The Urban Redevelopment Authority (URA) closed tenders for three GLS sites at Tan Quee Lan Street, Bernam Street and one-north Gateway on Sep 5. The public tender for the three GLS sites at Tan Quee Lan Street, Bernam Street and one-north Gateway was launched on 29 March 2019, 30 May 2019 and 27 June 2019 respectively.

URA said that this is not an announcement of tender award for the three GLS sites and that a decision on the award of the tenders will be made after the bids have been evaluated. This will be publicised at a later date.

Colliers International commenting on the three GLS sites said, “if there was a theme to sum up developers’ mindset from the batch tender results released by the Urban Redevelopment Authority on 5 September, ‘safety first’ would be quite apt.”

Table of Contents

Colliers added that the tender outcome for the three GLS sites were all moderate with the results for Tan Quee Lan Street particularly surprising.

“This site in Bugis was widely anticipated to witness stiff competition among developers, but it only attracted two bids which turned out to be a bit of an anticlimax. Meanwhile, Bernam Street in the Tanjong Pagar area only pulled in four bids.

We believe the lukewarm response to the Tan Quee Lan Street and Bernam Street sites potentially reflects developers’ concerns over the macroeconomic headwinds and weaker economic outlook ahead.

In contrast, the tender for one-north Gateway was better received and the top bid was well within our forecast. We can infer from one-north Gateway’s popularity that size is a major consideration among developers – this being the site on the Confirmed List that could yield the lowest number of potential units (165 units).

TAN QUEE LAN STREET

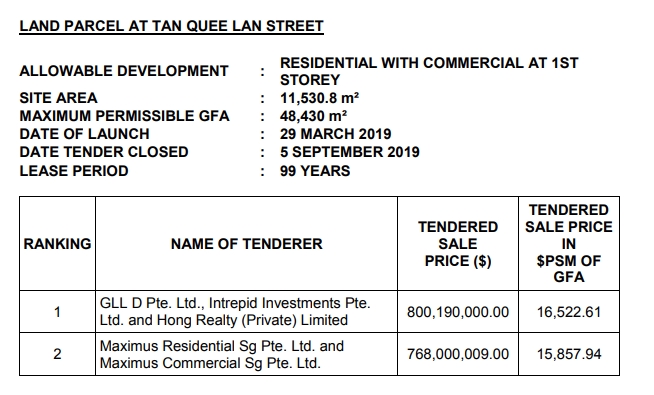

The response for the site was surprisingly underwhelming, especially given the 10 bids received for the nearby Middle Road site. The Tan Quee Lan plot received just two bids, with the top bid from the partnership of GuocoLand, Intrepid Investments and Hong Realty. The other bid was placed by a tie-up between City Developments and MCL Land.We think some developers could have been put off by the hype over the site and expected aggressive bidding for it. In addition, there might be worries about competition from the Middle Road site and the Midtown Bay project.

Nonetheless, the top bid of SGD800.19 million or SGD1,535 per square foot per plot ratio (psf ppr), is still relatively in line with market expectations and is still a benchmark land pricing for a residential site in the area. The site offers an opportunity to build a signature project on top of the Bugis (Downtown Line & East-West Line) MRT interchange station. We expect a breakeven cost of SGD2,200 psf, and the developer could look to sell for above SGD2,400 psf.

The highest bid for the Tan Quee Lan Street site is 5.3% above the SGD1,458 psf ppr top bid for the Middle Road site.

This site complements the nearby Guoco Midtown and Midtown Bay, which GuocoLand is developing, offering more choices of private housing to support the growing commercial enclave of Duo, South Beach and Midtown in the area.

According to the URA, about 580 residential units can be built on the site. The serviced apartment Gross Floor Area (GFA) shall not exceed 14,530 sq m. A maximum of 2,000 sq m of the total GFA of the development may be developed for commercial uses at the 1st storey.

BERNAM STREET

The Bernam Street site received just four bids with the top bid of SGD1,462.8 psf ppr, which is below market expectations.The poor response could be due to concerns of increased competition that could potentially arise from the CBD Incentive Scheme unveiled in the URA Draft Master Plan in March 2019. The Scheme encourages the conversion of ageing commercial space to residential and mixed-use space.

We estimate breakeven could be about SGD2,150 to 2,200 psf and the developer can build smaller units to cater to city living. We observed that 99-year leasehold residential projects in this area, such as Altez, Skysuites@Anson and Icon transacted at SGD1,700 to 2,500 psf on average in the past 12 months, depending on age and unit size.

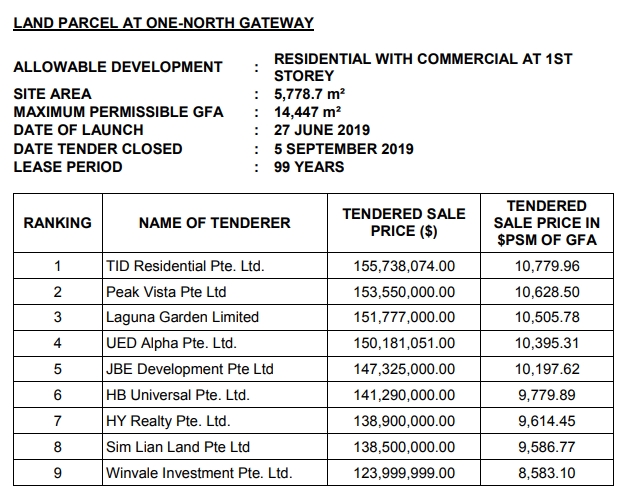

ONE-NORTH GATEWAY

The one-north Gateway site received nine bids, highest since the GLS tender for the Middle Road plot. This came as no surprise as it is the smallest site on the Confirmed List (165 units) and hence of a palatable development quantum which appeals to more developers. It is also deemed to be at a lower risk of not being able to sell-out within the ABSD timeline of five years.There is also less competition in the locale, as it is the only new land supply in 10 years within the growing one-north technology enclave.

The top bid of SGD155.7 million or SGD1,001.5 psf ppr is in line with our expectations. We project a breakeven cost of SGD1,500 to 1,550 psf. We believe the developer could look to sell above SGD1,600 psf, taking into account the minimum average unit size requirement of 85 sq m.

The adjacent project, one-north Residences, which was completed in 2009 have transacted at around SGD1,500 psf for units around 900 to 1,000 sq ft in the year-to-date 2019.”

How to Secure a Home Loan Quickly

Are you planning to invest in properties in the District 9 but ensure of funds availability for purchase? Don’t worry because iCompareLoan mortgage broker can set you up on a path that can get you a home loan in a quick and seamless manner.

Our brokers have close links with the best lenders in town and can help you compare Singapore home loans and settle for a package that best suits your home purchase needs. Find out money saving tips here.

For advice on a new home loan.

For refinancing advice.