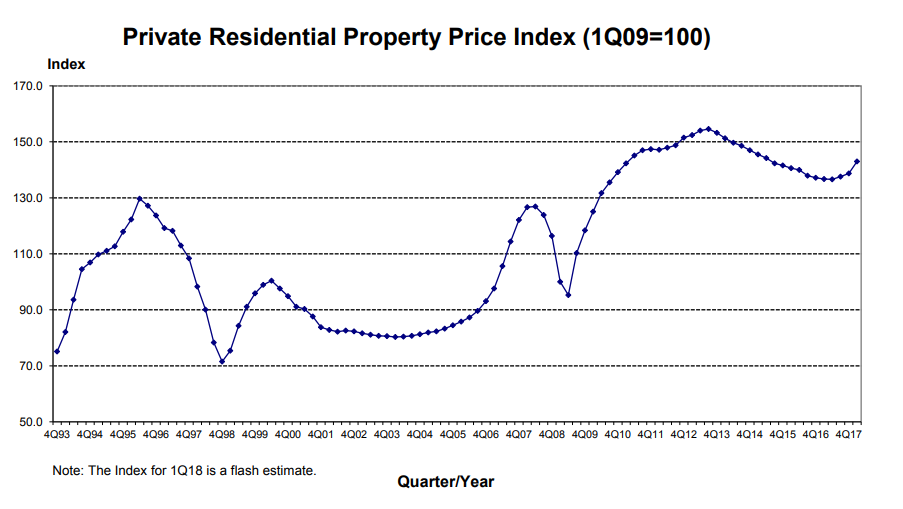

Private residential property saw the highest quarterly increase in 8 years. The Urban Redevelopment Authority (URA) revealed this in its flash estimate of the price index for private residential property for 1st Quarter 2018 today.

Overall, the private residential property index increased 4.3 points from 138.7 points in 4th Quarter 2017 to 143.0 points in 1st Quarter 2018. This represents an increase of 3.1%, compared to the 0.8% increase in the previous quarter.

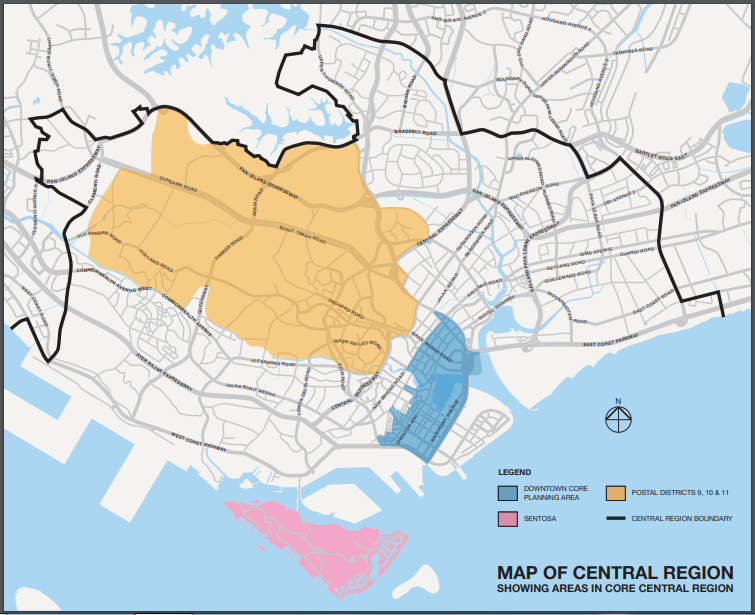

Prices of non-landed private residential properties increased by 5.0% in Core Central Region (CCR), compared to the 1.4% increase in the previous quarter. Core Central Region comprises Postal Districts 9, 10, 11, Downtown Core Planning Area and Sentosa.

Prices in the Rest of Central Region (RCR) increased by 1.1%, after registering an increase of 0.4% in the previous quarter. Prices in Outside Central Region (OCR) increased by 3.8%, after registering a 0.8% increase in the previous quarter.

The flash estimates are compiled based on transaction prices given in contracts submitted for stamp duty payment and data on units sold by developers up till mid-March. URA said that its statistics will be updated on 27 April when it releases its full set of real estate statistics for 1st Quarter 2018.

Past data have shown that the difference between the quarterly price changes indicated by the flash estimate and the actual price changes could be significant when the change is small. URA advised the public to interpret the flash estimates with caution.

Market sentiments for private residential property remain upbeat despite sales of new homes dropping in February 2018. The data for February home sales showed that sales of new homes fell by 28 per cent from the sales in January 2018. But this lower numbers is not indicative of a slump of the property market’s recovery. Analysts attributed the drop to the traditional Chinese New Year lull, with the festivities taking place in February this year.

https://www.icompareloan.com/resources/demand-landed-properties-will-heat-heels-en-bloc-sales/

Another sign that the private property market sentiments are upbeat is the increasing rental prices. Private non-landed home rents rose by 1 per cent in February 2018 from a month ago, higher than the 0.5 per cent rise in January.

When compared to a year ago, rental prices are 0.7 per cent lower, and 18.8 per cent lower than January 2013’s peak rental price. But the overall positive property market sentiments has continued well into 2018, with 3,376 units being tenanted last month.

The positive residential property market sentiments is further reflected in the largest collective sale in more than 10 years – with the sale of Pacific Mansion for S$980 million. This sale marked the largest sale since Farrer Court was divested at $1.34 billion in 2007.

Even the the recent hike to the top marginal rate for buyer’s stamp duty (BSD) is not expected to dent the market optimism. Augustine Tan, president of the Real Estate Developers’ Association of Singapore (Redas), said the new revised BSD “may add some friction to transaction volumes as buyers remain price-sensitive (but) it is unlikely to derail the recovery (of the property market).”

However, in an environment of rising interest rates, buyers of investment properties should exercise more caution with the type of mortgage loan they require to buy their private residential property. You could save thousands if you are guided by an experienced mortgage broker.

https://www.icompareloan.com/resources/enbloc-sales-huge-property-supply/