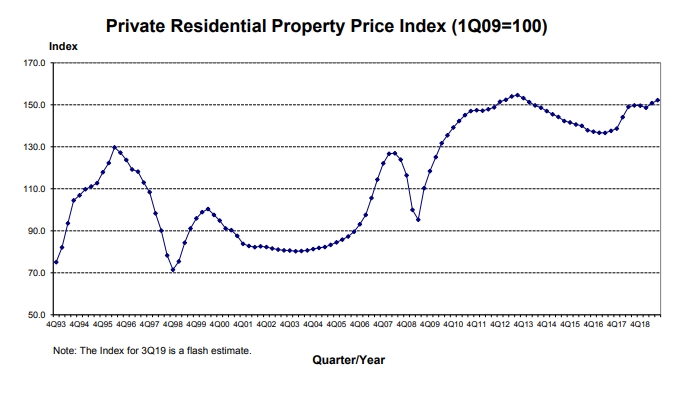

URA 3Q 2019 flash estimate showed private residential property index increased 1.4 points

The Urban Redevelopment Authority (URA) released the flash estimate of the price index for private residential property for 3rd Quarter 2019 on Oct 1. URA said that overall, the private residential property index increased 1.4 points from 150.8 points in 2nd Quarter 2019 to 152.2 points in 3rd Quarter 2019. This represents an increase of 0.9%, compared to the 1.5% increase in the previous quarter.

Prices of non-landed private residential properties increased by 2.9% in Core Central Region (CCR), compared to the 2.3% increase in the previous quarter. Prices in the Rest of Central Region (RCR) increased by 1.6%, after registering an increase of 3.5% in the previous quarter. Prices in Outside Central Region (OCR) increased by 0.7%, compared to the 0.4% increase in the previous quarter.

The flash estimates are compiled based on transaction prices given in contracts submitted for stamp duty payment and data on units sold by developers up till mid-September. The statistics will be updated on 25 October 2019 when URA releases its full set of real estate statistics for 3rd Quarter 2019. Past data have shown that the difference between the quarterly price changes indicated by the flash estimate and the actual price changes could be significant when the change is small. URA advised the public to interpret the flash estimates with caution.

<Whether you are looking for a new commercial loan or to refinance and existing one, our brokers can help you get everything right from calculating mortgage repayments, comparing interest rates, all through to securing the final loan. And the good thing is that all our services are free of charge.>

Commenting on the URA 3Q 2019 flash estimate, CBRE noted that it registered a positive change of 0.9% q-o-q, marking the second consecutive quarter of increase. This brings the year-to-date change for 2019 to +1.7% – in line with CBRE Research’s forecast of 0%-3% increase for 2019, and the view that the price index will continue to increase on the back of rising land prices.

Mr Desmond Sim, CBRE’s Head of Research for Southeast Asia, commenting on the URA 3Q 2019 flash estimate said, “the increase of price index this quarter was contributed by the strong performance in the non-landed private residential segment.”

He added, “in particular, prices in the CCR and RCR climbed by 2.9% q-o-q and 1.6% q-o-q, respectively, in Q3 2019. This can be attributed to the handful of successful launches which continue to drive the bulk of transactions. According to REALIS data, there were 3,044 new homes sold in Q3 2019 which accounted for 65% of all sales, as compared to 2,144 units in Q2 2019 which accounted for 51% of all sales.”

CBRE said that despite the rise in per-sq-ft prices, the total price quantum tends to hover at the same range – implying that buyers continue to lean towards smaller unit sizes. In Q3 2019, median unit sizes for new homes maintained at 710 sq ft, while prices remained at a palatable quantum of S$1,265,000 – a similar trend observed in the past few quarters. In addition, 72% of new home sales are transacted below S$1.5 million, which continues to be the sweet spot for investors.

CBRE Research expects that the property price index to remain relatively stable or show moderate growth for the rest of the year. This is in lieu of the increase in project launches in Q4 2019, where sales from new projects is likely to continue to drive up the per-sq-ft price. Underlying demand will still support the property market, though downward pressure will possibly materialise when unsold inventory piles up in the mid to long term.

Ms Tricia Song, Colliers International’s Head of Research for Singapore, commenting on the URA 3Q 2019 flash estimate said, “private residential property prices in Singapore rose for the second straight quarter in Q3 2019, supported by the resilient underlying demand for homes. Flash estimates from the Urban Redevelopment Authority (URA) on Tuesday (1 Oct) showed that private residential property prices climbed by a higher-than-expected 0.9% quarter-on-quarter (QOQ) in Q3 2019, after a surprise 1.5% uptick in the previous quarter.”

“Cumulatively, private home prices have risen 1.7% in the first nine months of 2019. With the Q3 2019 estimates out, private home prices are now 1.7% above the most recent peak in Q3 2018 (149.7) and 1.6% below its all-time peak in Q3 2013 (154.6).

Based on caveats downloaded on 30 September 2019, developers sold 3,083 new homes in Q3 2019 – up by 31.2% QOQ (2,350 in Q2 2019) and 2.4% year-on-year (YOY) (3,012 in Q3 2018). Meanwhile, secondary transactions stood at 1,957 units in Q3 2019, down 19.0% QOQ (from 2,416 in Q2 2019) and down 28.9% YOY (from 2,753 in Q2 2018).”

<If you are you planning to purchase a residential property but unsure of funding, contact iCompareLoan mortgage brokers as we can set you up on a path that can get you a commercial loan in a quick and seamless manner>

Ms Song added that the pace of price increase has slowed, coupled with a slower economy and that this was reflected in the URA 3Q 2019 flash estimate. “As such we do not expect the government to impose more cooling measures at this stage following two quarters of price growth.”

“For the full year 2019, Colliers Research now expects overall home prices to rise by 2% YOY, up from our initial growth forecast of 1%. We believe there is still some headroom for prices to rise – albeit it at a slower pace. That said, the cocktail of global risks and softer growth outlook will likely exert some pressure on pricing going forward, especially if there is a severe economic downturn.

There is still an ample launch pipeline which should keep prices stable. Potential launches include prime projects in CCR: Royalgreen (285 units, former Royalville), Pullman Residences (340 units, former Dunearn Gardens), Hylle on Holland (321 units, former Hollandia and The Estoril), One Holland Village (559 units), former Tulip Garden (672 units), Midtown Bay (219 units), former Pacific Mansion (376 units) etc.

In the city fringe, launches include: Verdale (258 units) and Amber Sea (132 units). Meanwhile, in the suburbs, potential launches include: Sengkang Grand Residences (682 units), Infini at East Coast (36 units), and Midwood (564 units).

The underlying demand for homes remains resilient and has supported sales and prices in recent months. In addition, the more benign interest rate environment is also favourable for the housing market.”