreign exchange rate reserves in the developing world at about US $160 billion (compared to about US $30 billion in 1997), this can more than pay up its external debt at US $130 billion.

Thailand’s Debt-to-GDP is sensibly below 50%. Even though its household debt-to-equity has risen to about 71%, it is still not dangerous yet.

Today Thailand’s food and vegetable exports are only 12% of its economy while 58% are Machinery/Electrical, Plastics/Rubber and Transportation industries.

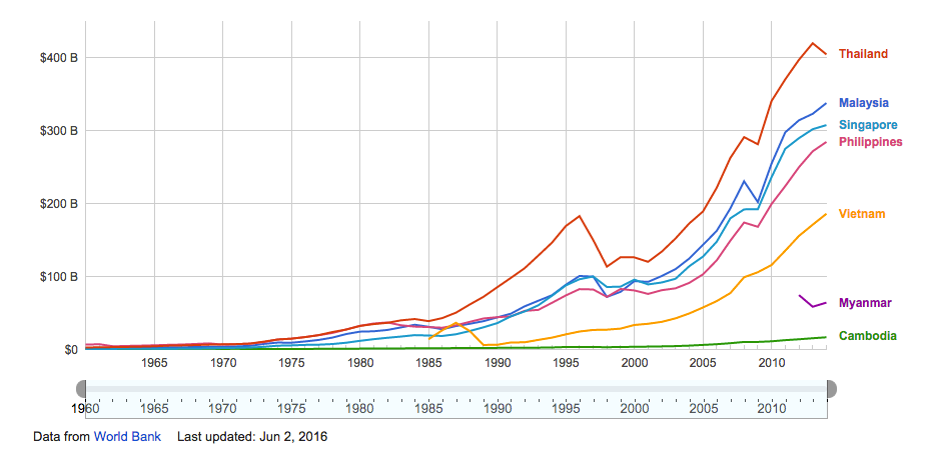

Chart 1: Thailand’s GDP versus Malaysia, Singapore, Philippines, Vietnam, Myanmar and Cambodia, Worldbank

While the world’s economy is slowing down, Thailand is also not immune.

Thailand is able to set its own exchange rate at 1.5% (overnight) without succumbing to funds flight, this means Thailand is strong enough to maintain domestic monetary sovereignty (When you reduce interest rates, you will exacerbate funds outflow). Businesses will not suffer as much as long as they can still have access to capital and can continue to do business.

One of your favourite destinations is still Thailand, which has one of the best tourism infrastructure within Asia coupled with the extensive reach of their overhead rail system (BTS) Bangkok sky train (As good as Singapore’s MRT, if not better) and underground rail system (MRT). Your favourite rice is from Thailand of course.

Today Thailand produces about 2m cars a year and exports 1m of them.

So the next time you think Thai Baht is dangerous or Thailand is backwards, your favourite car might very well be manufactured in Thailand.

Despite the usual ups and downs, the Thai Baht is as safe as it possibly can be. It is backed by really solid exports, Trade surpluses, strong reserves, fast improving infrastructure, manageable government budget deficit, low Non-performing loan and a friendly and hardworking people.

And yes, it is also getting more expensive, but rightly so.

Perhaps Singaporeans need to change their mindsets about other countries and start to look at facts and figures rather than chanting that Singapore is always number 1 or risk losing out to potentials in emerging economies.

Next time you think of Thailand, perhaps you want to have images of, manufacturing hub, factories, world’s 7th largest car producer, finished electronic goods and services, agriculture powerhouse in the Indochina region and a potential regional business HQ for businesses in Thailand, Myanmar, Laos, Vietnam, etc.

With the ever rising cost of living in Singapore, perhaps you could even obtain an equity term loan from your housing loan in Singapore, buy a Thai property now and retire in 10 years from now. By that time, you may be sitting on tidy capital gains on your Thai property, stay in it, and you can rent out your house in Singapore for living cost.

Do you agree?