A CPF grant which assists Singapore Citizens live with or near their child or parents is the Proximity Housing Grant (PHG). The PHG was introduced to help more families to buy a resale flat to live with or close to each other for mutual care and support.

This particular CPF grant is meant to help a family, especially married/ engaged couples or families who are buying an HDB resale flat to live with or near their parents/ child. The CPF Grant is also meant to help Singles buying an HDB resale flat to live with or near their parents.

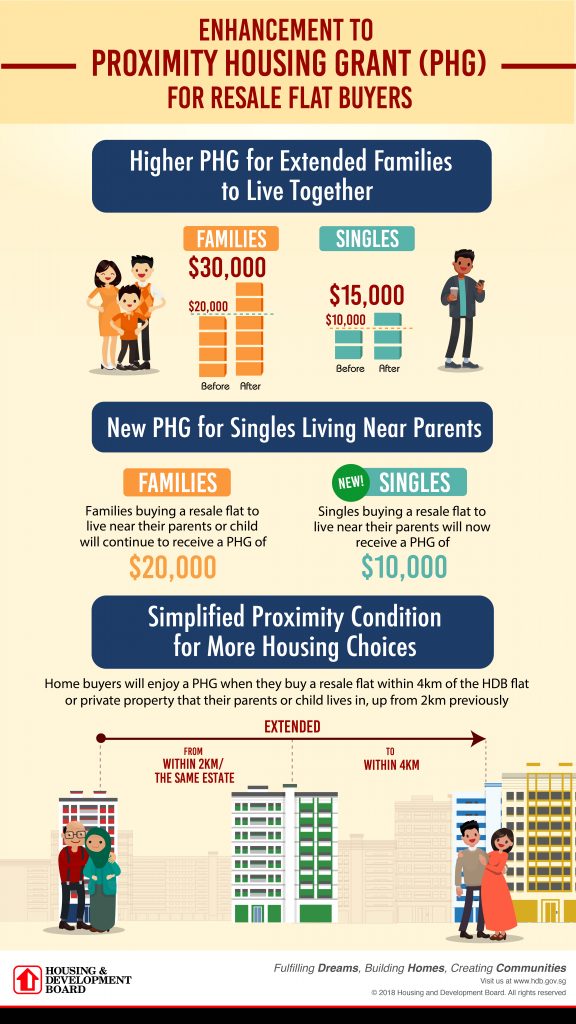

This CPF grant provides amounts ranging from $10,000 – $30,000 for buyers of resale HDB flats.

Table of Contents

Recipients of this CPF grant may also be eligible for CPF Housing Grant for Family, or CPF Housing Grant for Singles. They may further qualify for the Additional CPF Housing Grant. The citizenship, age and family nucleus requirements to be eligible for this CPF grant are similar to CPF Housing Grant Scheme for Single Singapore Citizen Applicants and First-Timer Applicants.

https://www.icompareloan.com/resources/cpf-housing-grant-scheme/

For the CPF grant to be disbursed, you must not have received the PHG previously, and there is also the Proximity Condition.

The Proximity Condition specifies that the parents/ child must be living with you in the resale flat you intend to buy; or must be living in an HDB flat or a private residential property, which is within 4 km of the resale flat you intend to buy.

Applicants also have to note that as for the parents/ child helping the grant applicant qualify for the PHG, at least one of them must be a Singapore Permanent Resident. If your parents/ child do not own the private residential property, it must be owned by their immediate family members (defined as child or adopted child, parent(s) or parent(s)-in-law, or siblings).

Singles living near parents may use the PHG to buy a 2 to 5-room flat, while singles living with parents may use the grant to buy any flat type. The remaining Lease of Flat for the resale flat has to be at least 30 years.

Applicants have to note that having no income doesn’t entitle you to more grants. While CPF grants are typically higher for those with lower income, no income means you can’t service your home loan and that cuts you out. For example, the Additional CPF Housing Grant and Special CPF Housing Grant are applicable only if one of the flat buyers have worked continuously for at least one year. This is to ensure you can finance your home loan.

If you are thinking of selling your flat and applying for the same grants in getting a new flat, please do not be under this illusion as most grants apply for first time home applicants. Also, if you have intentions to sell your flat to buy another one, be prepared to pay a resale levy (please see below).

| First subsidised Housing Type | Resale Levy Amount | |

| Households | Singles Grant Recipients | |

| 2-room flat | $15,000 | $7,500 |

| 3-room flat | $30,000 | $15,000 |

| 4-room flat | $40,000 | $20,000 |

| 5-room flat | $45,000 | $22,500 |

| Executive flat | $50,000 | $25,000 |

| Executive Condominium | $55,000 | Not Applicable |

| (Source: HDB Resale Levy amount, Adapted by iCompareLoan.com, HDB)http://www.hdb.gov.sg/cs/infoweb/residential/selling-a-flat/additional-information | ||

Table 2: HDB Flat Resale Levy amount, adapted by iCompareloan, HDB

Be mindful that a CPF grant is not cash handout, neither is it a loan. It has to be returned to your CPF account.

Most CPF grants are for first time applicants so do use it carefully. After taking the grant, the balance outstanding amount will need to be financed from a home loan. You can consider taking a HDB home loan which is currently charging you 2.6% or a HDB flat home loan from the bank which is much lower at 1.5% to 1.9% range (correct at the time of publishing). If your interest cost is too high, you will end up withdrawing too much CPF to pay for your house, then when you sell your house, you may end up with NO CASH. If you intend to take a bank’s HDB home loan, you can read more about the mortgage loan terminology.

Written by: Phoenix Lee/Contributor iCompareLoan

How to Secure the Best Home Loans Quickly

iCompareLoan is the best infomercial loans portal for home-seekers, buyers, investors and real estate agents alike in Singapore. On iCompareLoan, you will be able to find all the latest news and views, informational guides, bank lending rates and property buying trends, and research data and analysis.

Whether you are looking to buy, sell or refinance apartments, condominiums, executive condos, HDB flats, landed houses or commercial properties, we bring you Singapore’s most comprehensive and up-to-date property news and best home loans trends to facilitate your property buying decisions.

Our Affordability Tools help you make better property buying decisions. iCompareLoan Calculators help you ascertain the fair value of a property and find properties below market value in Singapore.

Our trademarked Home Loan Report is Singapore’s first one-of-a-kind analysis platform that provides latest updates of detailed loan packages and helps property agents, financial advisors and mortgage brokers analyse best home loan packages for their clients, so that they may give unbiased home loan/commercial loan analysis for their property buyers and home owners. Our distinguished Panel of Property Agents who are users of our Home Loan report can give the best all-rounded advise to real estate seekers.

All the services of our mortgage consultants are ABSOLUTELY FREE, which means it’s all worth it to secure a loan through us.

Whether it is best home loans, best commercial loans or refinancing of existing loans or SME loans, CONTACT US TODAY!