Why rushing to pay off your flat might be the worst mistake of your life

A common piece of financial advice is to “pay off your home loan as soon as possible”. While this may be applicable in other countries, Singaporeans should think twice – rushing to pay off your flat has relatively few benefits, in exchange for the risk it brings. Here’s why it might be a bad idea:

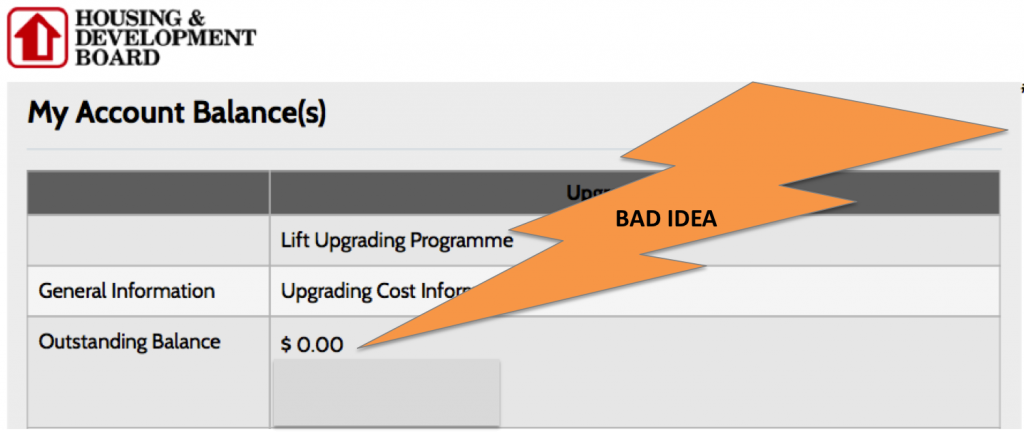

Image credits: HDB Flat – My Account Balance, Paul Ho, iCompareLoan.com

Why there are few advantages to paying off your flat early

The main reason most people want to pay off their flat is psychological: it might give you peace of mind to know that your home – a major debt – is paid up. But what if we told you that peace of mind can easily be shattered, and turned into a prolonged nightmare?

Here’s why:

- You cannot easily convert your flat to cash during emergencies

- You may not be making sufficient preparations for retirement

- You could be paying off your debts in the wrong order

- If you’re using a private bank loan, you will incur prepayment penalties

- You cannot easily convert your flat to cash during emergencies

Time and again, we come across Singaporeans with fully paid-up flats, who are so broke they’re re-using coffee powder. How does this happen? Let us explain:

Say you have $160,000 remaining on your HDB loan. After years of saving, you have managed to accumulate $100,000 – either in cash or your CPF.

Then you stumble across a web article that tells you to “end your debt! Pay off your home loan as soon as you can!”

You then take the $100,000, and pour it all into your HDB loan repayment. Congratulations, you now owe just $60,000.

A few weeks down the road, you encounter an emergency. Perhaps you lose your job, or a loved one needs expensive surgery. Consider your situation when that happens:

You have $0 to deal with the problem, as your $100,000 has been poured into your HDB loan. It’s true you only owe $60,000 on your flat now, but of what use is that? That isn’t going to help you pay your bills.

Ironically, it can even cost you the flat. If you lose your job and can’t pay the mortgage, you will lose your home even if you “only owe $60,000”.

But if you had kept the $100,000 in savings, you could have continued to service the mortgage for years, and had more time to find another income source. At the very least, you could have taken your time to sell and downgrade, making sure you got the best price.

So before you rush your loan repayment, decide if you’re prepared to deal with emergencies. If you insist on repaying your flat early, make sure you set aside sufficient savings for six months of your income first.

As an aside, note that borrowers who use a private bank loan have a partial solution to this. If they make a mistake and pay too early, they can use cash out refinancing (a home equity loan) to get money out of their house again. But this isn’t a cheap or fast option, and don’t always assume it’s available.

If you want to get money out of your house this way, speak to one of our mortgage experts at iCompareLoan.com. We’ll find you the best mortgage deal among all the local banks.

- You may not be making sufficient preparations for retirement

Instead of sinking a huge amount into early repayment, consider using the money for a retirement fund instead. This is safer than pouring all your money into the flat, and then considering the flat to be your retirement fund.

If you have a proper financial plan, you can build a comfortable retirement income, while still managing to pay off your flat before 62. For example:

Let’s say you borrow $315,000 for your HDB flat. At an interest rate of 2.6 per cent per annum (HDB Concessionary Loan), you would make monthly repayments of $1,261 over 30 years. Let’s also assume you are 35 years old when you take the loan.

Now, assume you’re able to set aside $500 a month in savings.

If you put that $500 a month into repaying your home loan faster (thus paying about $1,571 per month) you would pay off your HDB flat in more or less 22 years, instead of 30 years.

Your flat would be paid off by the time you are 57 years old. However, you wouldn’t have any retirement savings, as all of it has gone into the flat. Assuming you keep working to 65, eight years is a very short time to build a fund that will last the next 25 years (age 65 to 90).

However, let’s say you put that $500 a month in a well-balanced retirement portfolio instead; a mix of unit trusts, ETFs, endowment policies, etc. Over a period of 30 years, we’ll assume you get compounding returns of four per cent per annum – as most financial planners can tell you, this is realistic for the average investor.

After saving for 30 years, this retirement fund will grow to roughly $349,000. And as you’ve been repaying your HDB loan diligently, your flat will still be paid off by the time you’re 65. So you have both a fully paid-up flat, and almost $349,000.

- You could be paying off your debts in the wrong order

If you have high interest debts, such as credit card debts or personal loans, you are making a mistake by rushing your home loan repayment.

The average home loan rate from banks is about two per cent per annum, and HDB Concessionary Loans are 2.6 per cent per annum. This is peanuts compared to a personal loan or credit card loan.

Most personal loans compound at six to nine per cent per annum. Credit card loans balloon at an absurd 24 to 26 per cent per annum.

On top of that, consider that your home loan is well in hand anyway, if you service it with your CPF. The CPF OA rate is up to 3.5 per cent per annum, which is more than enough to cope with HDB loans and most bank loans.

On the other hand, nothing is helping with your credit card and personal loans, which snowball every month.

Always pay off your other debts first. Your home loan should be the last debt you pay off in your lifetime. Otherwise, you’ll finish paying for your flat just in time to sell it off to pay your other debts.

- If you are using a private bank loan, you will incur prepayment penalties

You will often hear the argument that, the sooner you repay your home loan, the less interest you will pay. If you are using a private bank loan, this may not be the case.

Banks don’t give up on the interest they’re owed, just because you decide to pay off your debts early. Most of the time, you can expect to pay about 1.5 per cent of the undisbursed loan amount (but it can be as high as twice this amount).

So before you try and prepay your home loan, make sure the penalties are worth it (hint: they’re probably not). If you’re not sure, contact our mortgage broker for some free advice.