An Orange Tee & Tie report said that the HDB resale market has received a new lease of life with the new Government policy changes announced in May.

The report highlighted:

- The HDB resale market received a new lease of life after the Government announced new policy changes in May.

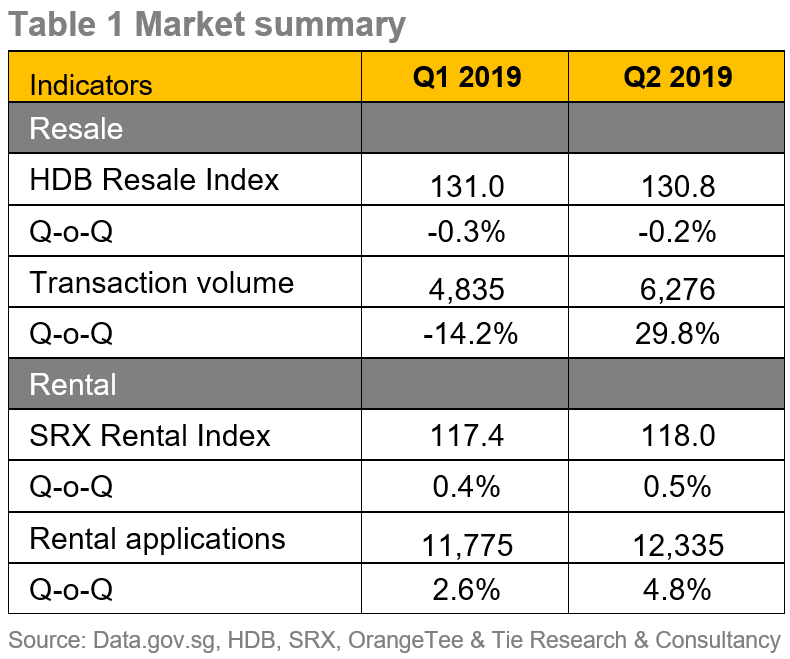

- Resale transactions rose 29.8 per cent quarter-on-quarter (q-o-q) to 6,276 units in Q2 2019, the first-time sales volume had increased since Q3 2018.

- Resale price index slipped by a marginally slower pace of 0.2 per cent in the second quarter of this year.

- Demand for older flats surged two months after the recent policy changes. 4 and 5 room HDB flats above 30 years old saw a larger increase in sales volume.

- The number of approved applications for rent rose 4.8 per cent to 12,335 cases in Q2 2019.

The report said that the HDB resale market may have received a new lease of life after the Government announced new changes that allow property buyers greater flexibility in using their Central Provident Fund (CPF) and get bigger housing loans for their property purchases, so long as the property’s remaining lease covers the youngest buyer till the age of 95.

Table of Contents

“Based on the latest HDB public housing data, the volume of resale transactions surged 29.8 per cent in Q2 2019 to 6,276 units (Table 1). This is the first-time sales volume had increased since Q3 2018. For the first half of this year, 11,111 resale transactions were recorded, up 6.8 per cent from H1 2018.

While the second quarter usually sees an uptick in sales activity and more units changing hands, resale transactions have also spiked 5.6 per cent year-on-year (y-o-y). This indicates that apart from a seasonal effect, the recent CPF changes may have been a major catalyst that has spurred buying demand last quarter.

The policy changes may revive demand for older flats in the coming months. Detailed analysis of HDB resale data downloaded from data.gov.sg (based on the latest update provided on July 8 2019) shows a significant surge in the number of older flats being sold two months after the policy implementation.”

4 and 5 room flats in the HDB Resale Market that are above 30 years old saw a bigger surge in sales volume when compared to other flat types.

The report said that due to the improving sentiment and revival of buying interest for older flats, HDB resale prices have declined at a marginally slower pace of 0.2 per cent in the second quarter of this year, when compared to the 0.3 per cent decline in the previous quarter. While this is a fourth consecutive quarterly decrease, prices have dipped less than one per cent over the past year indicating that the price decline has largely stabilized.

The report added that recent policy changes intended to spur demand for older flats in the HDB Resale Market may be seeing early success.

“Demand for older flats has seen a significant spike two months after the policy implementation. The positive market response is aligned with the Minister for National Development Lawrence Wong’s intention of improving the liquidity of the resale market and making it easier for people to buy and sell old flats.

Based on HDB resale data downloaded from data.gov.sg on 16 July 2019, resale transactions for older flats spiked two months after the policy changes. The number of resale transactions for flats that are 40 years old and above rose 40.0 per cent from 403 units in May-June 2018 to 564 units in May-June 2019. Sales of flats that are 30 years old but under 40 years have similarly risen 10.4 per cent to 1,219 units over the same period.

There were many concerns raised about the depreciating value of older flats in the earlier part of last year and many sellers were struggling to find a buyer. Therefore, the y-o-y increase is considered commendable and could signal that the recent policy changes may have started to take effect in helping to spur demand for older flats.

While sales volume of flats below 10 years old has also increased substantially over the same period, the increase may be attributed more to a surge in housing supply of flats reaching their five-year Minimum Occupation Period (MOP), rather than the policy changes.”

The report noted that the HDB resale market may continue to benefit from the new policy changes. With more public education, concerns surrounding the lease decay issue may start focusing on a new narrative that emphasizes the importance of financial and retirement planning when a buyer makes a property purchase.

Secure the Best Home Loan Quickly

Do you want to buy a private residential property but are unsure of securing funds? Don’t worry because iCompareLoan mortgage brokers can set you up on a path that can get you a commercial loan in a quick and seamless manner.

Alternatively you can read more about the Best Home Loans in Singapore before deciding on your next purchase. Our brokers have close links with the best lenders in town and can help you compare Singapore’s best commercial loans and settle for a loan package that best suits your commercial purchase needs.

Whether you are looking for a new commercial loan or for a refinancing package for your commercial properties, our brokers can help you get everything right from calculating mortgage repayment, comparing interest rates, all through to securing the best commercial loans which fits your profile. And the good thing is that all our services are free of charge. So it is all worth it to secure the best commercial loans through us.

You may contact us today for advice on a new home or refinancing advice, or for Personal Finance advice.

You may also speak to our Panel of Property agents.