There are several reasons why refinancing packages, may not remain ‘cheapest’ throughout the tenure of the mortgage loan.

By: Hitesh Khan/

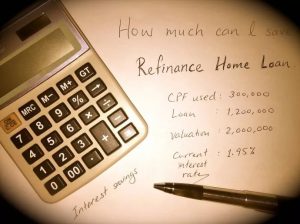

Traditionally, the decision on whether or not to refinance has meant balancing the savings of a lower monthly payment against the costs of refinancing. However, with the cheapest rate refinancing packages which are more readily available now, it can be worth your while to refinance to obtain a smaller reduction in interest rates.

Before you consider the cheapest rate refinancing packages, you should consider how long you expect to stay in your home. It is am important factor to consider as if you will be moving in a few years, the month to month savings may never add up to the costs that are involved in a refinance.

When you are making your decision on the refinancing packages, there are several things to keep in mind.

Table of Contents

First, if your current interest rate is significantly higher than the cheapest rate refinancing packages rates, you may be able to roll your loan costs into the loan and still get a lower rate than you have today, thereby reducing your interest payments and saving money immediately.

Second, if you are planning to stay in your home for at least three to five years, it may make sense to reprice your existing mortgage loans and save on closing costs then getting the refinancing packages.

Mortgage Repricing is the renewal of your existing mortgage plan with your existing lender without changing banks. The typical period to start reviewing your existing mortgage loans for repricing or refinancing should commence about four months before the ending of your package tie-in or lock-in period. This could range anywhere from between one to three years depending on the contractual terms when you first signed up the mortgage loan. At the end of this period your cheapest rate package, may no longer be the ‘cheapest’ in the market.

One main reason why homeowners should repricing or go for other refinancing packages is because of the rising US interest rates.

This is because the US Fed rate hike has an impact on mortgage loans here as Singapore interest rates are closely correlated with those in the US. The SIBOR (Singapore interbank offered rate) has gone up, and this besides denting some of the enthusiasm in the buoyant property market, could pose a big problem for homeowners who are still servicing their mortgage loans. This is because banks and financial institutions calculate lending rates by adding a margin (which covers their costs and their profit) to a published financial index, like the SIBOR or the SOR.

https://www.icompareloan.com/resources/mortgage-calculator-important-tool/

Since 2019, banks have raised interest rates for both fixed and floating home loan packages by 10 – 30 basis points (bps). Some banks have already upped their mortgage rate to 2.05 per cent, to keep pace with the increasing interest rates. Although the US Federal Reserve has announced that it may not increase its rates further this year, it remains to be seen if it will inadvertently drive interest rates for mortgage loans here lower.

Banks are usually slow off the mark in raising the interest rates in response to global news like the US Federal Reserve rate hikes. This lag time is where a mortgage consultant can best help a distressed buyer to finance a new purchase or to refinance their current property.

Mr Paul Ho, chief mortgage consultant said, “there may be a short window of opportunity for home-owners to refinance their home loans before interest rates are increased in the near future.” He added, “mortgage consultants can typically get the best rates for home owners who want to refinance their home loans by comparing across 16 banks and financial institutions – and best of all, their services are free.”

https://www.icompareloan.com/resources/mortgage-broker-singapore-best-rate/

Today, consumers have a wide range of home loan packages to choose from compared to several years ago. Home loans could also be tied up with other programmes which rewards customers with a higher interest rate on their deposits if they transact more with the bank, such as getting a home loan and crediting their salary with the same bank.

Typically, with mortgage loans you are offered attractive rates for the first three years when you refinance – following which the interest rates are adjusted upwards. This usually coincides with the end of the lock in period, offering borrowers a good opportunity to relook their loans.

Home owners searching for refinancing packages should also look to affordability calculators to determine how much loan they qualify for. You can also use mortgage payment calculator to determine how much you would have to pay every month by taking a mortgage loan with a 3-year lock-down period.

Some home owners who continually miss the refinancing opportunity may be held as mortgage prisoners as they will find it hard to switch to another loan with a lower interest rate. Financial institutions have been advertising low interest rates for refinancing to attract new customers. But it may be more difficult for such home owners to get onboard a new mortgage loan and miss refinancing opportunity because of the tougher lending restrictions imposed by Government regulators.

One such regulation which home owners need to be mindful is the Total Debt Servicing Ratio (TDSR). TDSR is to safeguard borrowers from overleveraging. This applies to property loans granted by all financial institutions. Currently, TDSR has a 60% threshold, and what does this translates to is that the percentage of your income that goes into servicing your loan cannot be more than 60%. All refinancing will have to pass the TDSR rule.

The TDSR was put in place to ensure that financial institutions exercise prudence in giving out loans, but this new rule actually traps a group of property owners, as they now would not be able to refinance their home loans to cheaper rates. Such home owners miss new refinancing packages by the banks who first offered them these highly leveraged lending.