Property valuation Singapore, knowing how to calculate the property valuation is of paramount importance to a home owner. It can help you determine whether you are overpaying for a home, or whether you have gotten yourself a real bargain. Even when you are paying a premium for the home, you need to make sure that you are paying a premium for something in return (e.g. fully furnished home or soothing interior design). You can check with a valuer or you can check with a property agent that has access to our iValue tool at Home Loan Report.

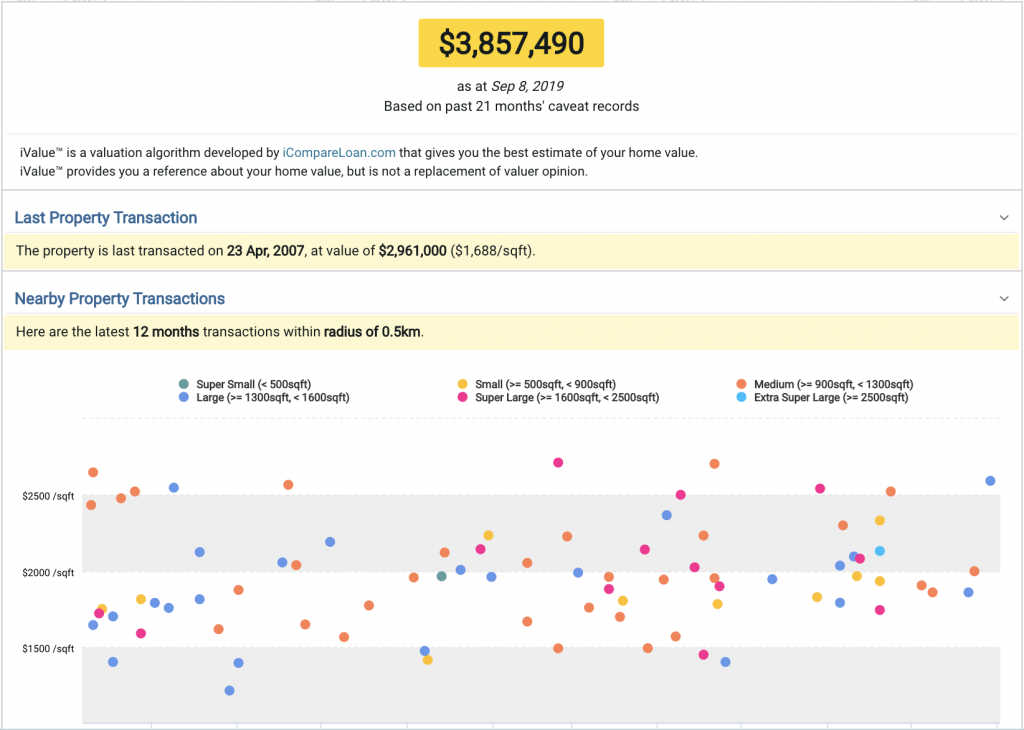

Picture 1: Property valuation is estimated for the Rivergate Condominium, home loan report by iCompareLoan.com

You can then use that as a first estimate of whether the property is worth buying, alternatively if your agent is telling you the price is 4 million, you can also see that the unit in question is estimated at around $ 3.86m, that gives you some level of guide as to whether the deal is possible or not. However if the agent is telling that the unit is $4.4m while the estimated value is only $3.86m, then it is very likely that the property agent is trying to “manage” you.

Ultimately, it is to help you make a better decision when it comes to choosing a home and also not to get ripped off by lousy sellers. Before you buy a property, you may also want to assess your property loan affordability and downpayment, so that you can be properly assured.

SAMPLE –> Property Buyer Report – Rivergate – iValue to get a feel of how a comprehensive property buyer report can SAVE you thousands or even hundreds of thousands from over-paying.

Ultimately you will not need to do the property valuation in Singapore yourself because there will be valuers who are experienced in doing that job. However the methodology is important to know, because it helps you to understand why a property price will go up or down and the reasons for it.

There are three methods that you can use for property valuation: Income; Direct Comparison (Comparative market analysis); and Residual method. To help our readers understand each of these property valuation methods, the iCompareLoan team has prepared this property valuation guide to dissect everything you need to know about property valuation.

3 Property Valuation Singapore – Methods Every Singaporean Should Know

-

Direct Comparison Method or Comparative Market Analysis

The direct comparison method is probably the property valuation method that people are most familiar with. Among the three types of property valuation methods, direct comparison method is also the easiest to understand. This is one of the main reasons why direct comparison is a popular property valuation method.

What Is Direct Comparison Method?

Table of Contents

The direct comparison method to property valuation is build upon the Principle of Substitution. According to the Principle of Substitution, the maximum value that any logical and rationale person will pay for a property is established by the cost of a substitute property that provides similar utility on the open market.

How Do You Value A Property Using The Direct Comparison Method?

This is the part where home owners are interested in knowing, i.e. how to value a property using the direct comparison method. The best way to explain this is to use an example to illustrate how the direct comparison property valuation method is done.

Case Study 1: Flats With Comparable Utility Sold In The Area

Imagine that you are getting married soon. You are looking to purchase a 5-Room HDB flat in Tampines to stay near your parents’ place. You and your spouse have decided on one that is a 5-minutes’ walk from Tampines MRT. The owner of the flat has quoted you a price of $650k for the flat. Is this a reasonable price to pay? This is where you need to use the direct comparison method to get a fair property valuation of the flat you are looking to buy.

Upon doing some research on property portals, you found that another 5-room HDB flat located in the vicinity just sold for $600k. Since everything else about the flat is the same (i.e. geographical location, amenities, floor level), the only difference between the two flats is that your target flat has a much better interior design. In this case, you need to ask yourself whether the $50k premium is justified by the interior design. If you think that the $50k premium is a price that you are willing to pay, then the flat would constitute a fair valuation.

Case Study 2: Flats Without Comparable Utility Sold In The Area

Like everything else in life, it is never so straightforward. After doing your research for months, you realized that there are no like-for-like comparisons. Instead, you managed to find a 4-room HDB flat that is located 10 minutes away from Tampines MRT. The 4-room HDB flat is also located on the lower floor while your target flat is on the upper floor. In addition, your target flat is right next to the hawker centre while the 4-room flat is 15 minutes’ walk away from the hawker centre.

In this scenario, you will need to adjust the value of the comparable property, based on the utilities that it is missing.

When doing this adjustment, you need to keep three rules in mind:

- Take the comparable property as the base if it is of a lower worth than the target property. Else, use the target property as the base.

- If the comparable property’s utility is better than the target property, subtract it from the comparable property’s value.

- If the comparable property’s utility is worse than the target property, add it to the comparable property’s value.

| Comparable Property

(4-Room HDB Flat) |

Target Property

(5-Room HDB Flat) |

|

| Transacted Price | $400k | – |

| Number Of Rooms | +25% | – |

| Distance From MRT | +10% | – |

| Floor Level | +5% | – |

| Distance From Hawker Centre | 10% | – |

| Property Valuation | $600k | $600k |

What Is The Value To Assign For Each Utility?

But how do you know what is the value to assign to each utility? For example, how do you know that an additional room is worth 25% of the comparable property’s value?

The best way to assign the right value for each utility is to repeat the direct comparison method. But instead of using the property that you are intending to purchase as the target property, you can choose a different property to use as a benchmark property.

The key is to find two properties with similar utilities except for one, which is the utility you are trying to value. This will allow you to assign a fair value to each utility of the property.

| Comparable Property

(3-Room HDB Flat In Tampines) |

Benchmark Property

(4-Room HDB Flat In Tampines) |

|

| Transacted Price | $350k | – |

| Number Of Rooms | +25% | – |

| Property Valuation | $387.5k | $387.5k |

-

Income Method

A common reason why Singaporeans invest in property is for their monthly rental. This unique ability to generate income on a monthly basis helps Singaporeans to create passive income while enjoying the capital gains of property in the long run. If you are thinking of investing in property for the rental income, then this method of property valuation would be very useful for you.

What Is Income Method?

The income method of property valuation is built on the basis that any property is worth as much as the amount of income it can generate for you. While the income method is traditionally used for commercial properties due to their income generating nature, it can also be applied to residential property if you are looking to use your residential property for rental income.

Property Value Singapore – How to derive it using the Income Method?

According to the income method, property valuation is derived from this simple formula:

Property Value = Net Operating Income / Capitalisation Rate

In order to derive the fair property value using income method, you need to first understand Net Operating Income and Capitalisation Rate. This is of course not as commonly used in Singapore, this is often used as a guide for property valuation and support level of property prices in Singapore.

What Is Net Operating Income?

Net Operating Income (NOI) refers to the total annual income you can generate based on the income-generating property after taking into account the total expenses that would be incurred. For example, by renting out your property, you are able to make $24k a year. But at the end of each year, you need to incur the cost of refurbishment (e.g. repainting, change of furniture). These costs should be deducted from your total income to give you an accurate picture of your property’s true income.

NOI can be broken down into a few components, namely Potential Gross Income, Vacancy, Effective Gross Income and Expenses.

Net Operating Income = Effective Gross Income – Expenses

1. Potential Gross Income

Potential Gross Income (PGI) is the easiest metric to understand. It is just the sum of all the rent you can receive in a year, assuming that the property is fully occupied throughout the year.

The way to determine your property’s monthly rental rate is to use the average rental rate of properties that are comparable to your target property. You can find the rental rate by browsing through property rental portals like Propertyguru, 99.co ad Ohmyhome.

2. Vacancy ‘Cost’

While you would ideally want to rent out your property for as long as possible, you must also account for a potential loss of income due to vacancy. Rental lease for residential properties is typically 1-2 years. Once the rental lease is up, you might encounter a vacancy period of 1-2 months while you search for new tenants. Thus, you need to factor in these vacancy periods into your NOI calculation.

3. Effective Gross Income

The Effective Gross Income (EGI) is the amount of rental income that you can reasonably expect to collect from your property in the long run. If you have plans of doing short-term rental with your property during the months which are vacant, you can also include that income in this category.

Effective Gross Income = Potential Gross Income – Vacancy Cost

4. Expenses

Whenever you rent out your property, there are bound to be costs that will be incurred. These costs can come from property taxes, property insurance, management fees as well as reparation and maintenance cost.

For rental of residential property, the major expenses can be attributed to reparation and maintenance works. Reparation work needs to be carried out when your current tenant’s lease expires to prepare your property for the next tenant. Over the course of the year, you will also need to constantly maintain electrical appliances like refrigerator and aircon. Once in a few years, you might need to overhaul your aircon system as it gets old and faulty.

What Is Capitalisation Rate?

Now that you have gotten the NOI, you can then calculate the capitalisation rate of your target property and its associated capitalisation rate. Capitalisation rate is a metric that can be used to determine whether you are over paying for your property or got yourself a bargain price. It can be calculated quickly and will come in handy when you are in a price haggling contest with the seller.

Capitalisation Rate = NOI / Property Value

Capitalisation rate represents the rate of return you would get on your property in a year. The higher the capitalisation rate, the better it is for you as a buyer. This is because a higher capitalisation rate means that you are either paying a low price for the property, or the NOI is much higher than average.

If you are a seller, you would want your capitalisation rate to be lower compared to properties that are similar to yours. A lower capitalisation rate usually means that you are getting a good price for your property at the current market value for properties in your area.

-

Property valuation Singapore using Residual Method

This is the most complex method among the three property valuation methods. While it is uncommon for residential property owners to use this valuation method, we think that having more data points will help you make a more financially sound decision for your target property.

What Is Residual Method?

The residual method is principled on a simple concept, i.e. value of the property is the sum of the land cost, construction cost, fees to the authorities and profit for the developer.

Property Value = Land Cost + Construction Cost + Fees + Profit for Developer

How To Derive The Property Value Using Residual Method?

1. Land Cost

The land cost refers to the cost of acquiring the land parcel from the government. It constitutes the largest component of the whole property. The cost of each land parcel that is released to developers can be found on URA’s website. You can find the cost of land parcels for DBSS, condo, executive condo, landed property and mixed residential and commercial properties (e.g. Bedok Mall residence). Unfortunately, since the land cost of HDB sites aren’t released, this valuation method cannot be applied HDB flats.

2. Construction Cost, Fees

Construction cost and fees are expenses incurred by the developer when they are developing the project. It includes all the costs that are related to site preparation and construction of the property. In addition, the legal, architect, engineers’ fees and distribution fees for property agents are also taken into consideration. The list of costs and fees are periodically updated on Arcadis and BCA website.

3. Profit For Developer

While the developer won’t tell you how much they will make out of the project, you can get an estimate based on the developer’s profit margin in its annual report. The norm for developers’ profit margin is between 5% to 15%, according to Knight Frank.

Are You Paying The Right Price For Your Property?

Property valuation Singapore and its components of land costs, raw material and services costs and developer profit forms the basis of one measure of how prices of the properties will be positioned. (i.e. the market pressures for which the sellers will price their properties). The income method and capitalisation rate forms the basis of how affordable or unaffordable the properties are, hence the support level of buyer ability. The comparative market analysis or benchmark method is used to establish the precedence for price and is used most commonly.

With each of the components, you can get a range for the fair value of your target property. It is then time to decide whether you are paying the right price for your target property. Now that you know how to do property valuation the right way, make sure you leverage that knowledge in your next property investment.

Paying the right price is just one way you can avoid overspending on your property. Another smart way to avoid overspending on your property is to get the right loan. Getting the right loan can be a much simpler task, but only if you get the right person to it for you. Get in touch with iCompareLoan’s loan consultant to help you get the best loan deal at the right price.

Read also.

https://www.icompareloan.com/resources/housing-costs/