OCBC Home Loan

Table of Contents

OCBC Launched OHR Home Loan in Early October 2017. OHR stands for OCBC Home Rate. OHR home loan rates are based on OHR + spread while OHR is based on the long term average, 12-year moving average of the 1-month Sibor and 3-month Sibor as a reference.

You can also read more about the Best OCBC home loans have to offer and what they have offered in the past.

https://www.icompareloan.com/resources/best-ocbc-home-loans-guide-trend/

If you want to search loans across the banks.

How does OCBC OHR Home Loan Package work?

- OHR + Spread

At the time of the publishing, OHR was set at 1%, while Spread is 0.35%.

So for illustration: –

- OHR + Spread = 1% + 0.35% = 1.35%

How is OHR derived? How exactly does OCBC home loan work?

OCBC OHR rate is referenced to, but NOT pegged to the 12 years daily average of one-month Sibor and three-month Sibor. This means that a day-to-day Sibor movement, even an entire year of Sibor movement is unlikely to move the 12-year sliding average rate by much.

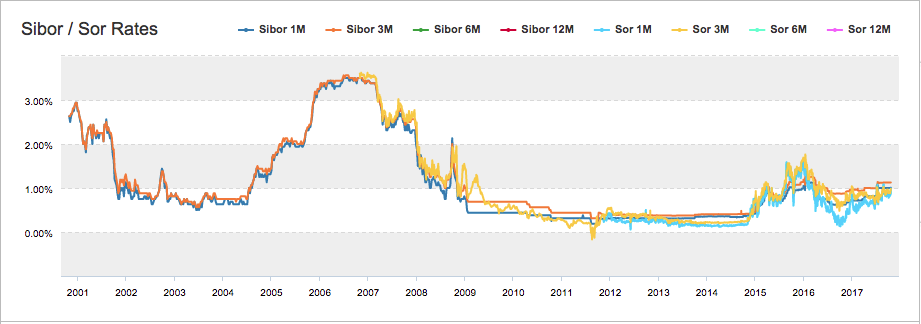

Chart 1: 1-month Sibor and 3-month Sibor from 2000 to 2017, ABS, iCompareLoan.com

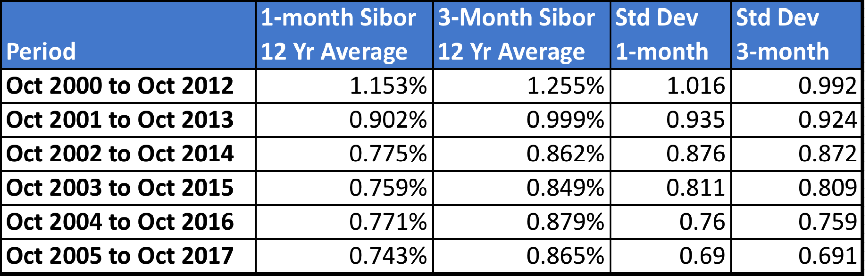

Table 1: 12-year average of 1-month Sibor and 3-month Sibor, ABS, iCompareLoan.com

OHR is set at 1% (Nov 2017). By looking at the 12-year average of the Sibor (1-month) and Sibor (3-month), both the 1-month Sibor and 3-month Sibor are all below 1%.

In fact, we ran the moving average from 2000 to 2012, 2001 to 2013, 2002 to 2014, 2003 to 2015, 2004 to 2016 and 2005 to 2017 and all the averages came in under 1%. Of course OCBC OHR is referenced to 12 year Sibor average, but not pegged to it, this we have to be mindful of.

If you take a look at the Chart 1 (above), you will see that Sibor did indeed have a few bumps, but that did not move the 12-year average much.

Since OCBC sets OHR at 1% based on observing the 12-year average of the Sibor (1-month) average and the Sibor (3-month) average, both of them are under 1%, we can very safely say that even if Sibor were to start rising in 2018, 2019 and 2020, the 12-year average of the 1-month Sibor and 3-month Sibor would only move up very slightly.

While OCBC’s OHR pegged home loan package is still not a fixed rate package, it still can change, it bears very strong characteristic of a Fixed Rate package. OCBC OHR package potentially has stronger Fixed Rate characteristics than that of the Fixed Home Rate (FHR) or FDMR or FDPR or other home loans pegged to fixed deposit rates.

OCBC’s OHR variable rate package would easily be the home loan with the strongest “Fixed Rate” characteristic in the market place right now based on these analysis while giving you rates as low as Floating Rate packages.

So much about OCBC OHR, let us examine some potential beneficial clauses for the Home Owner.

Partial Prepayment Fees – HYBRID

Although the loan comes with locked-in, sometimes banks allow Partial Prepayment waiver.

As an illustration, banks in general could sometimes offer such clauses which is a hybrid of Locked-in with partial prepayment penalty, but with some waiver clauses such as:

“1.5% penalty on loan amount prepaid. However, you are allowed to pay down during lock-in without any penalty as long as you maintain at least 50% of your original loan amount.”

Enbloc Fever – Reduced PENALTY for Redeeming your Home Loan

If you own a condominium in an older condominium estate, you may end up being enbloc. If such a situation occurs, then you will end up having to redeem your housing loan, also know as “Full Redemption” or Pay up your home loan.

Under such a scenario, many home owners may put off refinancing home loan and endure higher home loan rates for an enbloc that may or may not happen, incurring thousands of dollars of extra interest cost.

Clauses such as these are often very welcomed: –

“If you pay off the loan in full within 2 years from the date we release the loan, there is a prepayment fee of 1.5% of the outstanding loan amount as of the date we receive your prepayment notice.

Penalty is reduced to 0.75% if it is due to a sale of your property – subject to written confirmation from your solicitors.”

So refinancing your home loan or getting a mortgage can have some technicalities. You could check out a Mortgage broker who could guide you along and best of all, it is free-of-charge to you as they receive a fixed distribution fee from the bank. What could you lose?

Connect with iCompareLoan on Facebook or

Connect with Paul Ho on Linkedin if you do not yet have any questions to ask and just want to stay updated on the property market.

Search OCBC Bank Home loan Rates.