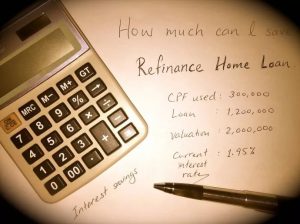

How to do home loan refinancing responsibly? How do you gain extra cash, lock in a fixed payment, lower your payment or increase your cash flow by paying off high interest debt?

By: Hitesh Khan/

These are some of the questions surrounding the benefits and options available to you for home loan refinancing.

Table of Contents

There are many things to consider when you are thinking of home loan refinancing and it is important to talk about your loan options with your loan officer. Because the fees associated with refinancing can add up quickly, many mortgage companies waive the fees which may result in a slightly higher percentage than expected.

The amount of time you plan to spend in your home will also impact your decision on home loan refinancing, so so home owner should obtain the lowest percentage rate possible. It is essential to be informed about refinancing options, rates and expenses.

Refinance Tips – Below are several factors you should consider before you decide to do home loan refinancing.

Evaluate Your Assets

Saving money is important to many consumers in today’s economy, and refinancing your home loan is one way you can lower your monthly payments. A careful analysis combined with the advice of your mortgage broker will ensure that you make the right decision.

Deciding to Refinance

The decision on whether or not to refinance has, in the past, meant balancing the savings of a lower monthly payment against the costs of refinancing. In recent years, some mortgage brokers have introduced “no cost” and low-cost refinancing packages that minimize or completely eliminate the out-of-pocket expenses of refinancing. With traditional refinancing, the interest rate for your new mortgage is often about two percentage points below the rate of your current mortgage. However, with the newer low and no-cost refinancing programs offered, home owners can find it valuable to refinance to obtain a smaller reduction in interest rates.

Cash Out Refinance

Many mortgage lenders will offer a refinance package where you refinance for more than the balance remaining on your old home loan. In the mortgage world this is called “cashing out”. The economy has also caused interest rates to drop recently which may allow you to refinance your home without increasing your monthly payments. The extra cash that results from refinancing can be used for many purposes; one of the smartest ways to use these funds is to pay off any loans with higher interest rates. If you are in a positive position regarding debt, you may be interested in using the money for a more enjoyable purpose, such as investing in real estate. However you decide to spend the money, your mortgage broker can help you through the process.

Will My Rate be Affected?

When homeowners make the decision to refinance their home loan they must decide which interest rate will work best for their situation. There is typically a range of interest rates and when you work with your home loan advisor you will be able to analyze the different interest rates which can save you money. Be sure to discuss all options with your home loan advisor before making a decision.

Refinance Expenses

The costs associated with refinancing are similar to those of obtaining an original home loan and include legal fees, application fees, settlement costs and other related fees. When refinancing, additional fees will arise and they can include a fee charged if you paid off your original mortgage early, and the home loan interest rate. You should discuss with a mortgage broker the various costs and fees charged by lender and the potential savings you can benefit from.

Your Second Refinance

Refinancing may be worth your while if you can reduce your monthly payments. The money that you save can be used to build emergency cash funds, or save it for a child’s education.

Converting Your ARM to a Fixed Rate

Homeowners have two rate options when refinancing their home loan, fixed rate mortgages and adjustable rate mortgages, often referred to as ARMs. ARMs are attractive in today’s economy because they offer very low introductory rates. But, due to financial market instability these rates can jump quickly and homeowners may find themselves paying more than they had bargained for. Adjustable rate mortgages are not always unpredictable, though; homeowners who know the length of time they plan to stay in their home may secure an ARM for that specific amount of time, which will save the homeowner money and avoid rising payments.

Refinance and Taxes

Many homeowners find the tax issues related to the home loan refinance process confusing, but your mortgage broker will guide you through the process.

There is good reason why homeowners are unsure and unfamiliar on how to get the best deal interest rates for their home loans. Most don’t buy homes as often as you buy other necessities (like food and clothes). But actually, there is no reason why you should contribute to the banks’ profits when you can keep the difference in interest rates.

All such homeowners need to do is, look for a mortgage specialist. The mortgage specialists will give them the advice that they need at zero cost to the homeowners. In case you are wondering why the service by the mortgage broker is free to the borrower – it is because the lenders will pay the mortgage broker a distribution fee upon successful disbursement of loan.

Mr Paul Ho, chief mortgage officer at iCompareLoan, said, “when sibors drop, banks increase the spread. For example when sibor was 1.5% Sibor + 0.2% was available, and when Sibor was 1%, banks will raise the spread – it becomes Sibor + 0.35%, etc, as it is now.”