This article has also been quoted on South China Morning Post – Sunday – 9th Aug 2015

Introduction

Table of Contents

Aging population is a problem Hong Kong shares with Singapore. Aging population and longer life expectancy is a major issue that will cripple any nation in finances.

Both HK and Singapore share similar characteristics of high population density, elevated housing prices and aging population.

More Contribution in Singapore’s CPF than HK’s MPF

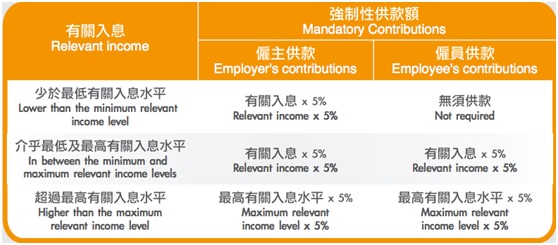

• Hong Kong’s Mandatory Pension Fund (MPF) is purely used for retirement needs. MPF allows members to select their own funds to invest in. The maximum contribution income ceiling is HK$30,000. Employer pays 5% and Employee pays 5%.

• Singapore’s Central Provident Fund (CPF) is used for many things. The maximum contribution income ceiling is S$5,500 and the employer/employee contribution depends on age. Typically Employer pays 16% and employee pays 20%.

HK’s MPF has Higher Returns than Singapore’s CPF

• MPF recorded an annualized 5.5% returns (net of fees) between 2000 and 2010. (http://www.mpfa.org.hk/eng/information_centre/publications/research_reports/files/10_year_performance_English.pdf)

• Singapore’s CPF ranges from 2.5% for the Ordinary account to 4% for the special account and is less efficient as the Singapore government makes use of these compulsory funds to invest and obtain between 6 to 16% of returns while giving back only 2.5% to 4%.

Singapore’s CPF has many uses compared to HK’s MPF

• MPF is currently limited to only 10% of a person’s salary. (Reference 1) and does not have as much funds as Singapore’s CPF despite higher returns as Singapore’s CPF runs into the mid 30% of an employed person’s gross salary (depending on age). MPF is only used for buying funds and bonds.

• Singapore’s CPF has been tweaked to be used for housing, children’s education, for medical care (under Medisave) and hospitalization, annuity (under Retirement Account) as well as Investment account if you have more than $20,000 in CPF ordinary account (OA) or $40,000 in Special account (SA).

Problems faced by HK residents

The major costs of retirements would be living cost such as food and housing, medical care. According to Hong Kong Housing Authority, there is still about 30% of residential stock being Public Rental Housing and there is a waiting queue of 3 years.

Subsidised rental units average HK$1500 per month, this cost may be reasonable for a household of 2 earning HK$10,000 a month. Hence paying rent is not a major issue if the household is gainfully employed.

There will be a problem though if one receives an increment breaching the salary ceiling of public housing. Will they be evicted from the rental unit and become homeless? If there is a danger that means testing will fail them and they should be kicked out of public subsidized housing, then a vicious cycle will form where these residents will be stuck in low income. This is because they will not be able to afford the rental for private housing while they will not be able to save enough for down payment for public housing. This leads them to seek out lower paying jobs so as not to breach the income ceiling.

For the rest of the households that do not qualify for subsidized housing, they would need to buy private housing. Often it is the down payment of 30% to 40% (Reference 3) that stops them from buying their own house. These group of people will be stuck in the renting trap and unable to build up their assets and nest eggs.

As I am not a resident of HK, I shall not dwell further into the myriad problems of which I have no deep understanding.

What can MPF potentially learn from Singapore?

MPF can extend its role to include housing down payments.

Suggestions: –

• An extra 3% contribution can come from the employer for people earning less than HK$30,000;

• And another 2% from employee earning above HK$10,000.

By increasing the contribution, these savings can be channeled into an account within MPF meant for property down payment. On top of that, MPF could also allow existing funds to be liquidated from funds to be used only for housing down payment.

While providing liquidity via MPF for down payment may somewhat raise property prices, but HK Monetary Authority’s guidelines on Debt Servicing Ratio (DSR) still applies. With DSR in place, the developers may not be able to price their properties too high, out of reach of residents.

This could free many HK residents from the rental trap where most of their money ends up in paying rent and buying food. There will be no money to retire if they are still renting a place when they reach retirement age. This will be an outcome that MPF do not want to see.

For the lower income earners, extra funding should come from employers into the MPF for education, either for them or for their children. This will ensure greater social mobility for people to move up should they work hard for it.

References: –

1. MPF Scheme Authority, HK.

2. Hong Kong Housing Authority.

3. HK Monetary Authority, Guideline No. 5.9.4, Property Lending,

http://www.hkma.gov.hk/eng/key-information/guidelines-and-circulars/guidelines/guide_594b.shtml

What does iCompareLoan.com do?

www.iCompareLoan.com is a Loan Portal and a Mortgage & Loan broker, helping property buyers and home owners to get the best fit home loan and business owners obtain Business loans for business expansion.

Home Loan Report ™ is Singapore’s first Cloud based Home Loan Report ™ platform to be used by Property agents, financial advisors as well as other Mortgage brokers to prepare reports for their customers.

Home Loan Report ™ – Enterprise allows a property agent’s website to immediately add a loan section. Improve your Google Ranking, let’s viewers increase Time-on-site. Property or Finance sites that deployed Home Loan Report ™ – Enterprise loan section sees viewers stay on their site longer by between 30% to 350% after 4 to 8 weeks of installing the Embedded Loan Plugins.

About PAUL HO:

Paul holds an a B.Eng(Hons) Aberdeen University (UK) and a Masters of Business Administration (MBA) from a Macquarie Graduate School of Business (MGSM) Australia. He also serves as current President of Macquarie University Alumni Association of Singapore and Hon. Secretary of British Alumni.

He is founder of www.iCompareLoan.com, his articles have been syndicated/featured on STproperty, iProperty, BTInvest, TheEdgeProperty, Propwise, Propquest, Yahoo and TheOnlineCitizen amongst many other sites.

He has also given speeches, guest speeches, trainings and/or seminars at NUH Lunch time talk, iProperty, David Poh and Associates, Getty Goh’s Ascendant Asset property, NTU (Guest Lecture on SEO), Panel discussions at GPS Alliance, C&H, Skillup just to name a few.

He is passionate about helping people enhance their wealth and in making money work harder for them.

Copyright © – www.iCompareLoan.com

For advice on a new home loan.

For refinancing advice.

For advice on a personal loan.

Download this article here.