Understanding SIBOR and SOR Based Home Loans in Singapore

By iCompareLoan Editorial Team

As a small, open economy that depends largely on imports for most of its needs, Singapore adopts an exchange rate policy, which curbs import-based inflation. Specifically, Singapore makes use of a managed float regime, whereby the Monetary Authority of Singapore (MAS) manages the Singapore dollar against a basket of currency of its main trading partners, but allows it to fluctuate between an undisclosed band. Thus the interest rate in Singapore is determined by world money markets. It follows closely the interest rate of the countries in the basket of currency, of which the US dollar makes up a main component. Consequently, there is a correlation between the US interest rates and that of Singapore’s.

What is Singapore Inter-bank Offered Rate (SIBOR)?

Table of Contents

SIBOR is the interest rate at which banks and financial institutions in Singapore borrow from each other. It is similar to the London Interbank Offered Rate (LIBOR). Set by the Association of Banks in Singapore, SIBOR is transparent and announced daily through the mainstream media.

Many home loan packages offered in Singapore are pegged to SIBOR.

SIBOR comes in different blends of 1-, 3-, 6- , 12-month. So the 1-, 3-, 6-, 12-month SIBOR are the interest rates for borrowing for 1, 3, 6 and 12 months, respectively. The longer the tenor the higher the rate is.

What is Singapore Swap Offer Rate (SOR)?

In contrast, SOR is the lending costs and the expected forward exchange rate between the US dollar and Singapore dollar. Upon maturity of the SOR tenor, there is a Forex conversion from US dollar to Singapore dollar, but there is no bid and spread, therefore the banks save money amongst themselves.

As SOR can be interpreted as currency swaps between the US dollar and Singapore dollar, it has slightly more volatility compared to SIBOR and current movements impacts the trading volume of the SOR contracts.

SOR is also set by the Association of Banks in Singapore and comes in different blends of 1-, 3-, 6- , 12-month.

What are SIBOR and SOR pegged home loans?

Floating (variable) interest rate loans in Singapore make use of SIBOR or SOR as the variable component in the interest rate. Most loan packages follow the 1- or 3-month SIBOR or SOR. The interest rate for the loan will be defined as spread + SIBOR or spread + SOR.

What is spread?

The margin that the financing institutions add to the loan is called the spread. Using a concrete example, for an interest rate of SIBOR + 1%, the +1% is the spread.

The spread is usually revised upward, after the first few years of the loan start-date. As an example:

Bank X SIBOR Loan

| Period | Interest Rate (p.a.) |

| First Year | 0.75% + 1-Month SIBOR |

| Second Year | 0.75% + 1-Month SIBOR |

| Third Year | 0.75% + 1-Month SIBOR |

| Fourth Year | 1.00% + 1-Month SIBOR |

| Thereafter | 1.25% + 1-Month SIBOR |

Advantages and Disadvantages of SIBOR and SOR

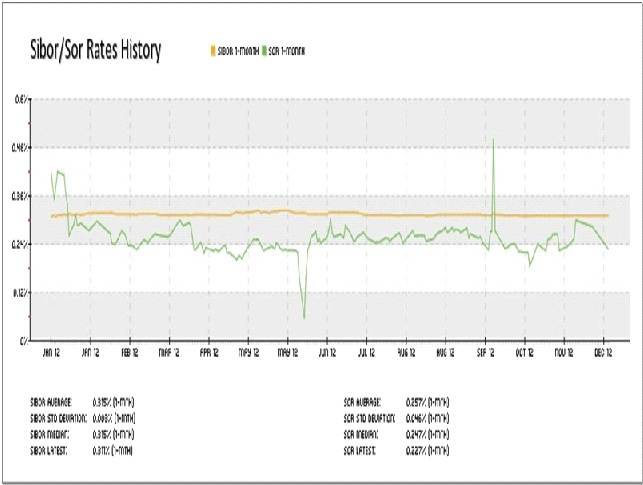

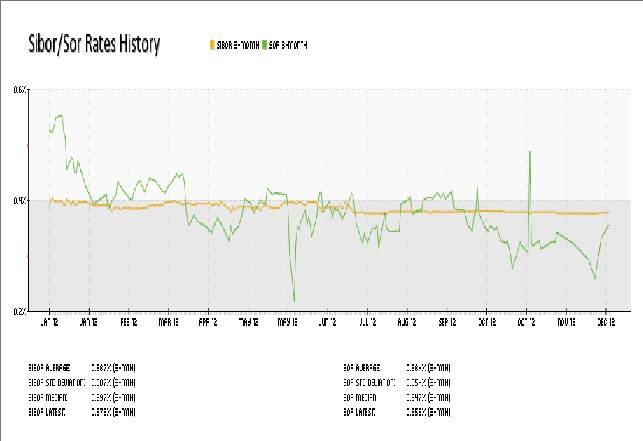

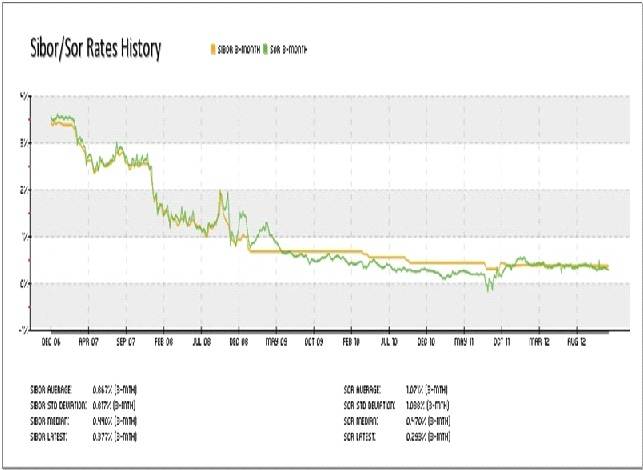

Contrary to popular belief, it is not always true that during a low interest rate environment, borrowers with a SOR-pegged package will necessarily enjoy lower rates than with a SIBOR-pegged loan. Although SOR and SIBOR are somewhat correlated, and the former tends to fluctuate more, the fluctuations of SOR can be above or below SIBOR. This is seen in Figure 1, 2 and 3, which show the most commonly used tenor of 1-month and 3-month.

Figure 1: 1-Month SIBOR/SOR for Jan 2012-Dec 2012

Source: www.iCompareLoan.com

Figure 2: 3-Month SIBOR/SOR for Jan 2012-Dec 2012

Source: www.iCompareLoan.com

Figure 3: 3-Month SIBOR/SOR for Dec 2006-Aug 2012

Source: www.iCompareLoan.com

Thus borrowers will be wise to focus on the spread instead. They should opt for packages with a reasonable spread throughout the loan duration.

Summarising the features of both SIBOR and SOR:

- Shorter tenor SIBOR has usually lower rates than the longer tenor SIBOR (Because it is riskier and there is a higher opportunity cost for longer term lending)

- Shorter tenor SIBOR is usually more volatile than the longer tenor SIBOR

- SIBOR fluctuates less than SOR

Thus, more risk-averse borrowers may prefer SIBOR loans as they provide more stability. But what tenor of SIBOR should they choose? Recently, banks started offering 1-month SIBOR packages to borrowers. This means an increased administrative cost for the banks.

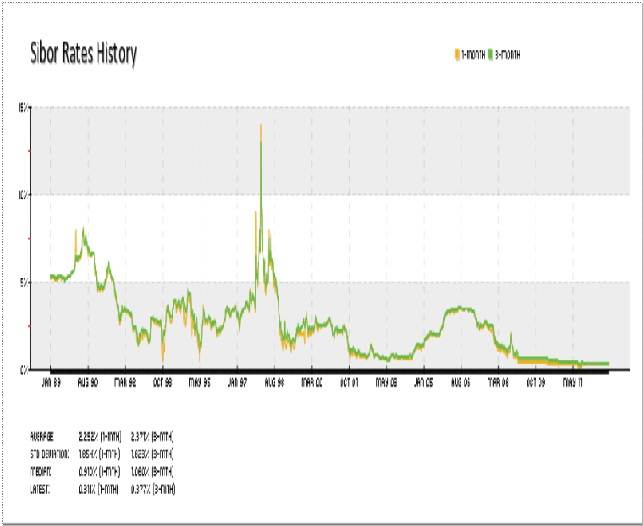

Figure 4: 1-Month and 3-Month SIBOR for Jan 1989-Dec 2012

Source: www.iCompareLoan.com

From Figure 4, a 1-month SIBOR is generally lower than a 3-month SIBOR as seen over the past 20 years, therefore borrowers may want to consider a 1-month SIBOR if the spread being offered is also attractive.

When to choose between 1-month SIBOR and 12-month SIBOR?

While a shorter tenor SIBOR may mean lower interest, but borrowers have to contend with greater instability as rates are revised at shorter intervals. For example, for a 1-month SIBOR the rate revision period can vary between 1 or 3 months, depending on the financing institutions. In contrast, with a 12-month SIBOR the borrowers may have to pay higher interest but the rate remains constant for 12 months.

Given the many factors to consider when deciding on the best loan package, the borrower may prefer to seek experts’ advice, like the free professional help available at www.iCompareLoan.com or simply fill up an enquiry form at http://www.iCompareLoan.com/contact

For advice on a new home loan.

For refinancing advice.

Download this article here.