The rising rental prices in the Central Business District (CBD) of Singapore (which have risen 1.3 per cent Quarter on Quarter (QoQ)), is causing tenants to resist the increase instead of accepting the higher asking prices.

The 1.3 per cent rising rental prices comes after the last two quarters also showed the average gross rent for Grade A office space in the CBD rising. The rent hike over three consecutive quarters has brought rents up to $9.06 per sq ft (psf) per month. Moderate rental growth was also seen in the Grade AAA and AA office sectors, with rates in the AAA grade rising by 6.1 per cent between Q2 2017 to Q4 2017. The rise in asking rental prices has crept in as the number of office rentals in Singapore for the first quarter this year has dipped by 0.6 per cent QoQ.

Savills Singapore, a leading real estate service provider, has noted that while the decline in the number of office rentals indicates a healthy market, the increasing rental prices are slowing down the market.

Table of Contents

According to the Ministry of Trade and Industry (MTI), Singapore’s GDP growth for the first quarter of 2018 hit 4.3 per cent year-on-year (YoY), higher than the 3.6 per cent growth in Q4 of last year. This was bolstered by the manufacturing sector, which grew 10.1 per cent YoY, and the services industry, led by finance & insurance and wholesale & retail trade, which registered 3.8 per cent YoY growth.

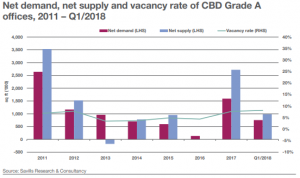

On the back of stronger than expected economic growth, the office leasing market remained healthy in Q1. Based on data from the Urban Redevelopment Authority (URA), a total of 1,2641 office leases commenced in the first quarter of 2018, inching down 0.6 per cent from a quarter ago.

However, leasing activity in the CBD has slowed slightly due to the hike in asking rents. While the strengthening economy has lifted business sentiment and encouraged business expansion, manpower and operating costs remain key concerns for most companies here.

In light of increasing rental prices, cost conscious tenants are deciding either to pull down their expansion plans or relocate their middle/back offices to city fringe or regional centres so as to release space for core business. On the other side, landlords, particularly those owning premium buildings with tight vacancy, continue to be in a strong position during rental negotiations.

This has caused a stalemate in the market, which is expected to continue in the coming quarters. As one of the major completions expected in 2018, Paya Lebar Quarter (PLQ), located next to Paya Lebar MRT Station, has secured tenants for more than half of its nearly one million sq ft of office space, ahead of its scheduled opening in Q3 2018.

This has caused a stalemate in the market, which is expected to continue in the coming quarters. As one of the major completions expected in 2018, Paya Lebar Quarter (PLQ), located next to Paya Lebar MRT Station, has secured tenants for more than half of its nearly one million sq ft of office space, ahead of its scheduled opening in Q3 2018.

The SMRT Corporation has taken up three levels for about 100,000 sq ft of space in one of PLQ’s three office towers, and will move its headquarters from North Bridge Road to this new location next year. At the same time, up to 15% of available office space in PLQ will be used to house co-working facilities, which will allow smaller start-ups to network and partner with established companies on special projects.

Savills Singapore’s research senior director, Alan Cheong, pointed out that the market views that the downside risks in the office leasing market are decreasing, especially given the healthy precommitment shown by the market in two upcoming developments – Frasers Tower at Cecil Street and Paya Lebar Quarter (PLQ) – and given the quick absorption of secondary stock.

Cheong added: “However, due to tenants increasing resistance to rent hikes and the widening rental gap between the CBD and outside the CBD, demand for CBD office space may divert to sites on the city fringe and in regional centres, and even in business parks if tenants can meet the qualifications for use.”

The hike in both prices and rents is no surprise to Cheong, due to the improved sentiment amongst buyers, landlords and tenants: “For rents, the healthy pre-commitment by tenants last year helped absorb a substantial amount of space in the new builds. On top of that, the secondary space found replacement tenants in the form of co-working spaces.”

Calling co-working space operators “the major lifeline for CBD office buildings” over the past two years, Cheong noted that the amount of floor space co-working space operators have occupied is about 390,000 sq ft, through the end of 2017. He said: “Although quite a few of the operators did not take up prime Grade A office space, they nevertheless soaked up the backfill or secondary space vacated by tenants moving to new builds.”

Cheong only expects the demand for CBD office space from co-working space operators to climb and predicted that demand from such space operators could reach 600,000 sq ft from this year onwards. Half of these spaces will be housed in secondary areas, Cheong forecast. He added: “Consequently, landlords expect the momentum from 2017’s strong take-up to spill over into 2018 and thus have been bold in asking for higher rents.”

Cheong also expects Grade A space rents to rise since all parties involved with office leasing are heading in positive directions, in terms of their respective businesses. Cheong shared, “Already, there is evidence of such optimism as $15 psf has been achieved for partial floor lettings in the Marina Bay area. This may rise to $16 psf by the latter part of 2018.”

The only thing the market seems to ignore, according to Cheong, is that a sizeable portion of rental demand will come from alternative or disruptive-model businesses, over the past few years and throughout the rest of this year. Noting that these businesses have quite a way to go before registering positive cash flow, Cheong concluded: “This is a major risk factor, but for now, barring any blowout in the disruptive business economy, we maintain our view that CBD Grade A office rents are expected to rise 10% YoY by Q4.”

—

If you are real estate hunting for a office property (either to make it your own or for investment), our Panel of Property agents and the mortgage consultants at icompareloan.com can help you with affordability assessment and a promotional home loan. Just email our chief mortgage consultant, Paul Ho, with your name, email and phone number at paul@icompareloan.com.